TurnKey Lender

4.6

64

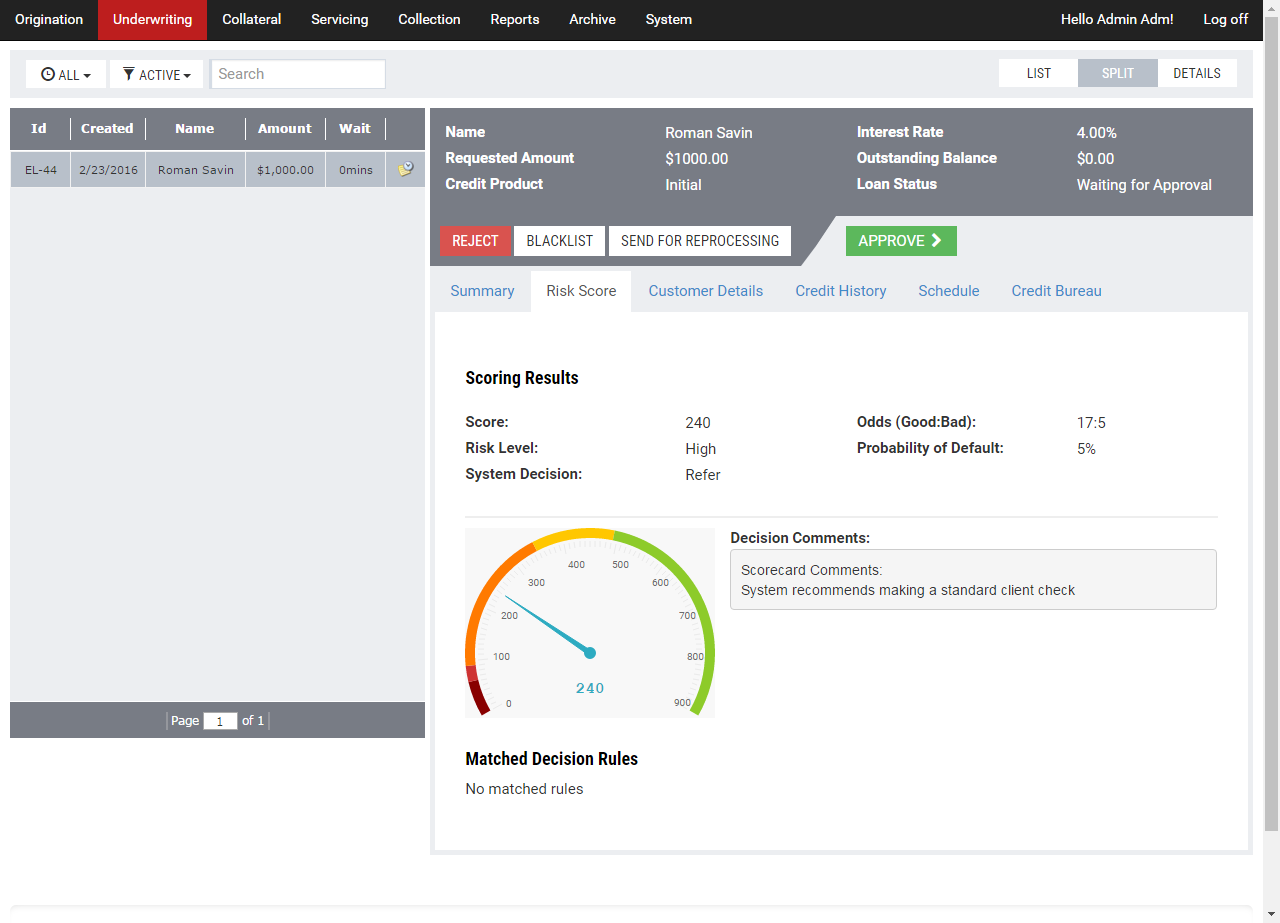

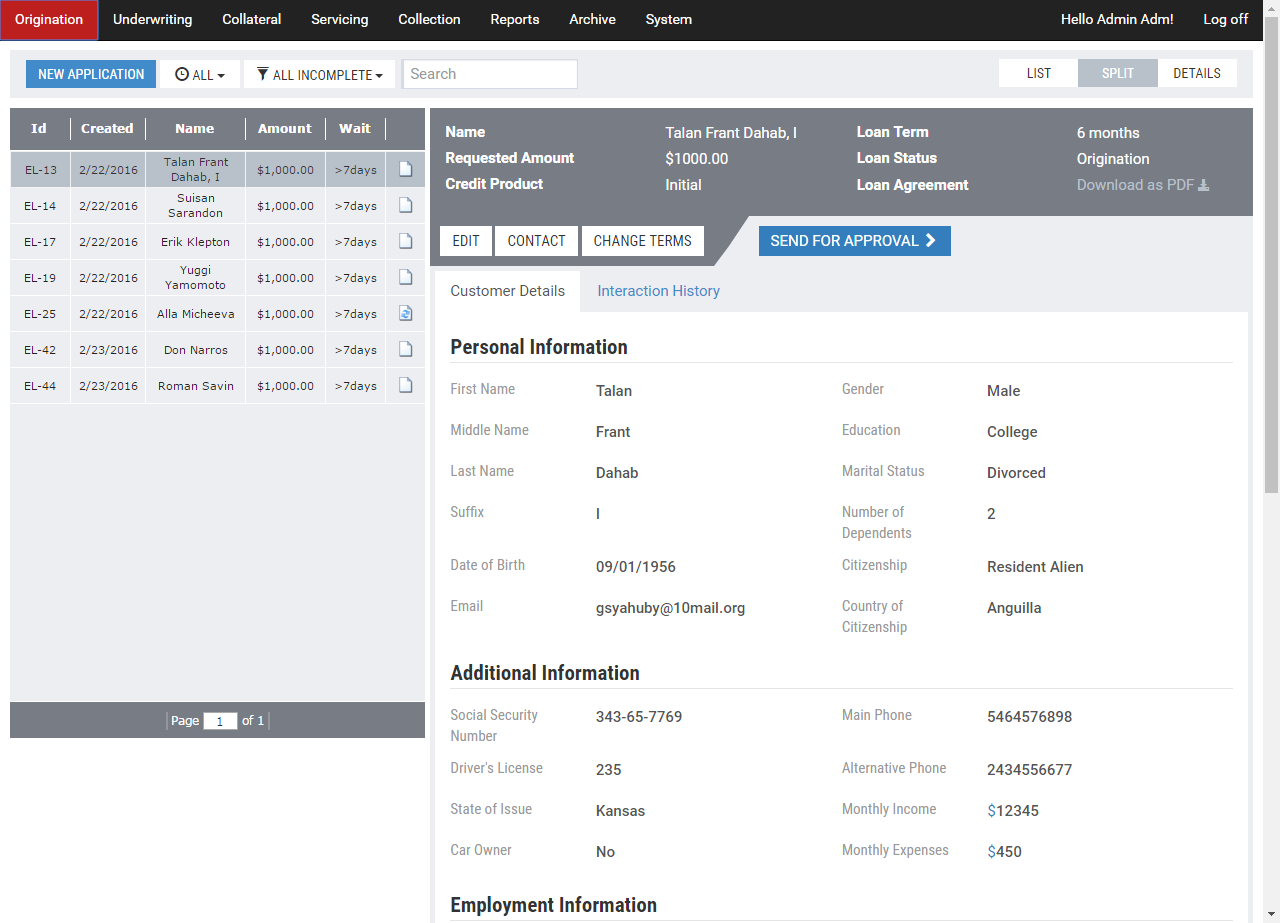

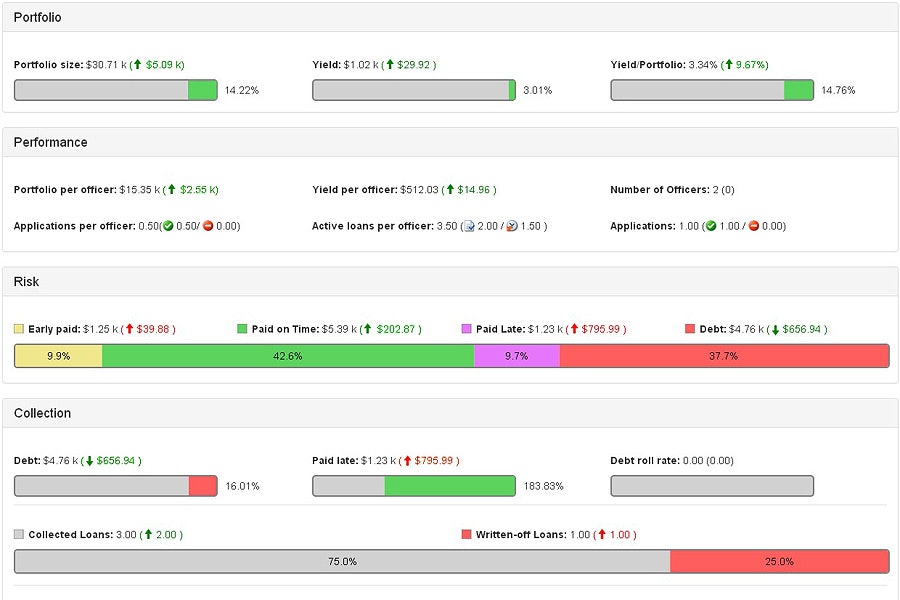

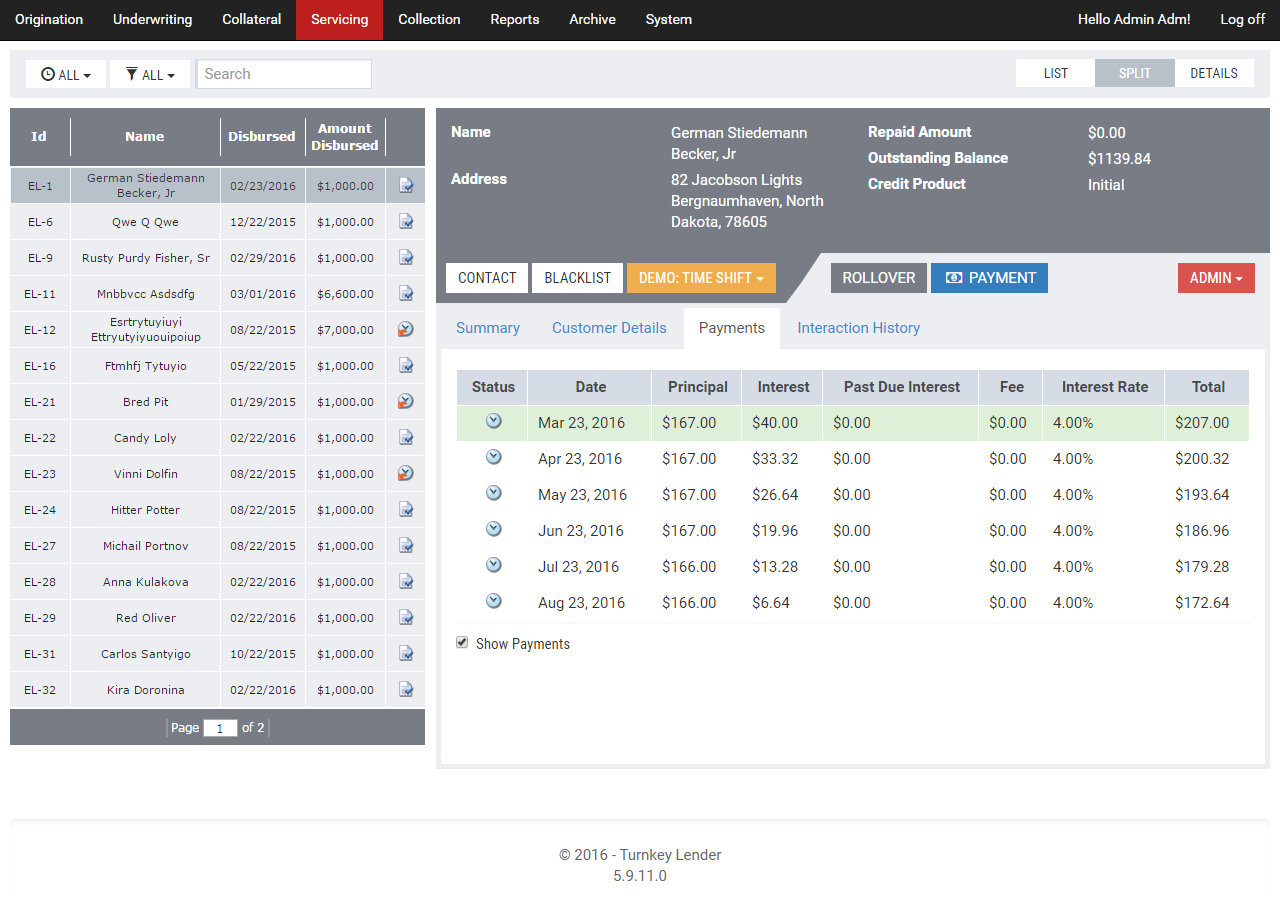

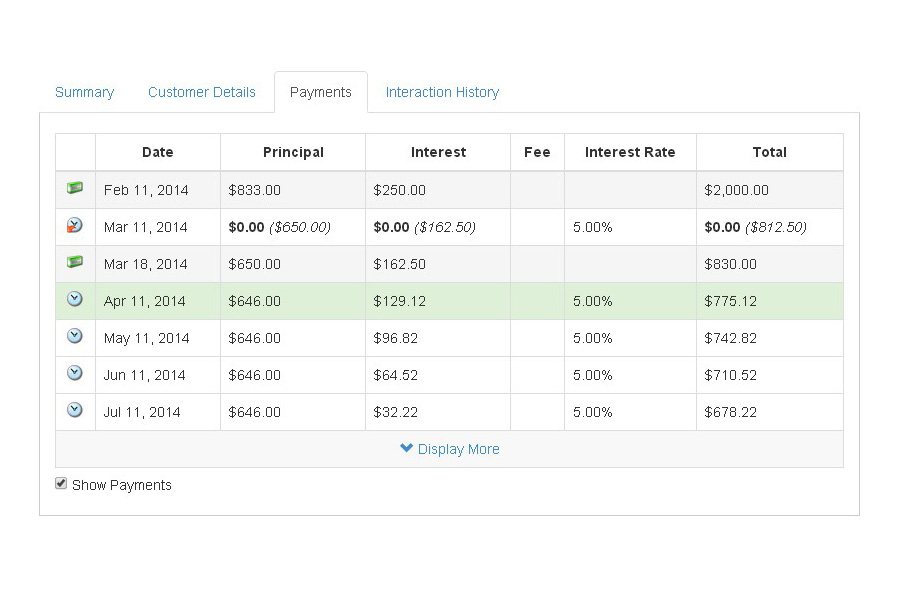

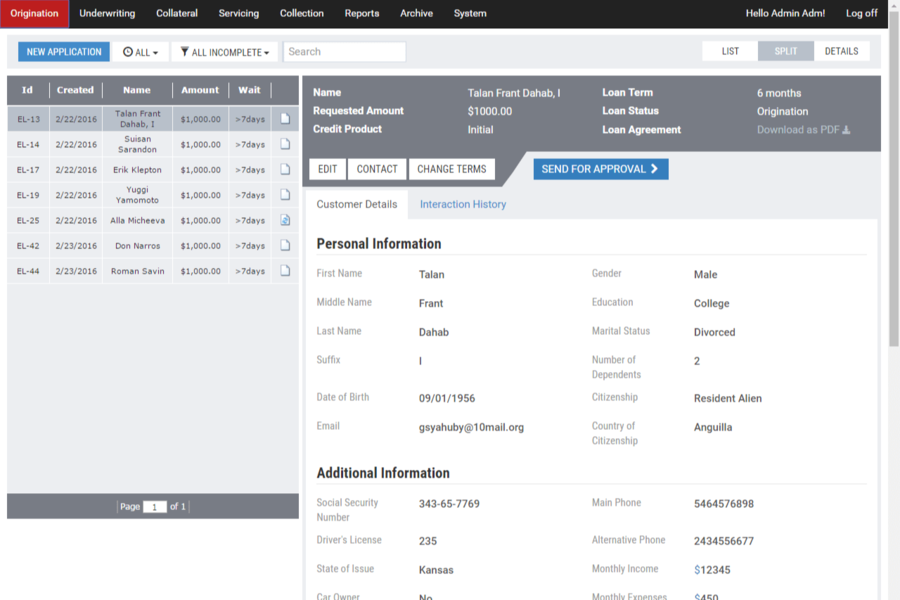

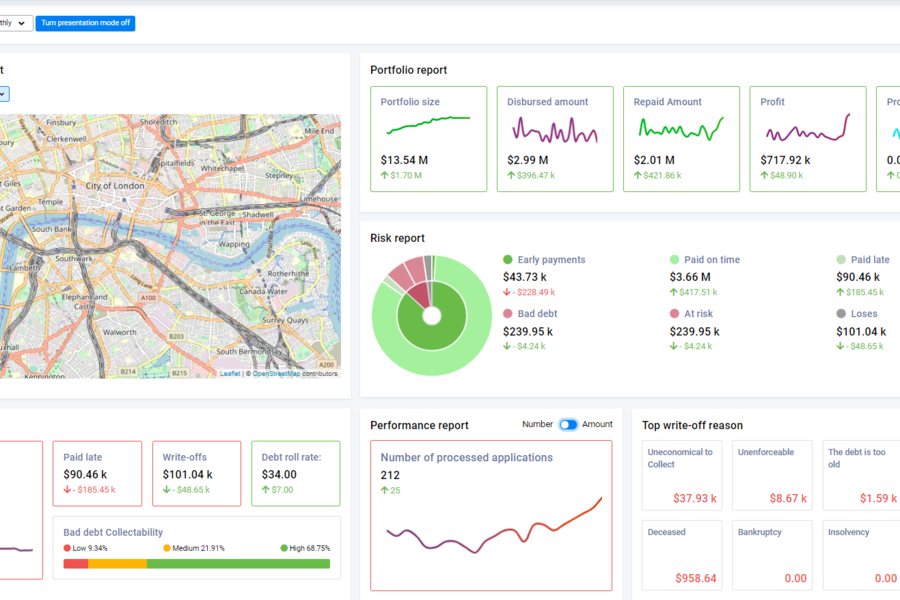

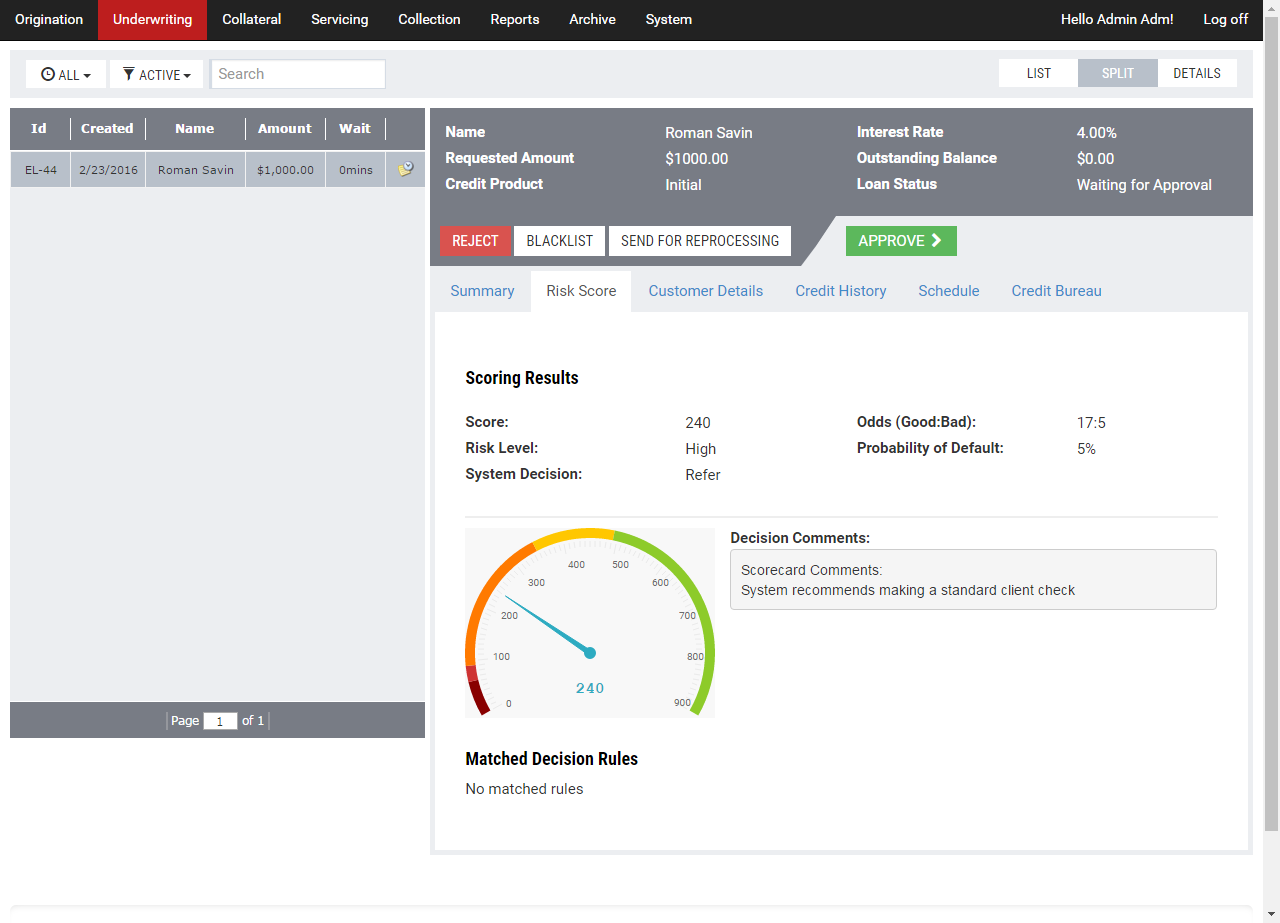

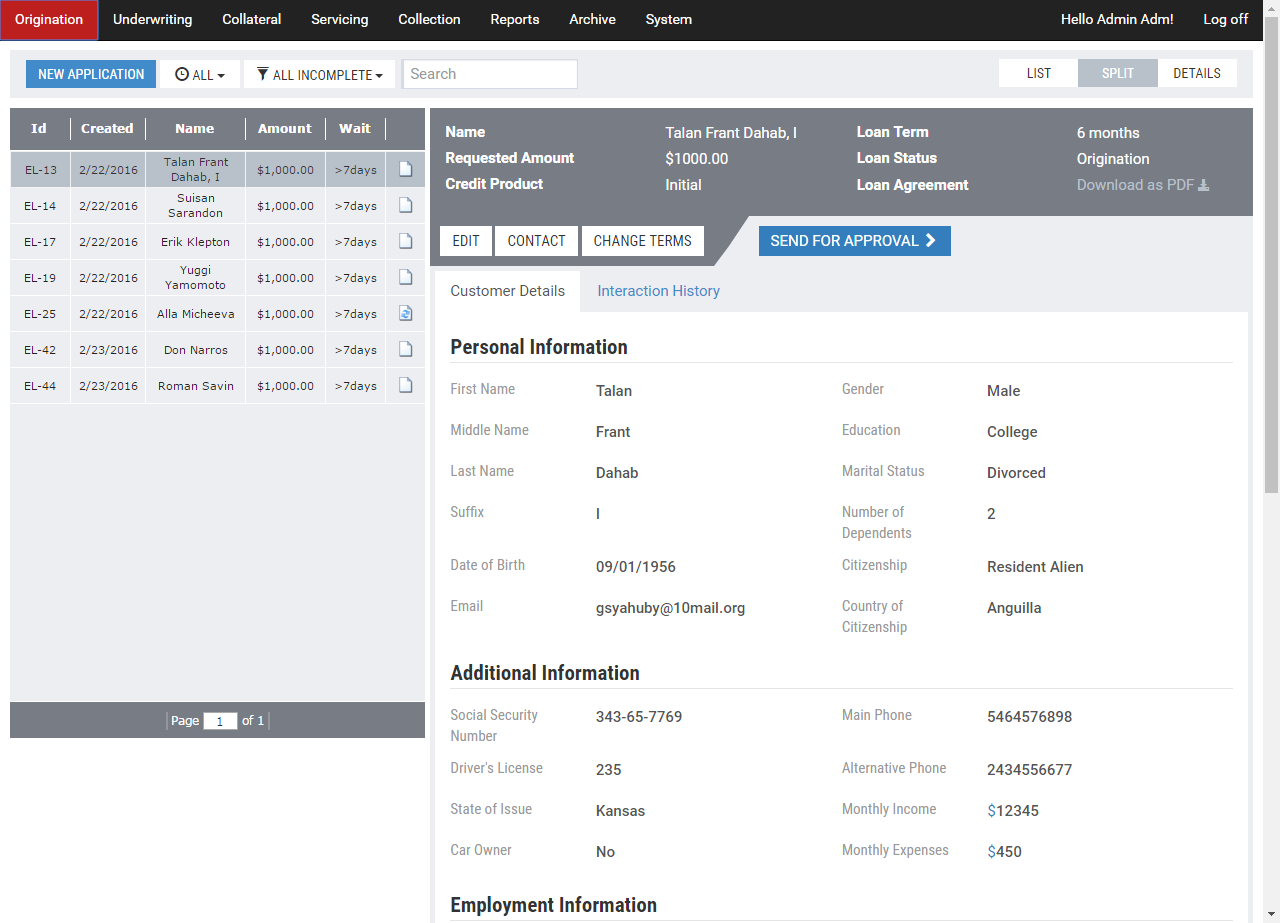

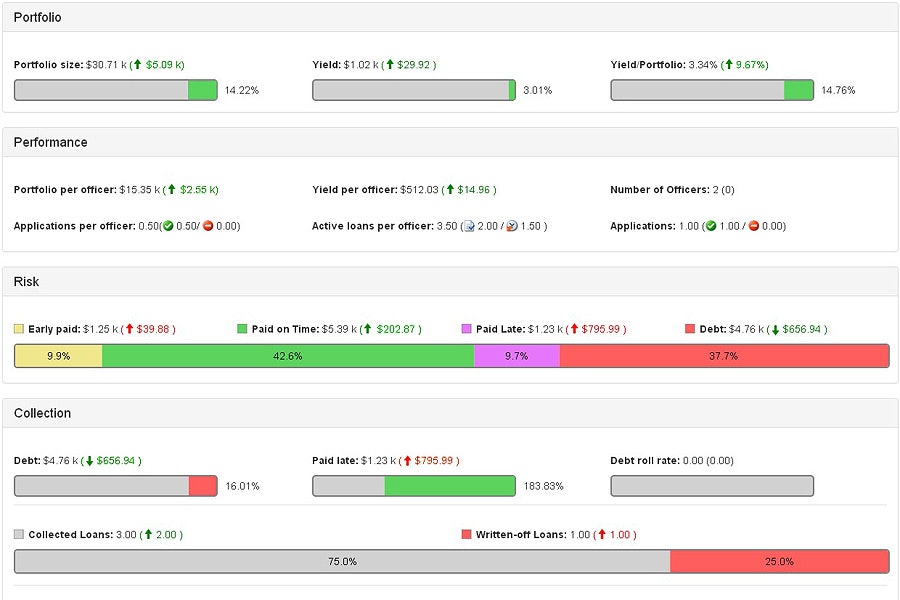

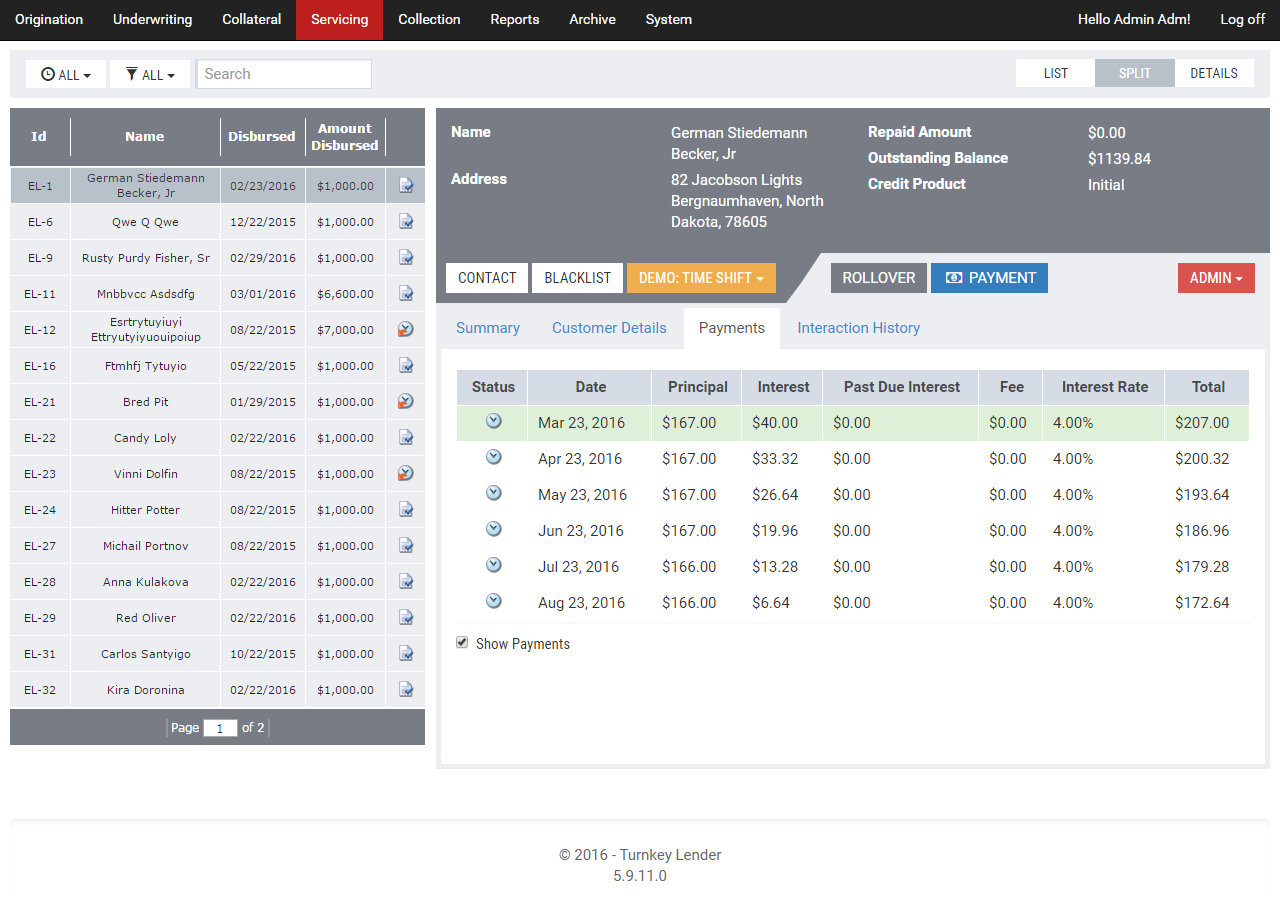

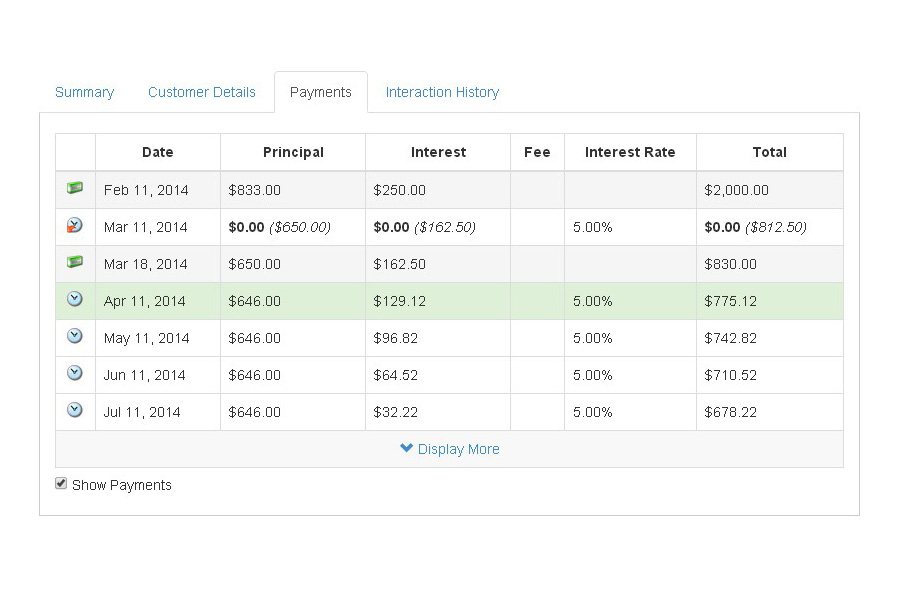

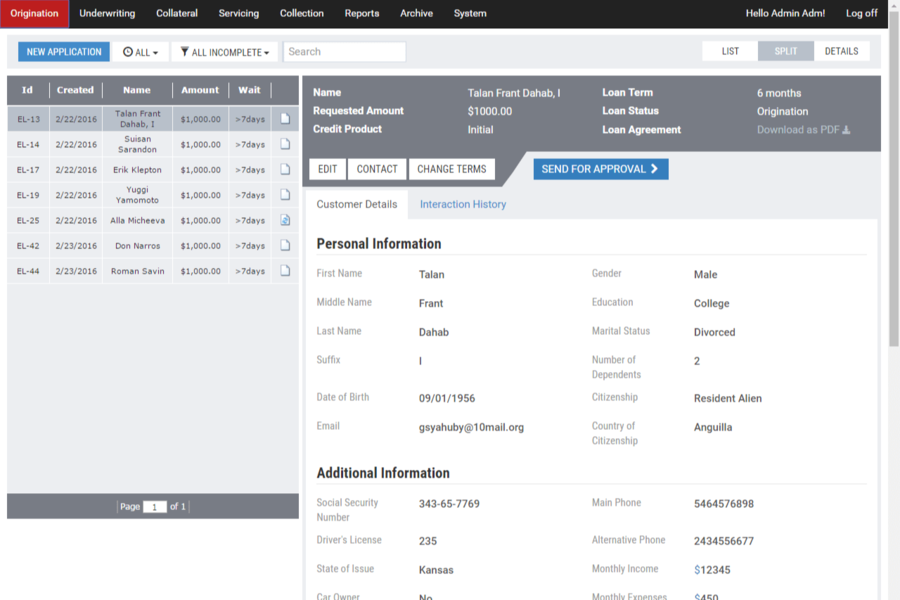

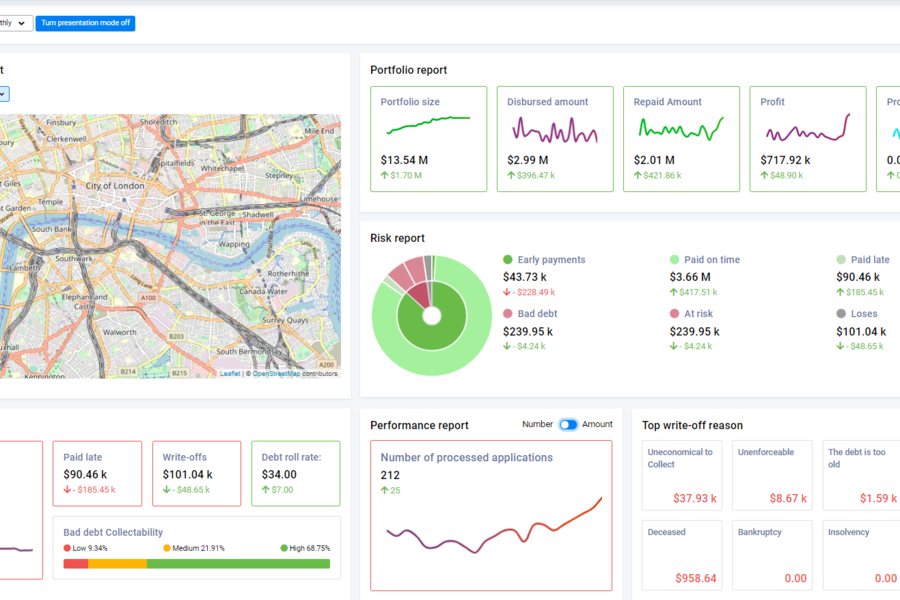

TurnKey Lender is a global leader in Unified Lending Management (ULM) software, offering intelligent solutions that automate the entire lending process. Their capabilities cover traditional and alternative lending, SME financing, grant management, money lending, leasing, trade finance, in-house financing, and more. They serve customers in 50+ countries and are gaining traction in regions like the United States, APAC, and the EU. All types of lenders, from large/mid-size banks to digital lenders and telecoms, are already using their solutions.

Strengths

-

Automation

Automated loan origination and servicing processes

-

Customization

Highly customizable to fit specific business needs

-

Scalability

Scalable to handle large loan volumes

Weaknesses

-

Pricing

Pricing may be high for small businesses

-

Integration

May require additional integration with existing systems

-

Learning Curve

May require some training to fully utilize all features

Opportunities

- Growing demand for loan origination and servicing solutions

- Opportunity to expand globally

- Opportunity to form partnerships with other financial institutions

Threats

- Intense competition from other loan origination and servicing solutions

- Changing regulations in the financial industry

- Economic downturns may affect loan volumes

Ask anything of TurnKey Lender with Workflos AI Assistant

https://turnkey-lender.com

Apolo

Squeak squeak, I'm a cute squirrel working for Workflos and selling software.

I have extensive knowledge of our software products and am committed to

providing excellent customer service.

What are the pros and cons of the current application?

How are users evaluating the current application?

How secure is the current application?

Media

TurnKey Lender Plan

TurnKey Lender offers a tiered pricing model based on the number of users and features, starting at $149/month for the Basic version.