Payroll Mate

4.5

131

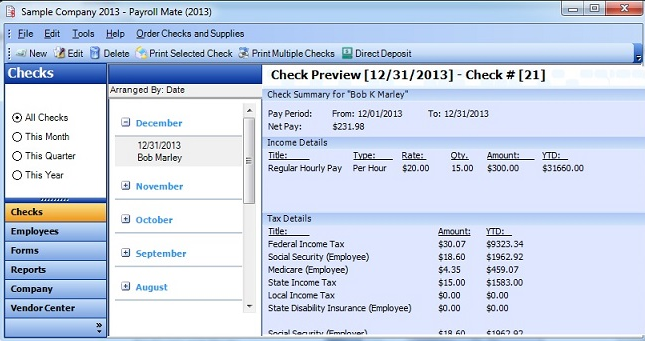

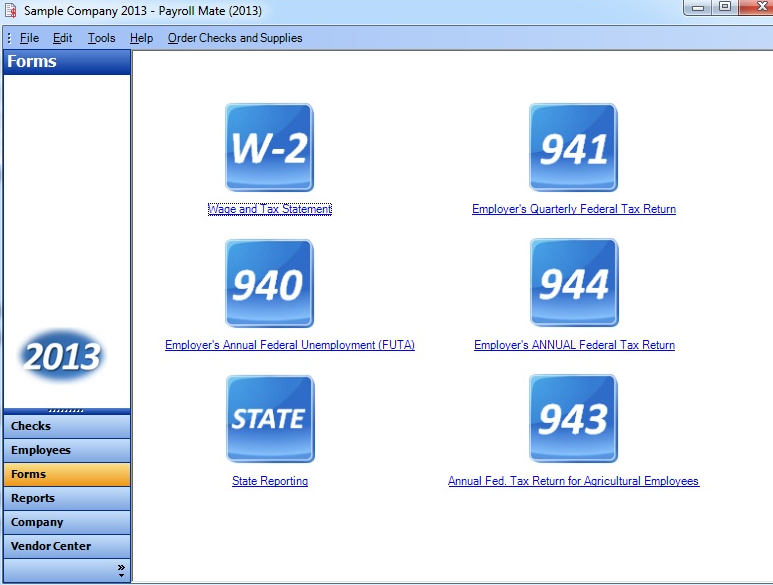

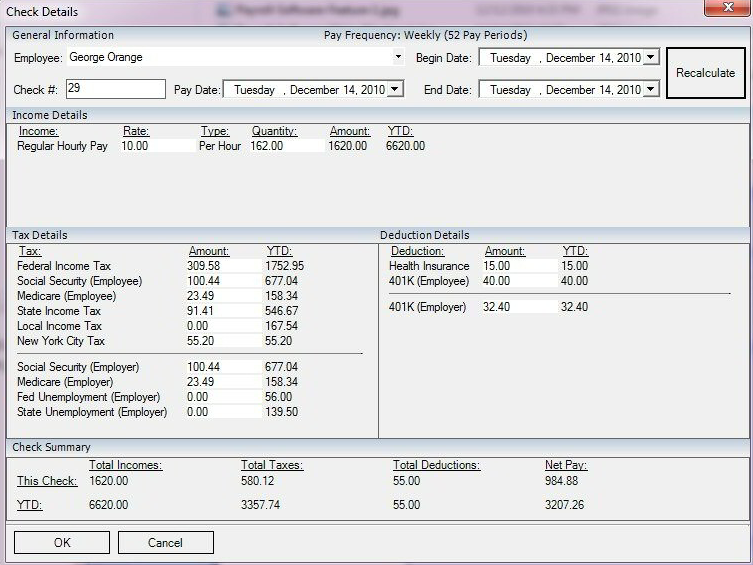

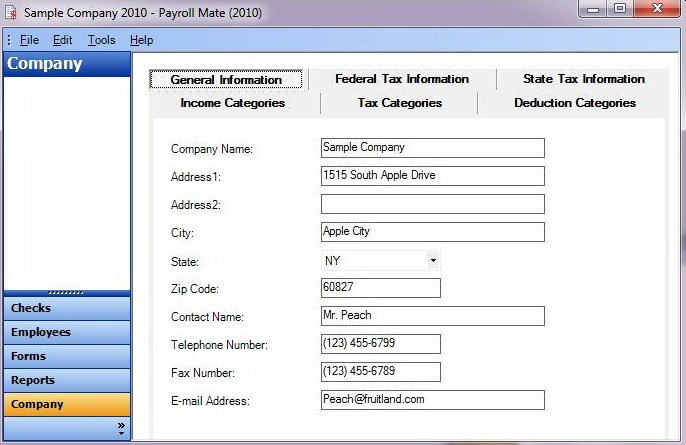

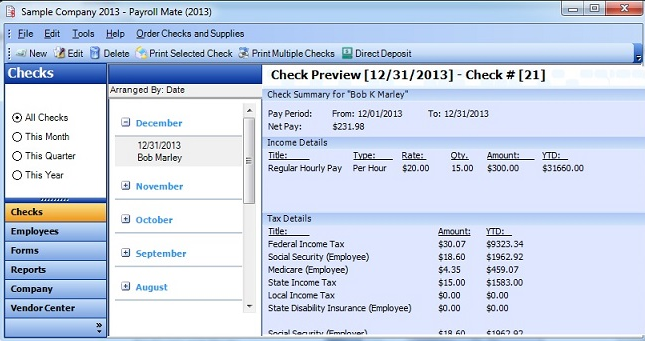

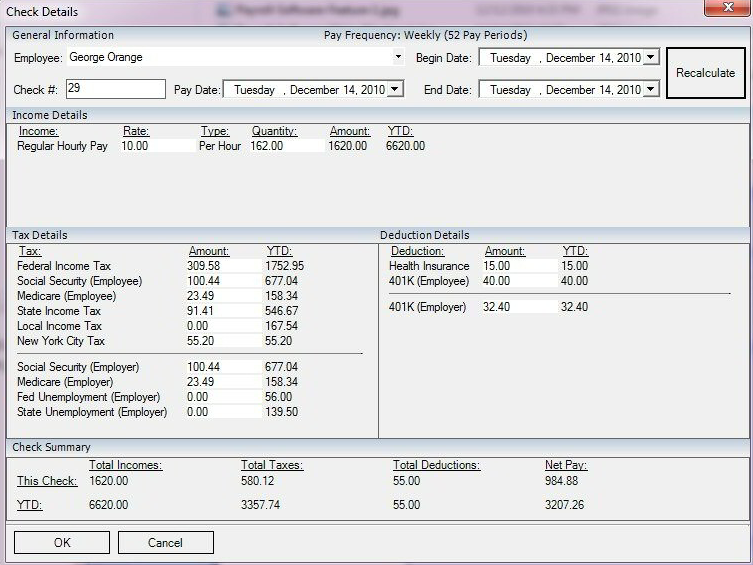

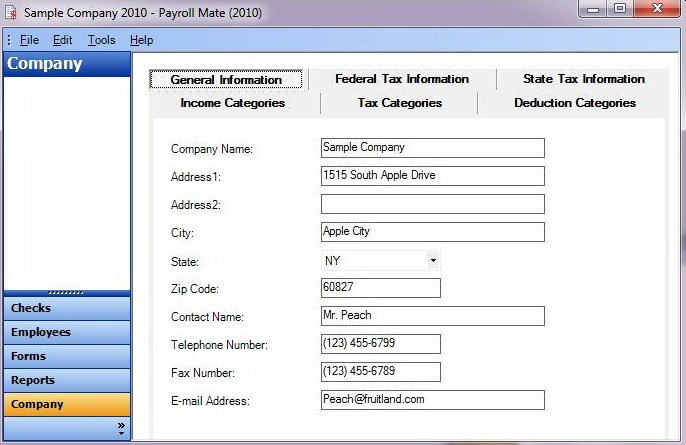

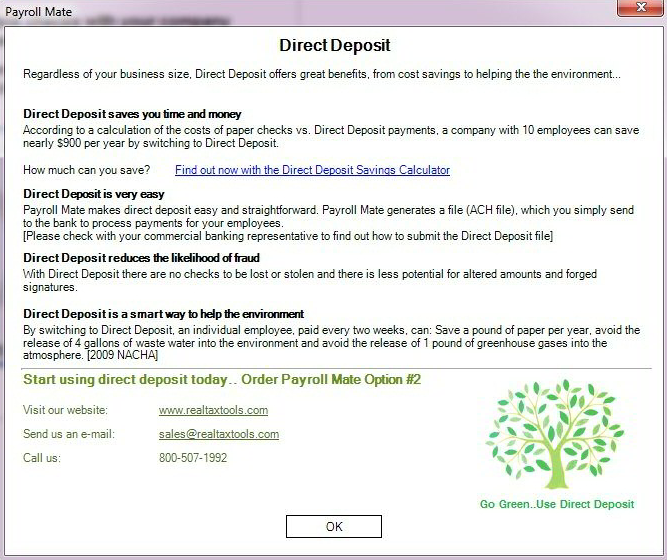

Payroll Mate is a desktop-based payroll software that is self-contained and does not require any external applications or systems.

Strengths

-

Affordable

Low cost compared to competitors

-

User-friendly

Easy to use interface

-

Customizable

Can be tailored to specific business needs

Weaknesses

-

Limited features

Not as comprehensive as other payroll software

-

No mobile app

Not accessible on-the-go

-

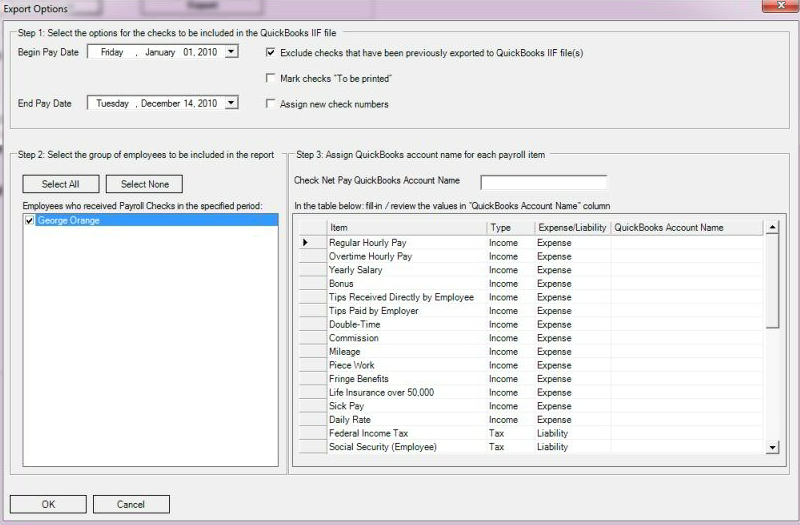

No integrations

Does not integrate with other software

Opportunities

- Add more functionality to compete with other software

- Increase accessibility for users

- Integrate with other business software

Threats

- Other payroll software with more features

- Changes in payroll regulations could affect software

- Decrease in demand for payroll software during economic recession

Ask anything of Payroll Mate with Workflos AI Assistant

http://realtaxtools.com

Apolo

Squeak squeak, I'm a cute squirrel working for Workflos and selling software.

I have extensive knowledge of our software products and am committed to

providing excellent customer service.

What are the pros and cons of the current application?

How are users evaluating the current application?

How secure is the current application?

Review Distribution

-

👍

High - rated users

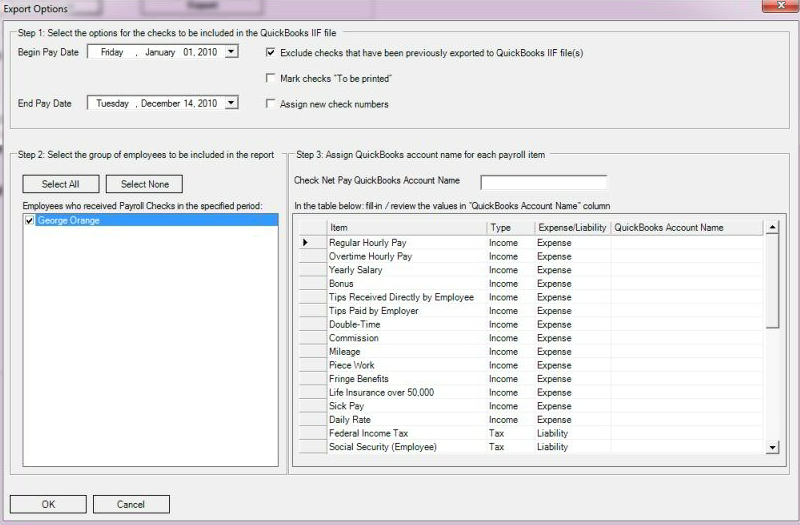

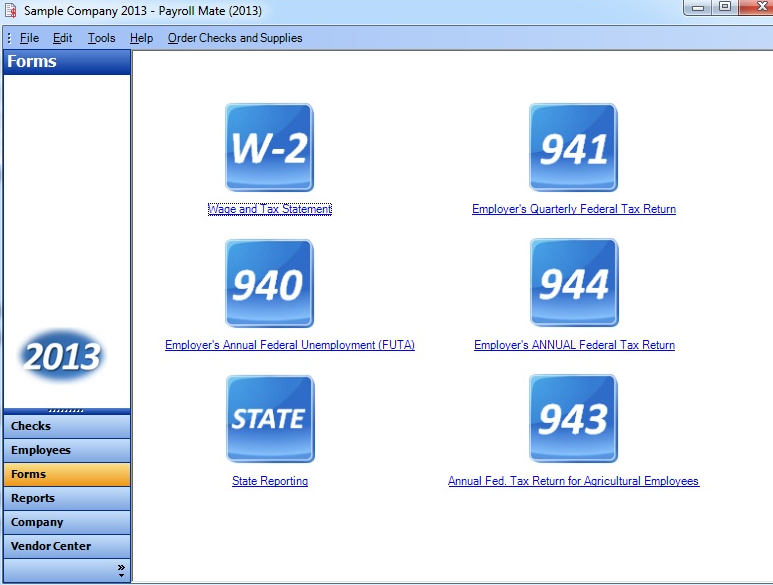

Easy to use, inexpensive, and helps with W-2s and taxes.Does not integrate with Quickbooks.

-

🤔

Average - rated users

N/A.Some users found the software to be glitchy and difficult to navigate.

-

👎

Low - rated users

N/A.Demo version did not work and caused issues for users.

Media

Payroll Mate Plan

Payroll Mate offers a tiered pricing strategy with three versions ranging from $119 to $499, each with increasing features.