Mortgage Automator

4.8

69

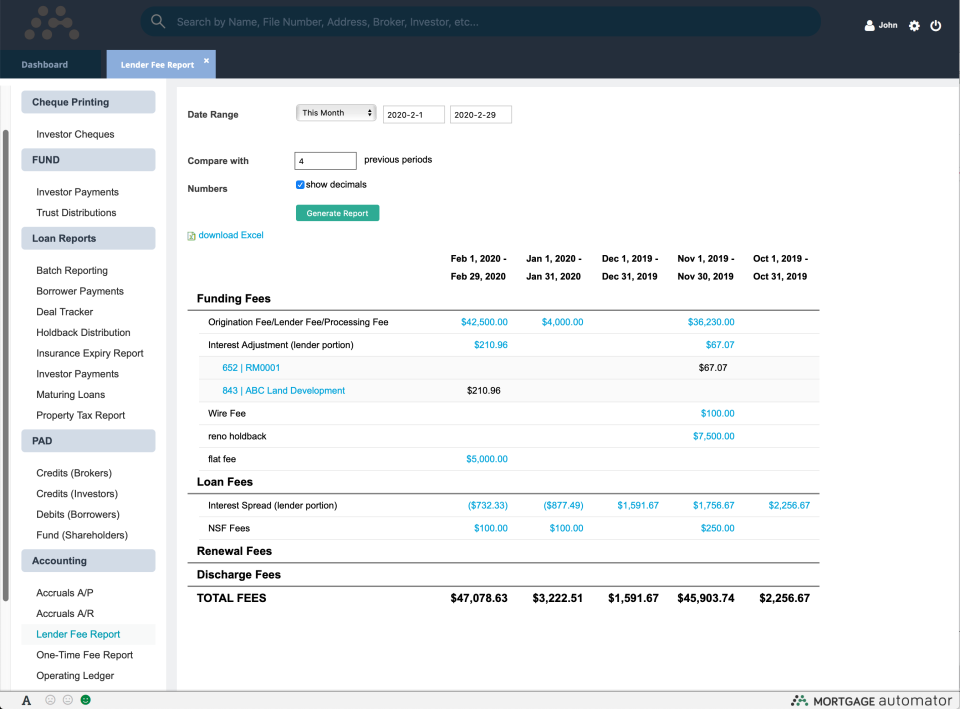

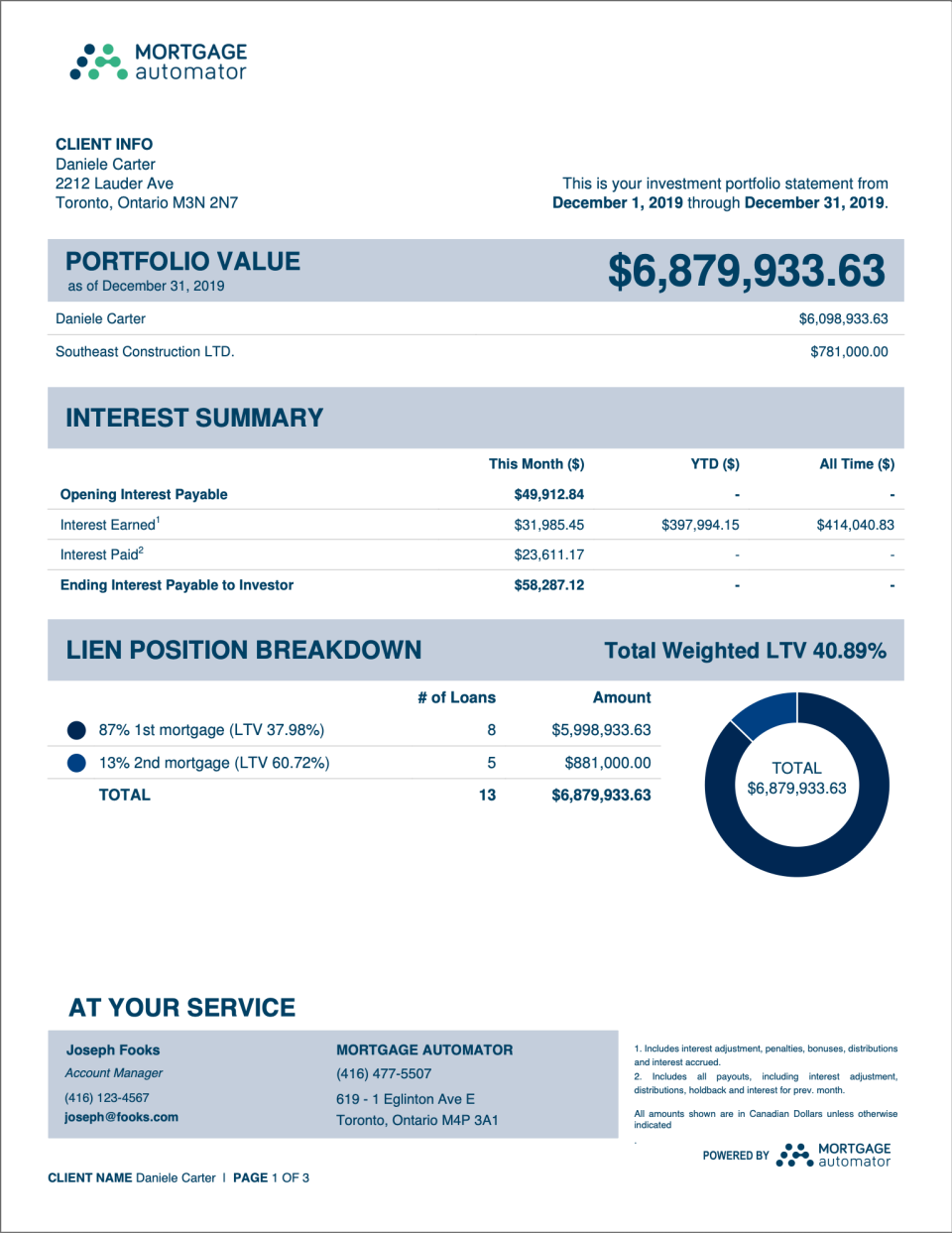

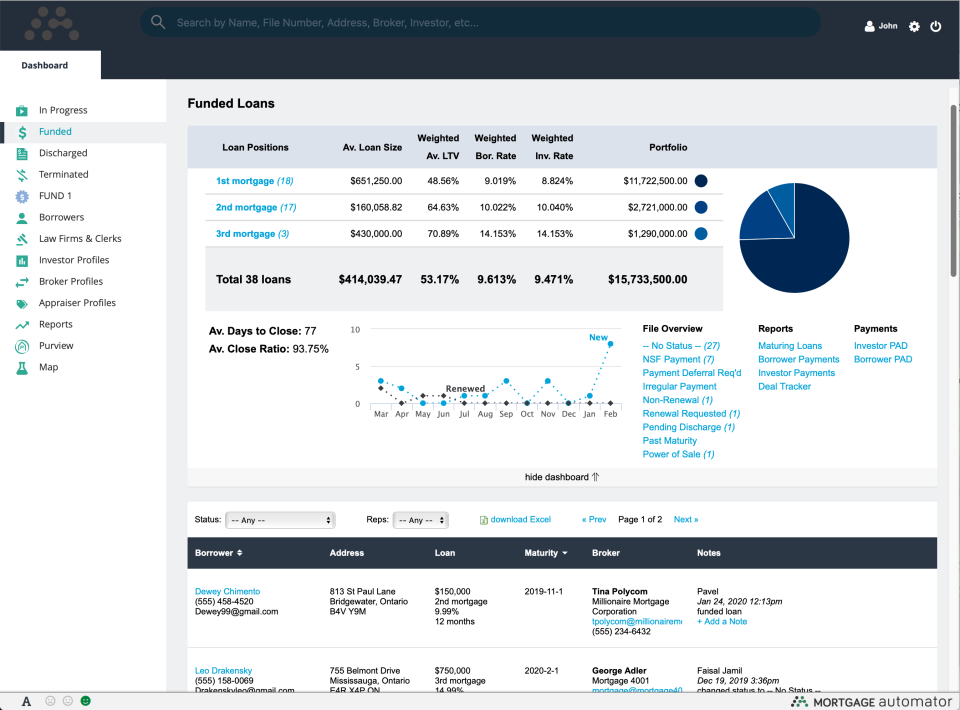

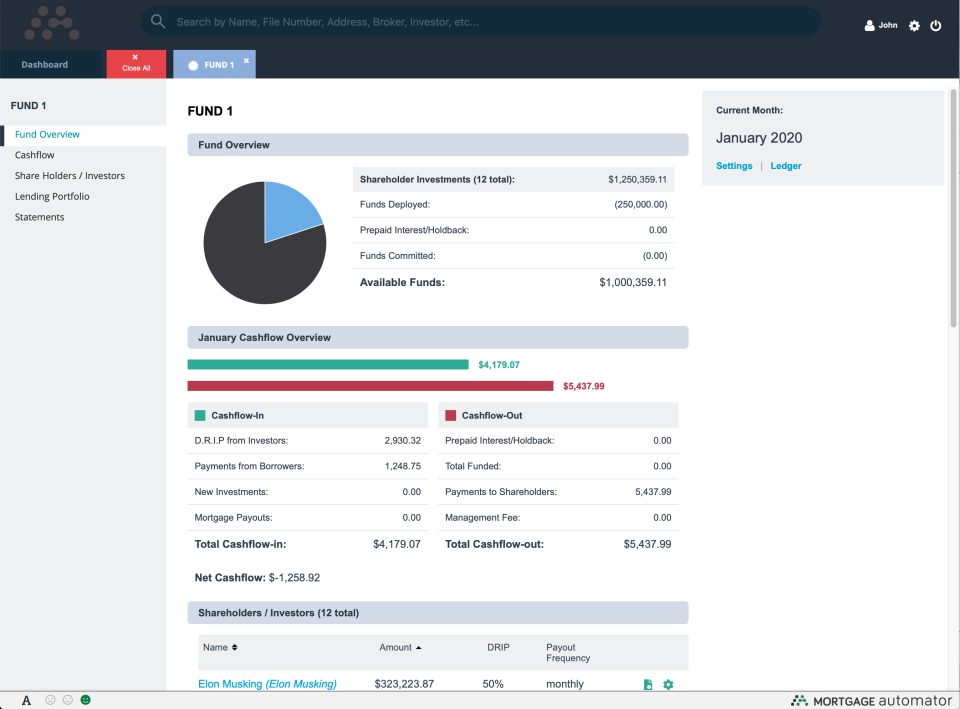

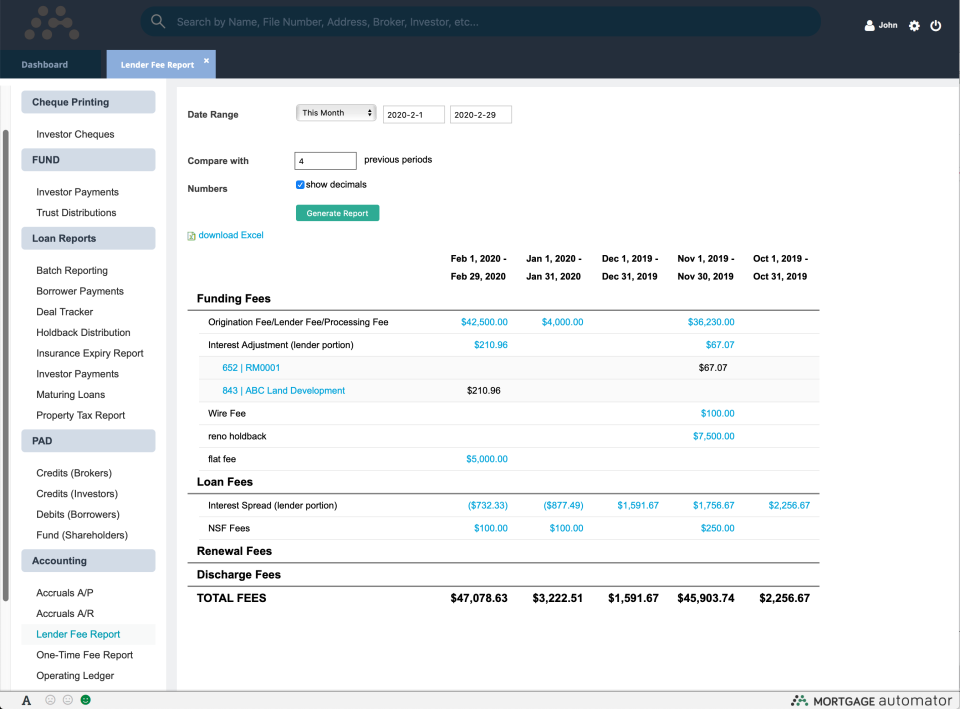

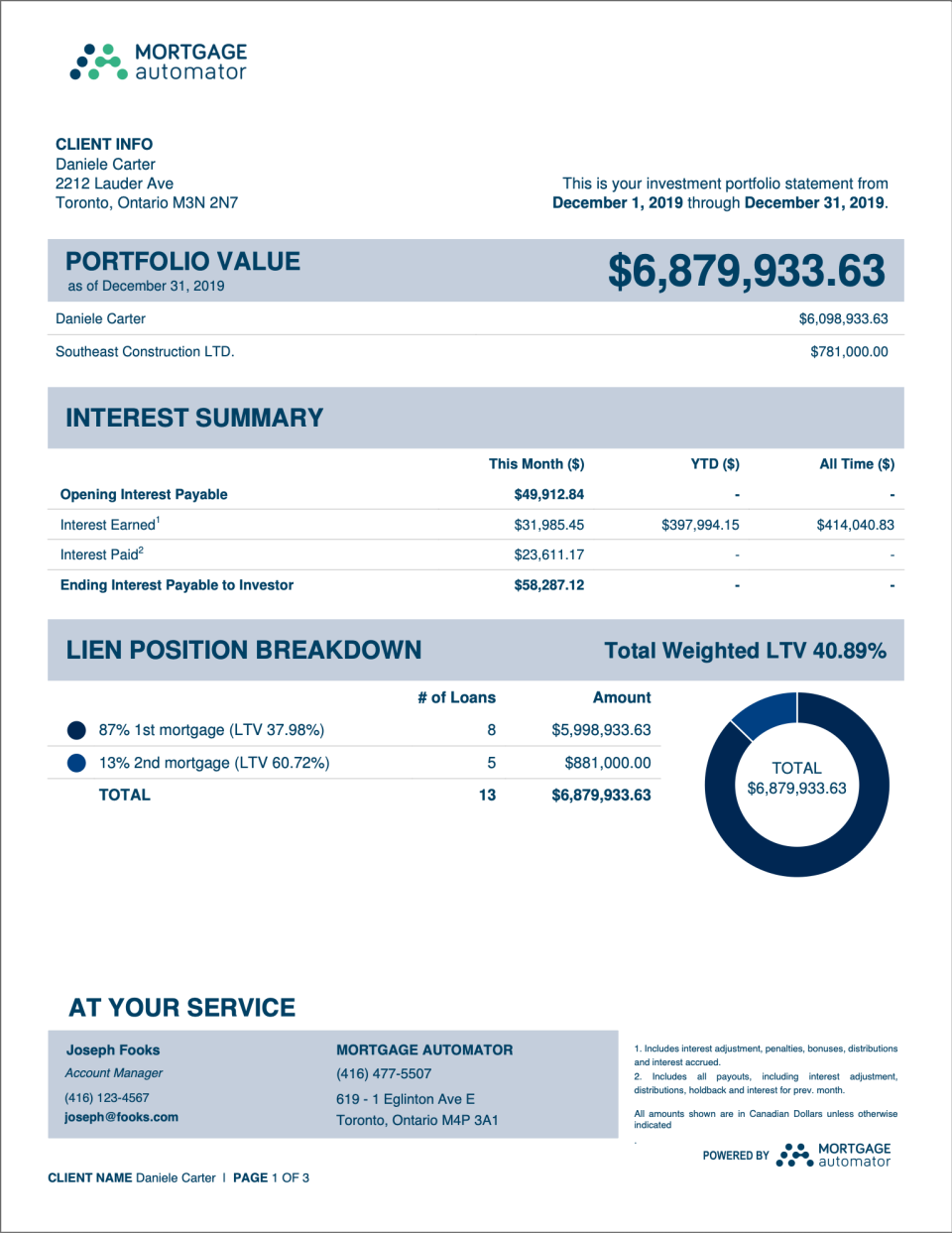

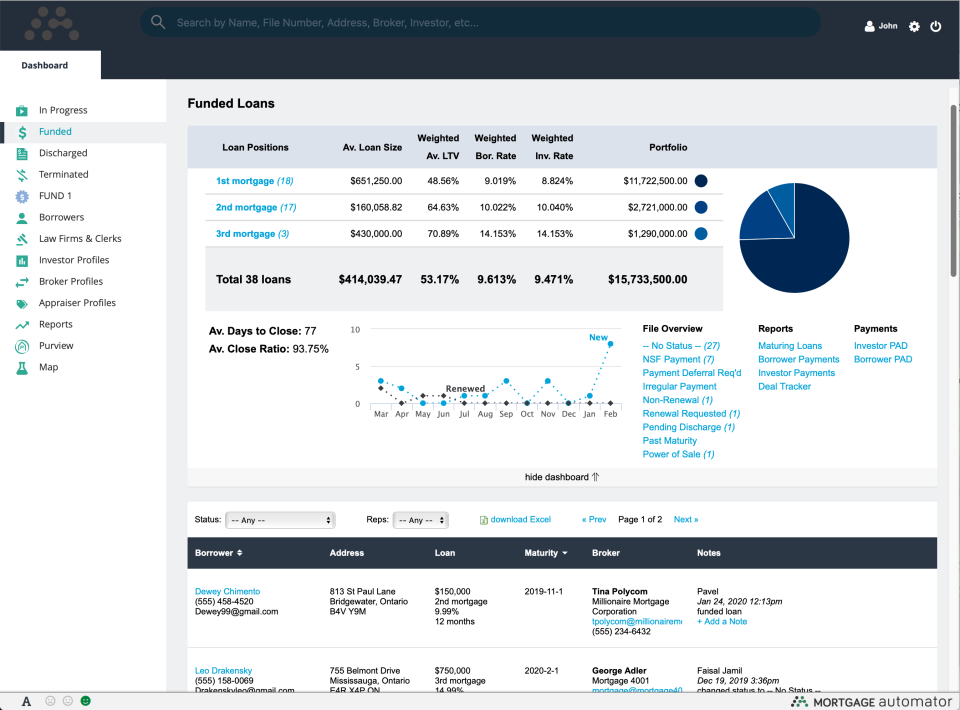

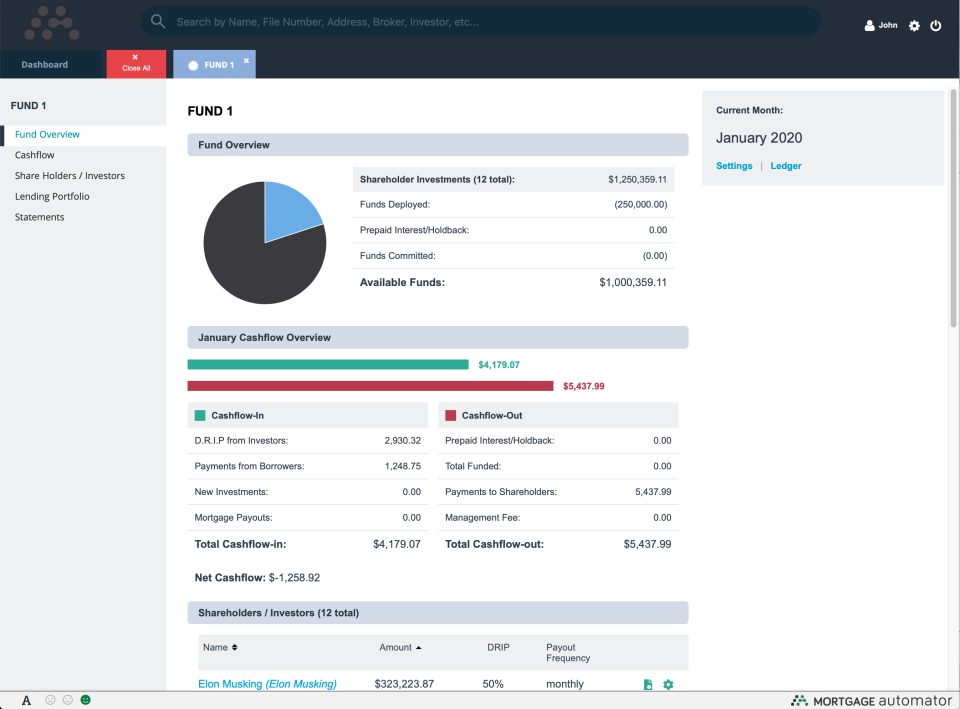

Mortgage Automator is a loan origination and servicing software designed for North American private and hard money lending businesses. It enables lenders to automate critical processes, increase efficiency, and focus on growing their business. The platform includes a comprehensive loan origination suite, an intuitive Upload Portal for borrowers to securely upload important files, and loan servicing features.

Strengths

-

Efficiency

Automates mortgage processing tasks

-

Customization

Flexible and customizable to fit specific business needs

-

Integration

Integrates with other software and systems for seamless workflow

Weaknesses

-

Cost

May be expensive for small businesses

-

Learning Curve

May require training and time to fully utilize all features

-

Limited Functionality

May not have all the features needed for complex mortgage processes

Opportunities

- Growing demand for mortgage automation solutions

- Opportunity to expand into new markets and industries

- Opportunity to form partnerships with other software providers

Threats

- Competitors offering similar solutions

- Changes in mortgage regulations may affect demand for the product

- Security breaches or data loss may damage the product's reputation

Ask anything of Mortgage Automator with Workflos AI Assistant

https://www.mortgageautomator.com

Apolo

Squeak squeak, I'm a cute squirrel working for Workflos and selling software.

I have extensive knowledge of our software products and am committed to

providing excellent customer service.

What are the pros and cons of the current application?

How are users evaluating the current application?

How secure is the current application?

Media

Mortgage Automator Plan

Mortgage Automator offers a subscription-based pricing model with three versions, starting at $199/month, with additional features and support at higher tiers.