LendingPad

4.6

132

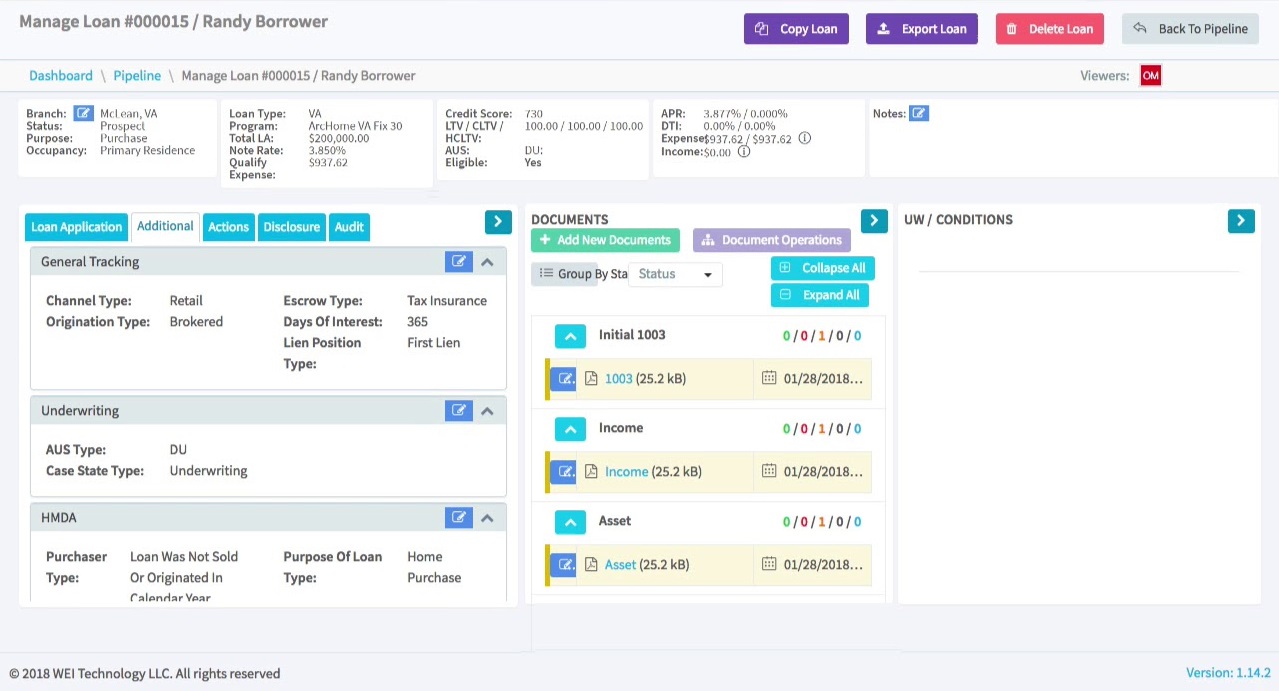

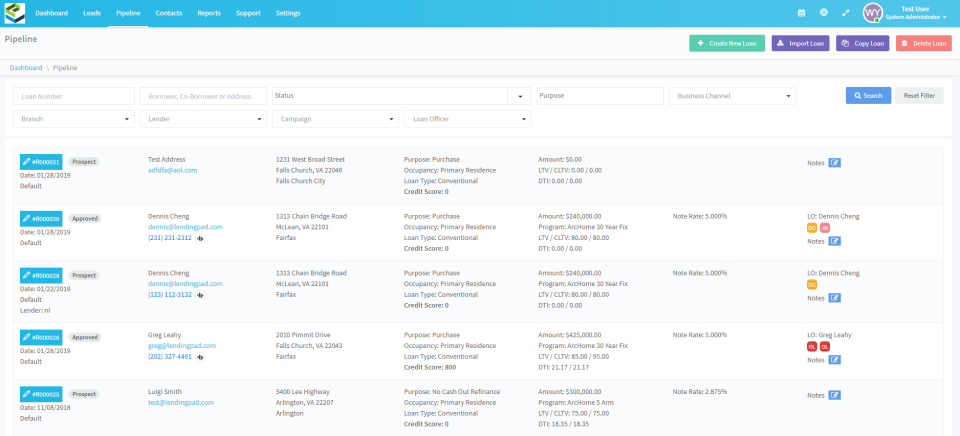

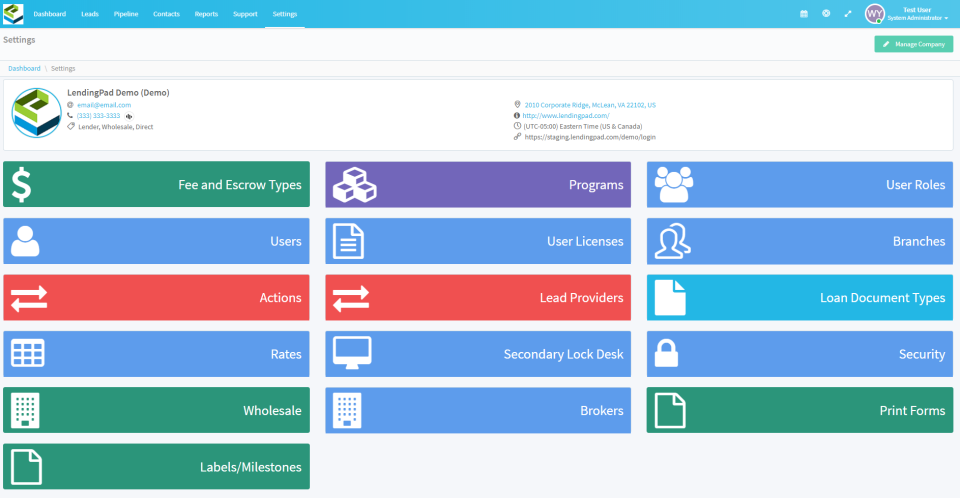

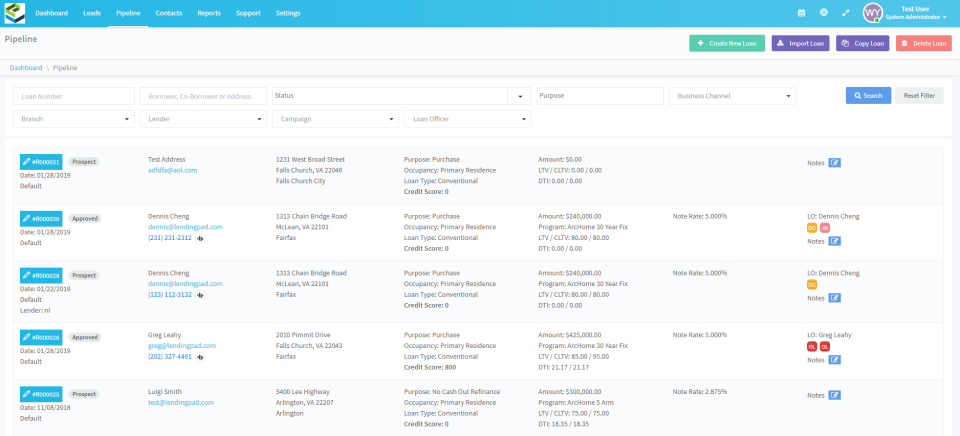

LendingPad is a modern loan origination system that serves lenders, brokers, bankers, and credit unions. It offers centralized, compliant, and automated technology to the mortgage industry, providing solutions for the entire lending process and reducing the cost of business.

Strengths

-

Efficient

Streamlines loan origination process

-

Customizable

Flexible to meet unique business needs

-

Integrations

Seamlessly integrates with other systems

Weaknesses

-

Pricing

May be expensive for small businesses

-

Learning Curve

May take time to learn and fully utilize all features

-

Customer Support

Some users report slow response times from support team

Opportunities

- Growing demand for digital loan origination solutions

- Opportunity to expand into new markets or offer additional services

- Potential to form partnerships with other companies in the industry

Threats

- Competitors offering similar solutions

- Changes in regulations could impact the industry

- Economic downturns could impact demand for loan origination solutions

Ask anything of LendingPad with Workflos AI Assistant

http://lendingpad.com/

Apolo

Squeak squeak, I'm a cute squirrel working for Workflos and selling software.

I have extensive knowledge of our software products and am committed to

providing excellent customer service.

What are the pros and cons of the current application?

How are users evaluating the current application?

How secure is the current application?

Review Distribution

-

👍

High - rated users

Easy to use program and online chat support.Wish there was an option to export the 1003 into the Lenders portal.

-

👎

Low - rated users

None outweigh the cons.Numbers get transposed when uploading to lender portal, no option to create templates, every fee needs to be manually input, no real interface with lenders or investors, times out too fast, no ability to switch company profiles.

Media

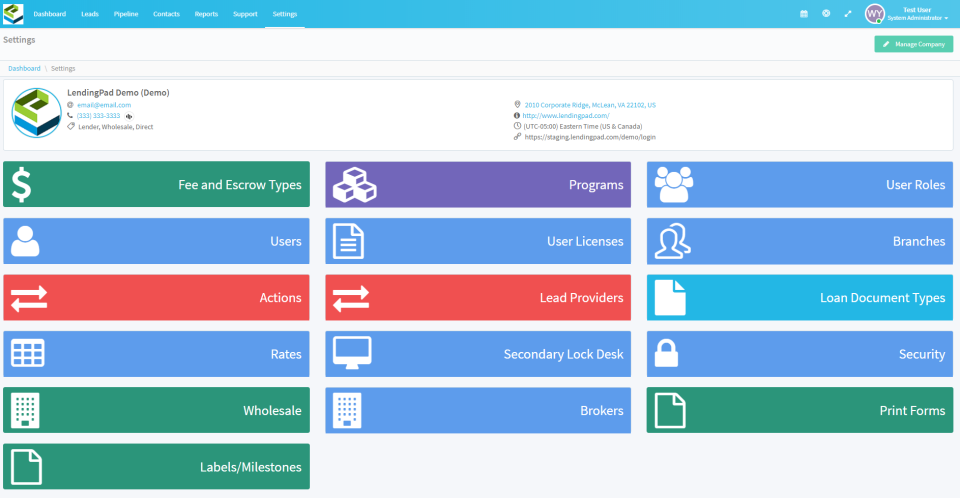

LendingPad Plan

LendingPad offers a tiered pricing model with three versions, starting at $99 per user per month, with additional features and support at higher tiers.

Institution Edition

Contact Us!

LendingPad's Institution Edition includes All features included in our Brokers and Bankers Edition, Phone Support During Standard Business Hours, Unlimited Users & Document Management, LendingPad Network Participant, Retail, Direct, Wholesale and Correspondent Channels, and API’s to Connect with Existing Systems.

Broker Edition

50

1 User Per Month

LendingPad's includes a Retail Channel, Email Support, Free Weekly Live Training, Broker's Feedback Forum, Unlimited Document Management, LendingPad Network Access, Integrated Service Providers, and Standard Support Hours.

Broker Edition

Lender Edition

Contact Us

Per Month

LendingPad® Lender Edition includes all of the origination features in the Broker Edition plus expanded features in operations, compliance, customization and overall support. Specifically, it includes:

Lending features such as underwriting, secondary, closing/funding, and post-closing functionalities

Expanded lending user roles.

Proper and compliant filing of MCR for loans made in both broker and lending channels Interchangeably stamp your company name as the broker, or the lender on disclosures, as legally required.

Lender Edition’s pricing structure is success-based instead of seat-based. There is no fees to add more users.

API access and support to power other systems or clients’ custom apps

Business rules

MERS generation and registration

UCD Registration with Fannie Mae and Freddie Mac free of charge instead of incurring a fee from doc vendors

Enterprise-grade hardware and low-latency performance

Custom user role/statuses/workflow features planned in 2023

Seamless TPO (third-party origination) expansion & DU redistribution capabilities

New features and tools are made available to lenders first on the platform free or at reduced fees

Point-of-sale (POS) included / MLO apps included / Chrome extension included / Comprehensive support options