Go-Insur

0

0

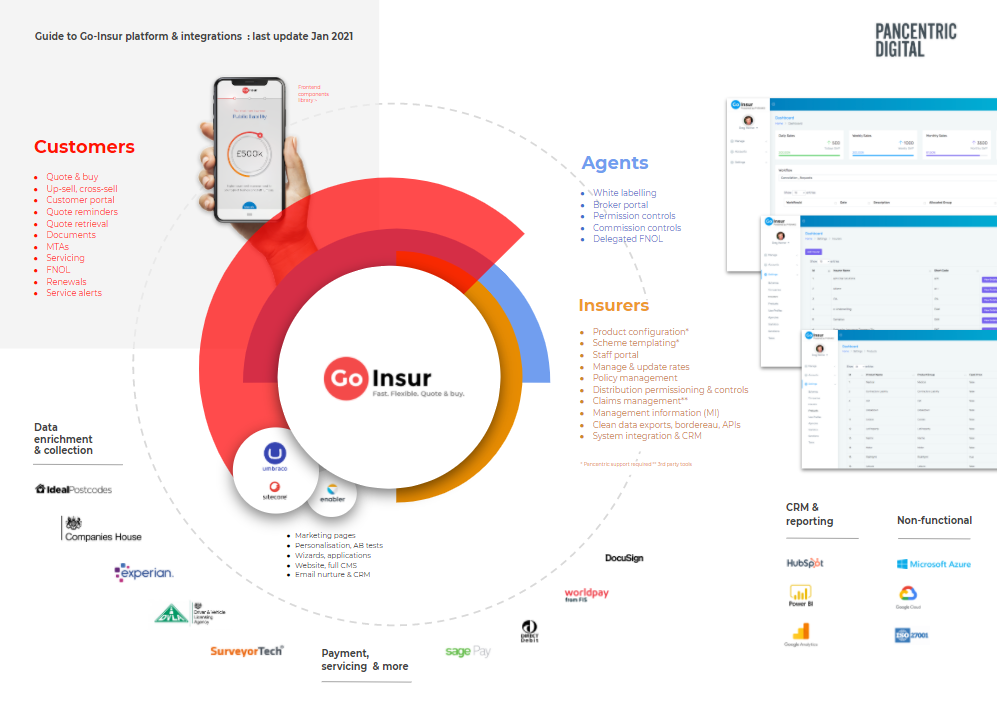

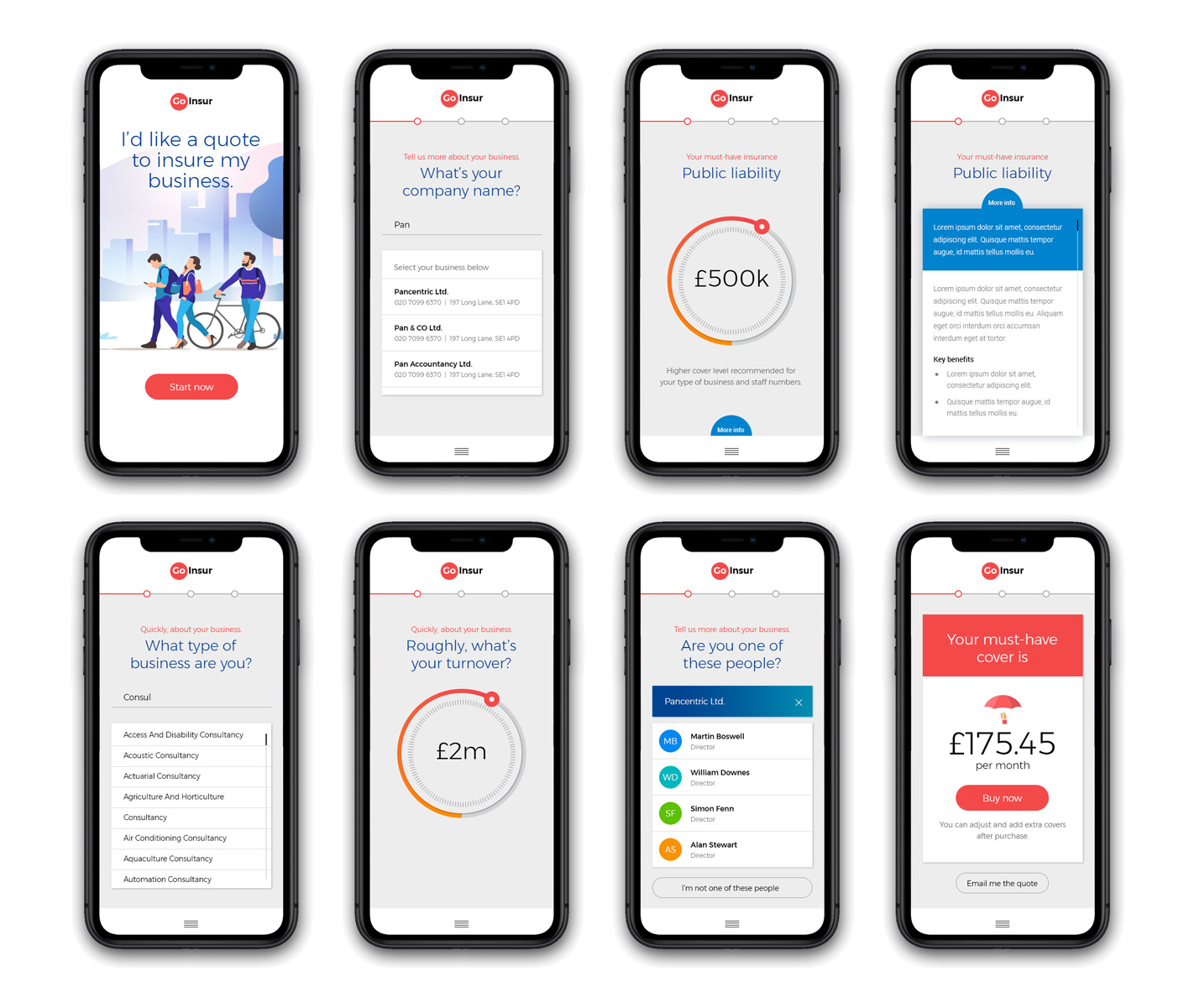

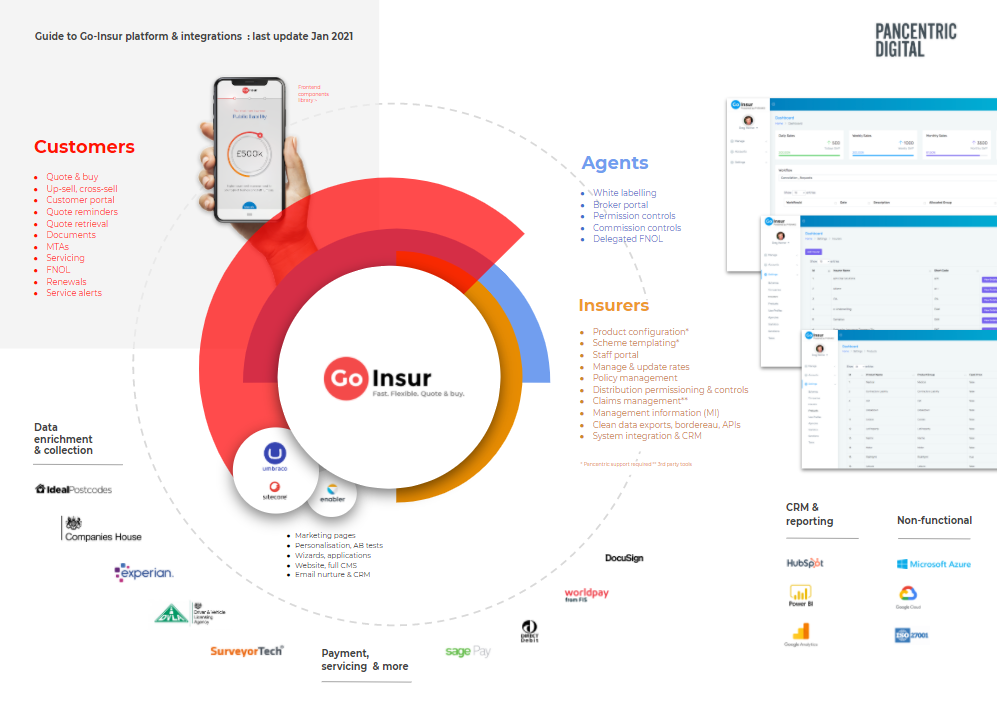

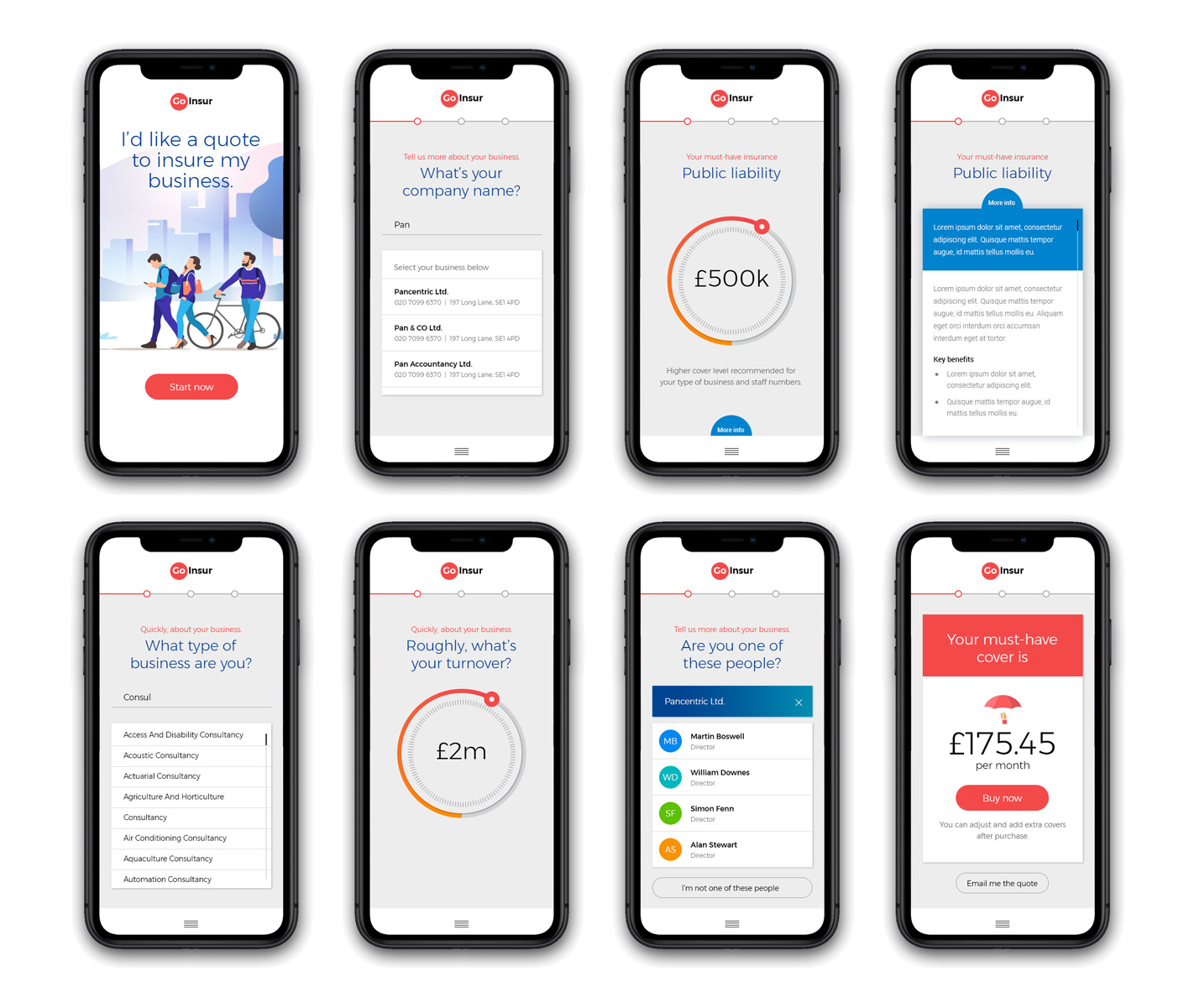

GO-INSUR is a cloud-based insurtech platform that enables D2C insurers, brokers, and MGAs to digitize their insurance operations. It offers a faster, agile, and scalable quote and buy solution that streamlines the entire customer lifecycle. GO-INSUR boasts impressive UX design, a cutting-edge quotation engine, and intelligent API integrations with well-known back-office and payment gateways. It empowers businesses to rapidly grow and respond to changing market conditions, gain a competitive edge, and adapt to the 21st century.

Strengths

-

Efficient

Automates insurance claims processing

-

Accurate

Uses AI to detect fraudulent claims

-

Customizable

Can be tailored to fit specific insurance needs

Weaknesses

-

Costly

May be expensive for small insurance companies

-

Complex

May require extensive training to use effectively

-

Limited Integration

May not integrate with all existing insurance software

Opportunities

- Insurance industry is expanding globally

- Can reduce processing time and costs for insurance companies

- Can add new features to stay competitive

Threats

- Other insurance software providers may offer similar products

- Changes in insurance regulations may affect product usage

- Data breaches can compromise sensitive insurance information

Ask anything of Go-Insur with Workflos AI Assistant

http://www.pancentric.com/

Apolo

Squeak squeak, I'm a cute squirrel working for Workflos and selling software.

I have extensive knowledge of our software products and am committed to

providing excellent customer service.

What are the pros and cons of the current application?

How are users evaluating the current application?

How secure is the current application?

Media

Go-Insur Plan

Go-Insur offers a tiered pricing strategy based on the number of users, with discounts for annual subscriptions.