Finflux

4.6

105

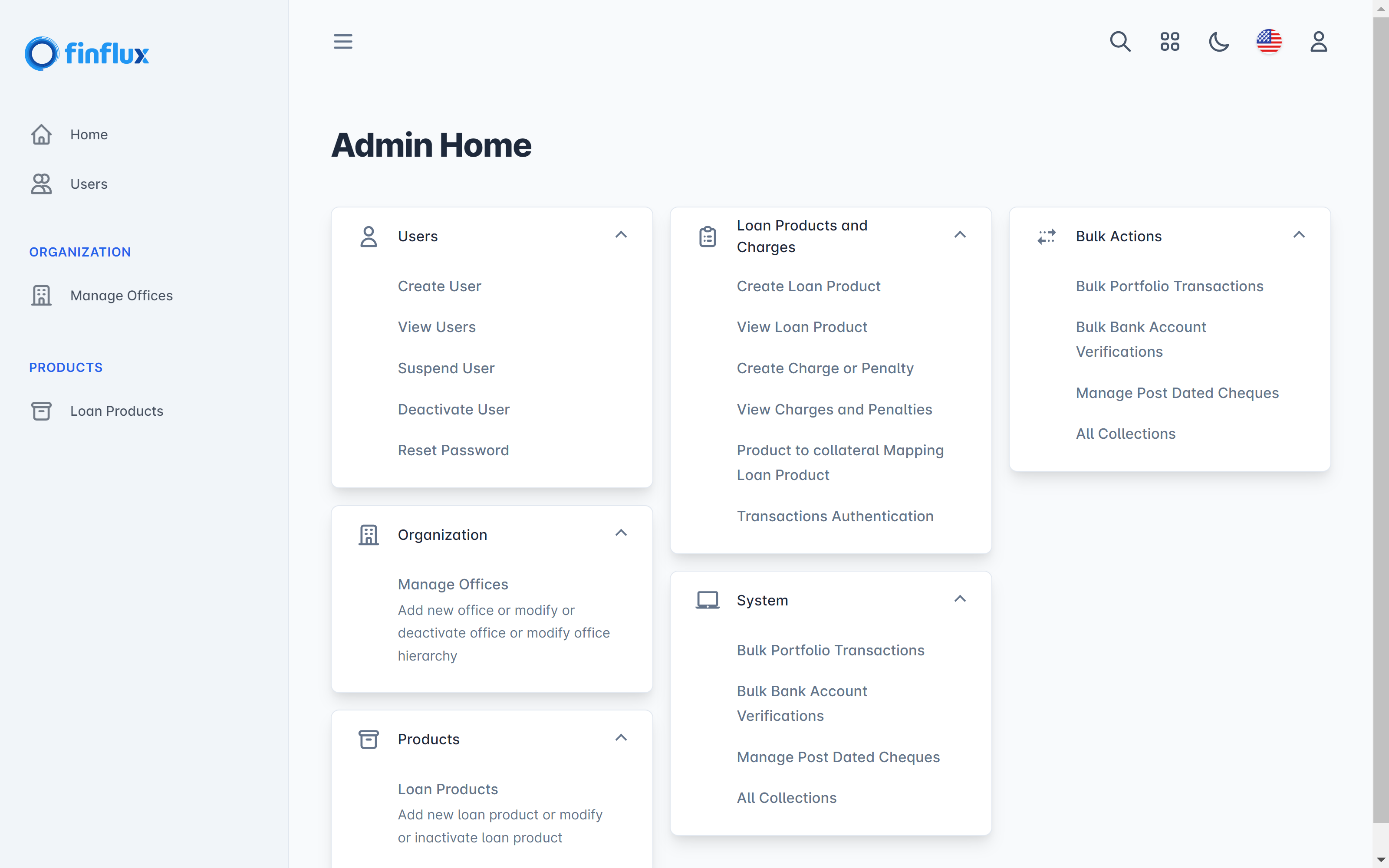

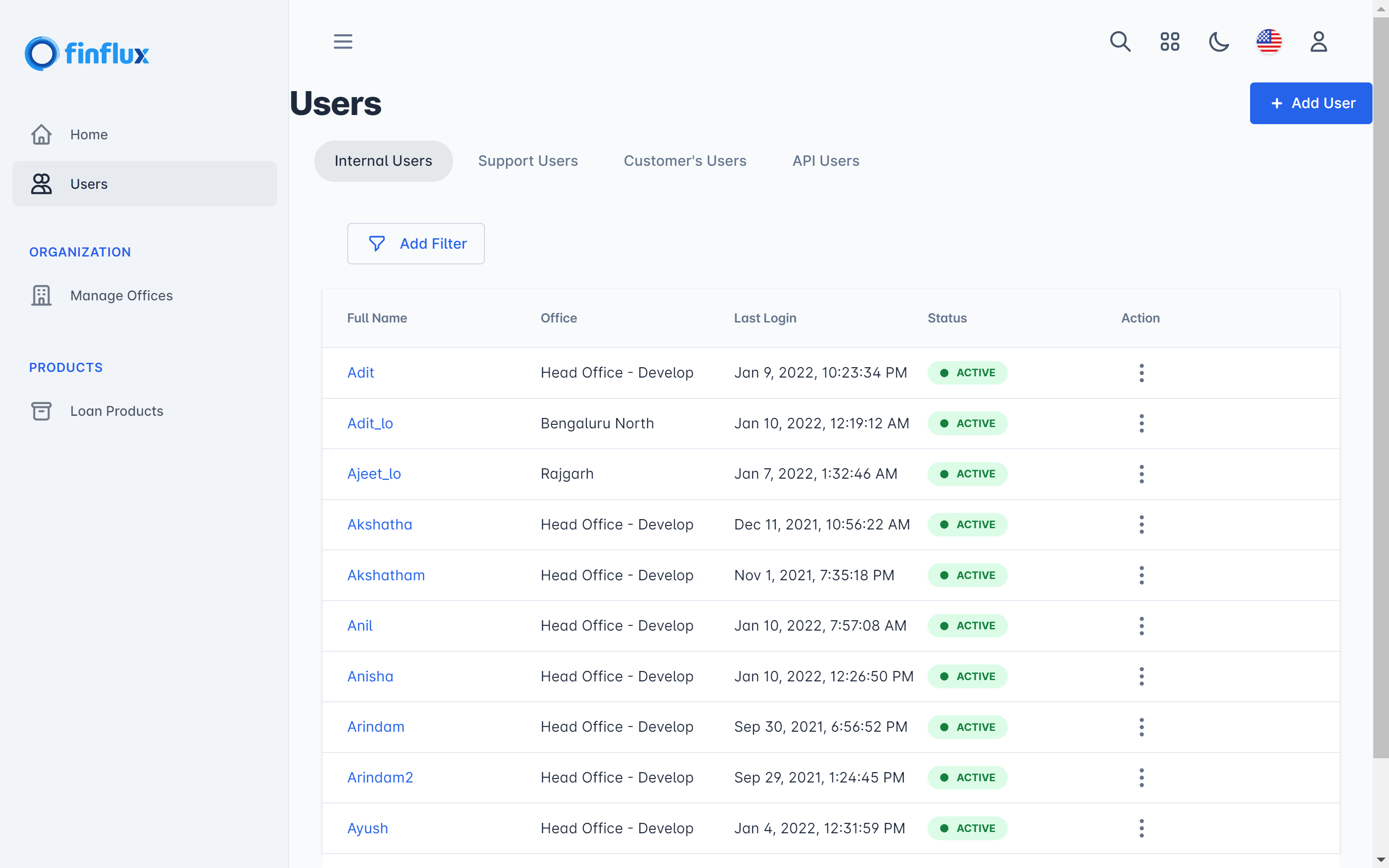

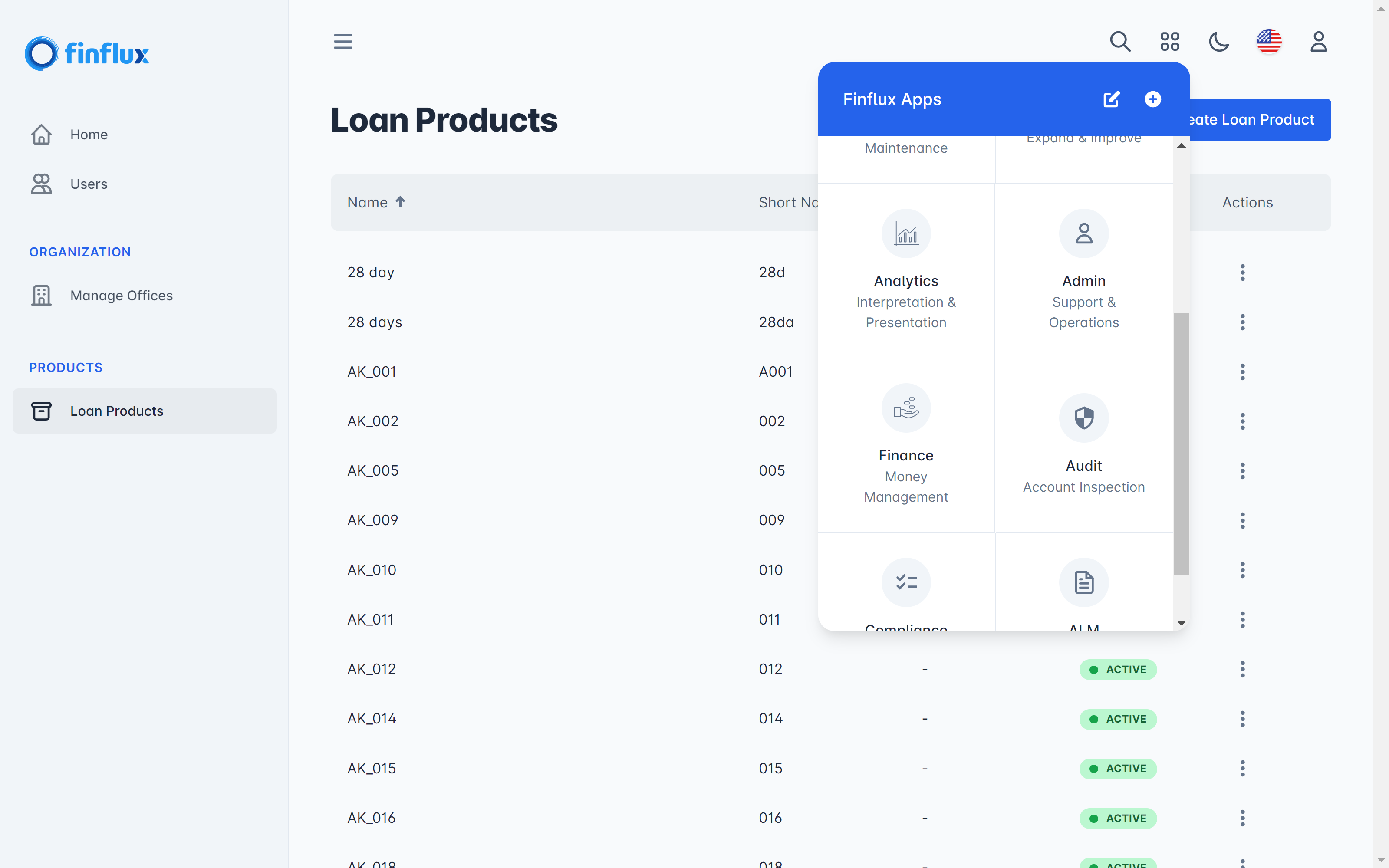

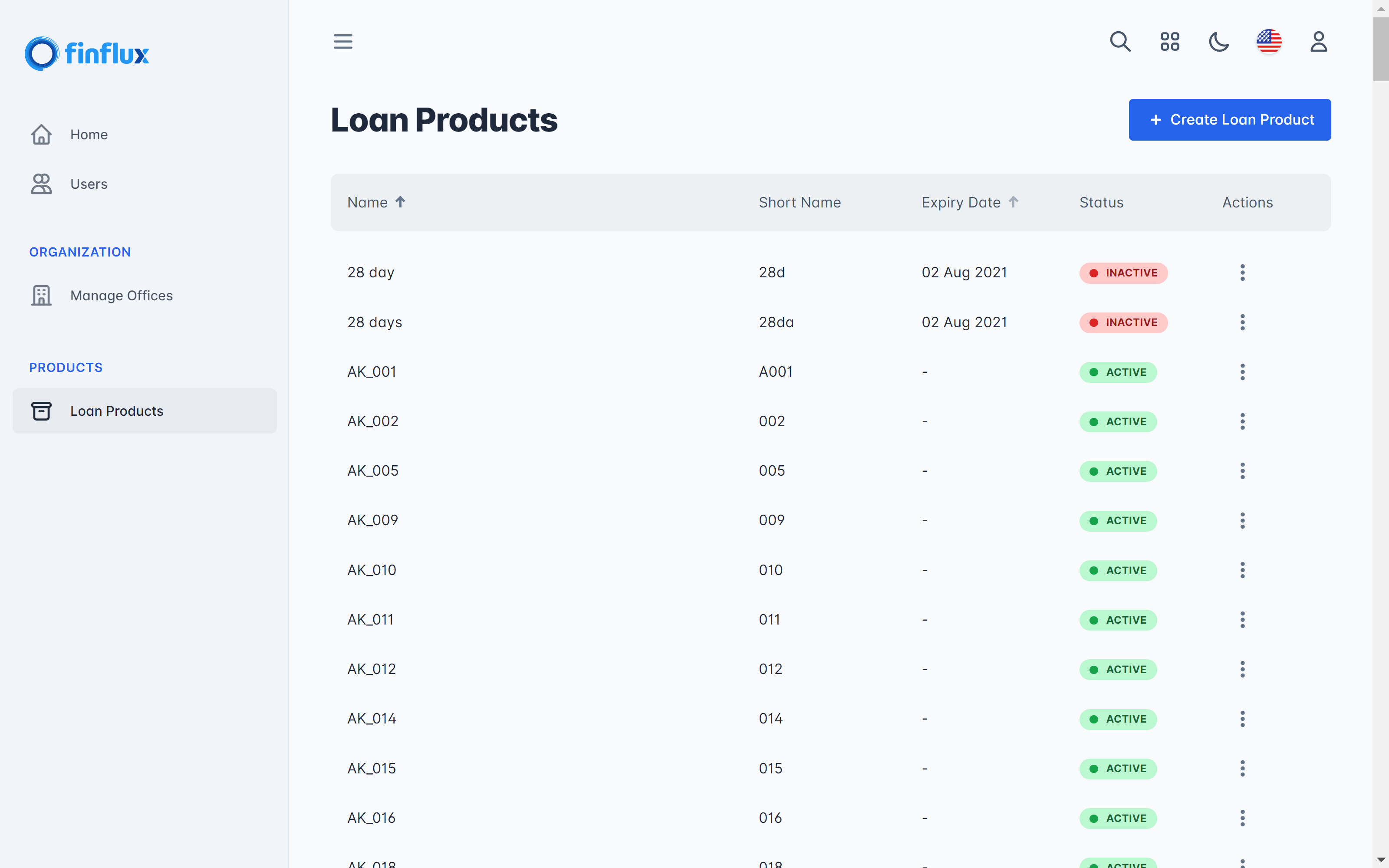

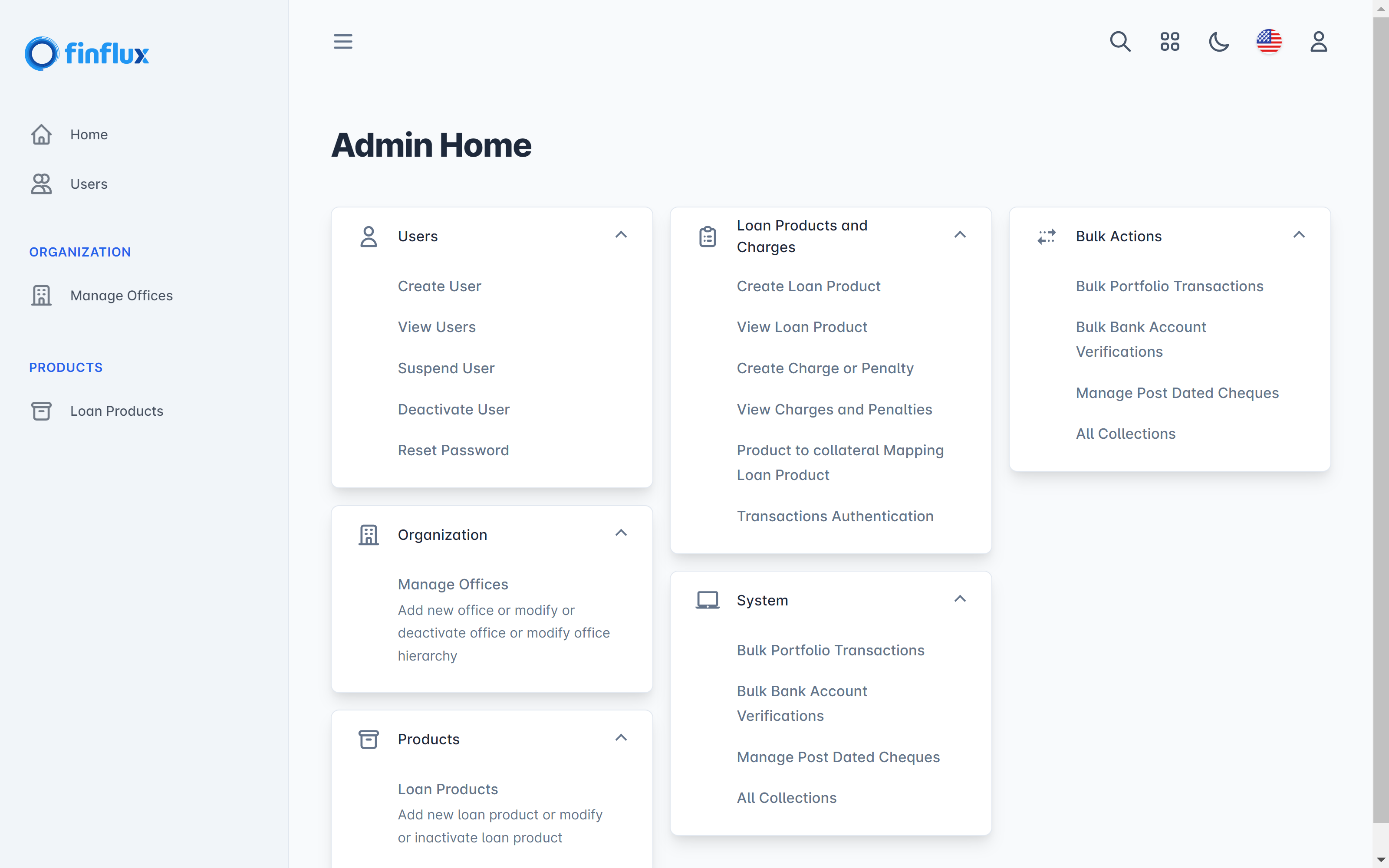

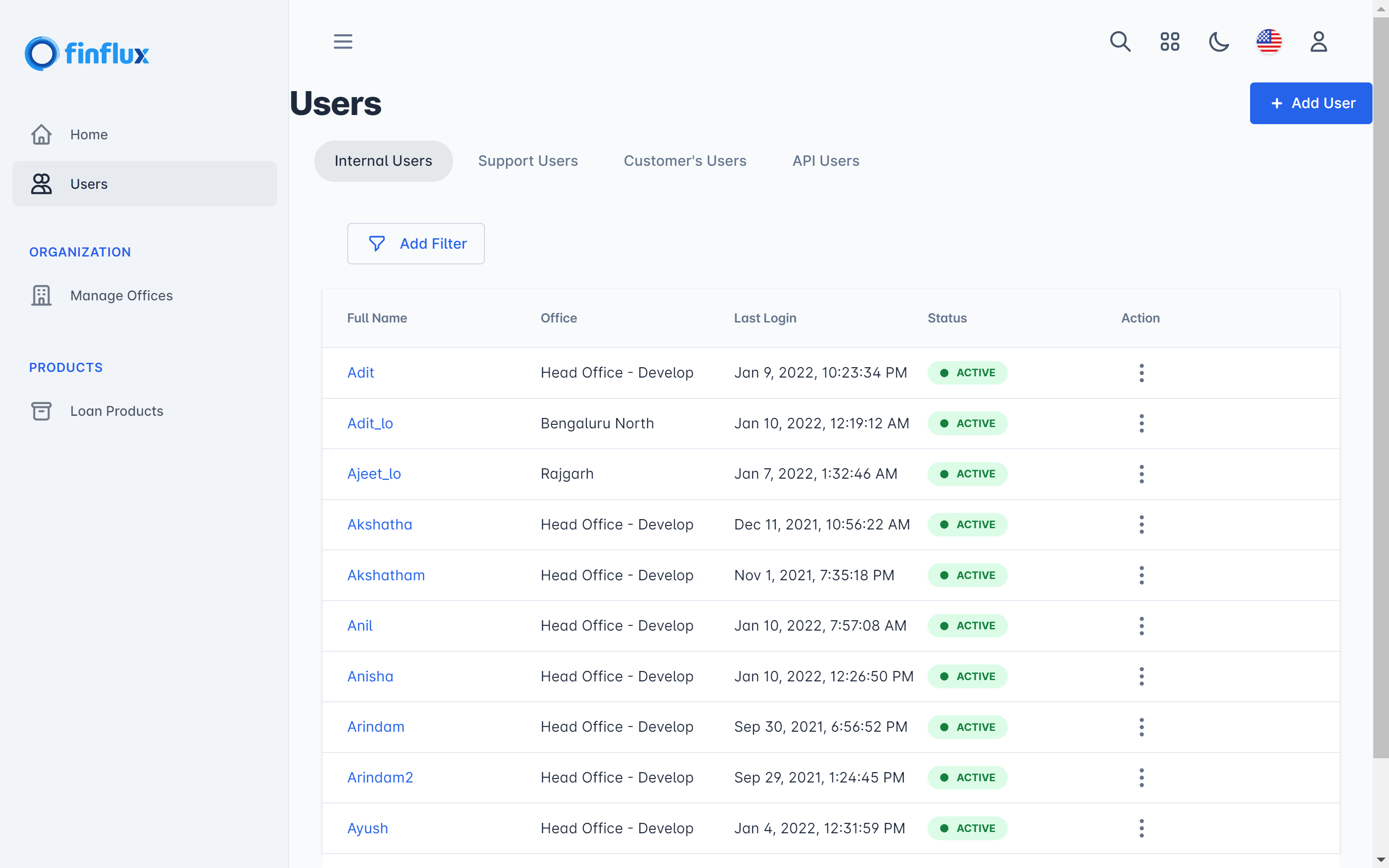

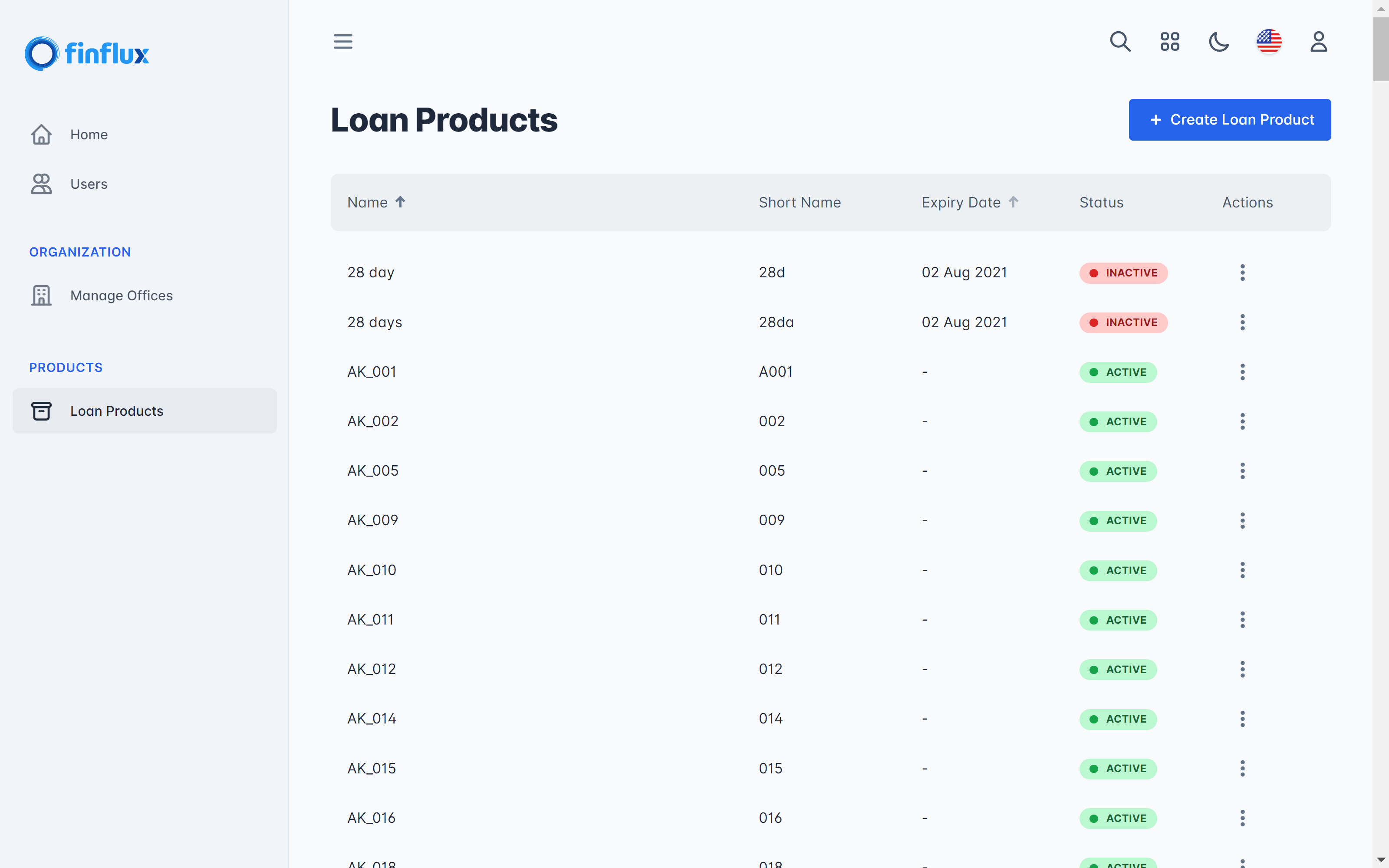

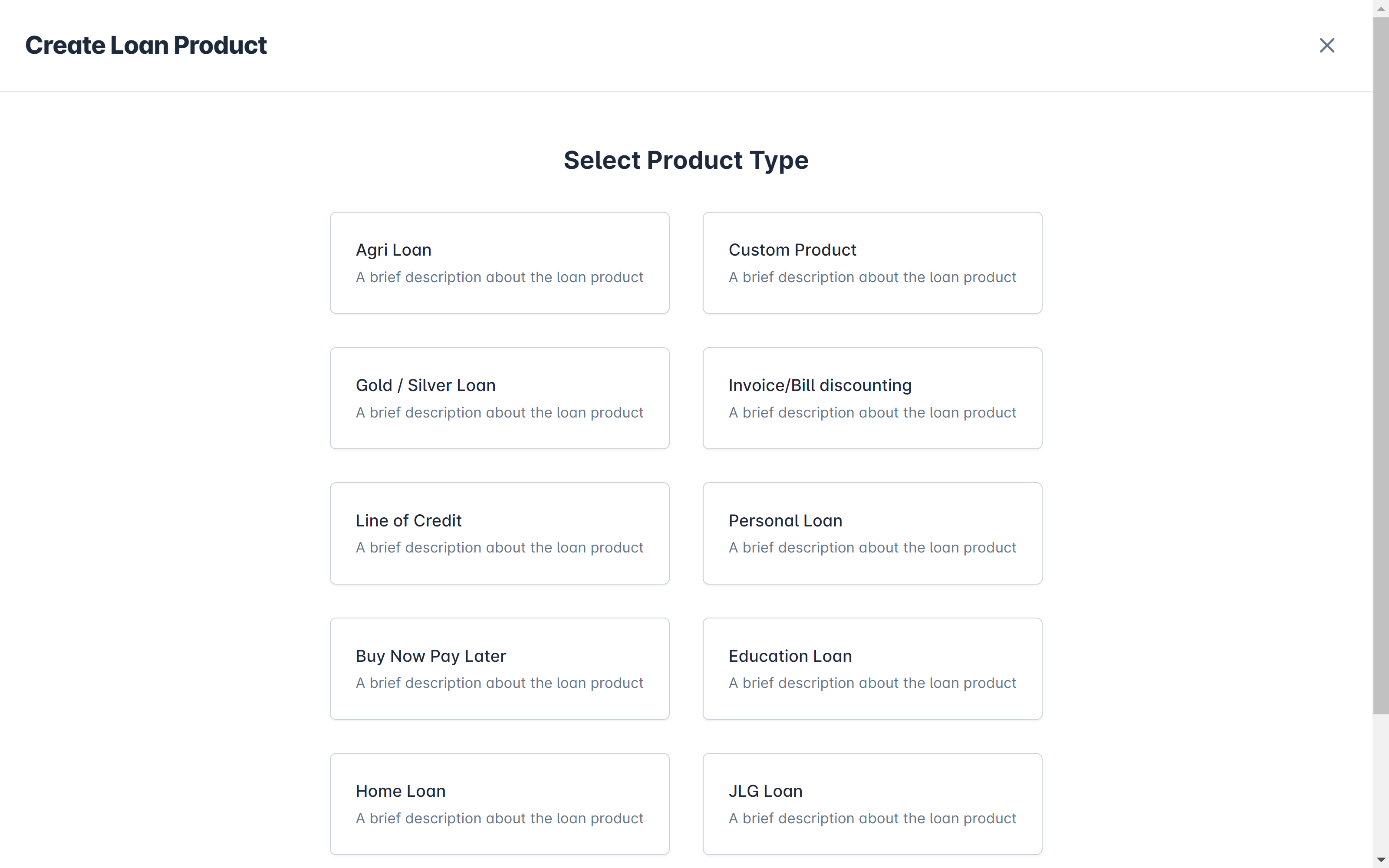

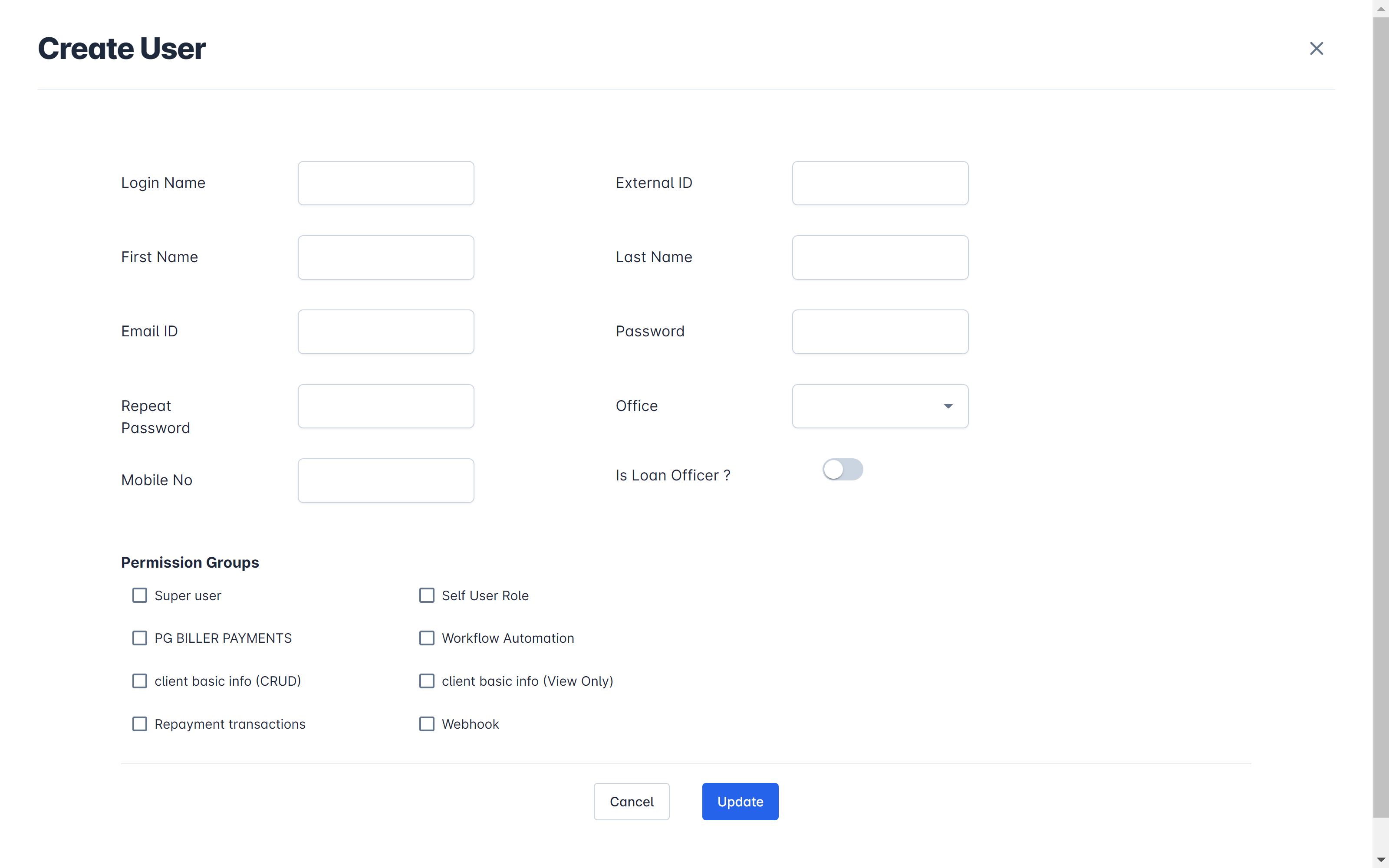

Finflux is a SaaS-based lending platform that offers solutions for loan origination, loan management, financial accounting, marketplace integration, app-based lending, alternative data-based credit scoring, dashboards & reporting, and analytics. They serve a wide range of institutions, from microfinance to banks and fintechs, and prioritize digitization, automation, and customer experience. The platform is cloud-first and mobile-first, with integrations and marketplace nexus to improve time to market, and is designed for performance, security, compliance, and scalability.

Strengths

-

Customizable

Can be tailored to specific business needs

-

Scalable

Can handle large amounts of data and users

-

Integrated

Offers a range of integrated features and modules

Weaknesses

-

Complex

May require technical expertise to set up and use

-

Expensive

Pricing may be prohibitive for small businesses

-

Limited Support

Support may be limited or require additional fees

Opportunities

- Increasing demand for financial software solutions

- Opportunities to partner with other financial service providers

- Potential to add new features and modules to stay competitive

Threats

- Increasing competition from other financial software providers

- Changes in financial regulations may impact software requirements

- Increased risk of cyber attacks and data breaches

Ask anything of Finflux with Workflos AI Assistant

http://finflux.co

Apolo

Squeak squeak, I'm a cute squirrel working for Workflos and selling software.

I have extensive knowledge of our software products and am committed to

providing excellent customer service.

What are the pros and cons of the current application?

How are users evaluating the current application?

How secure is the current application?

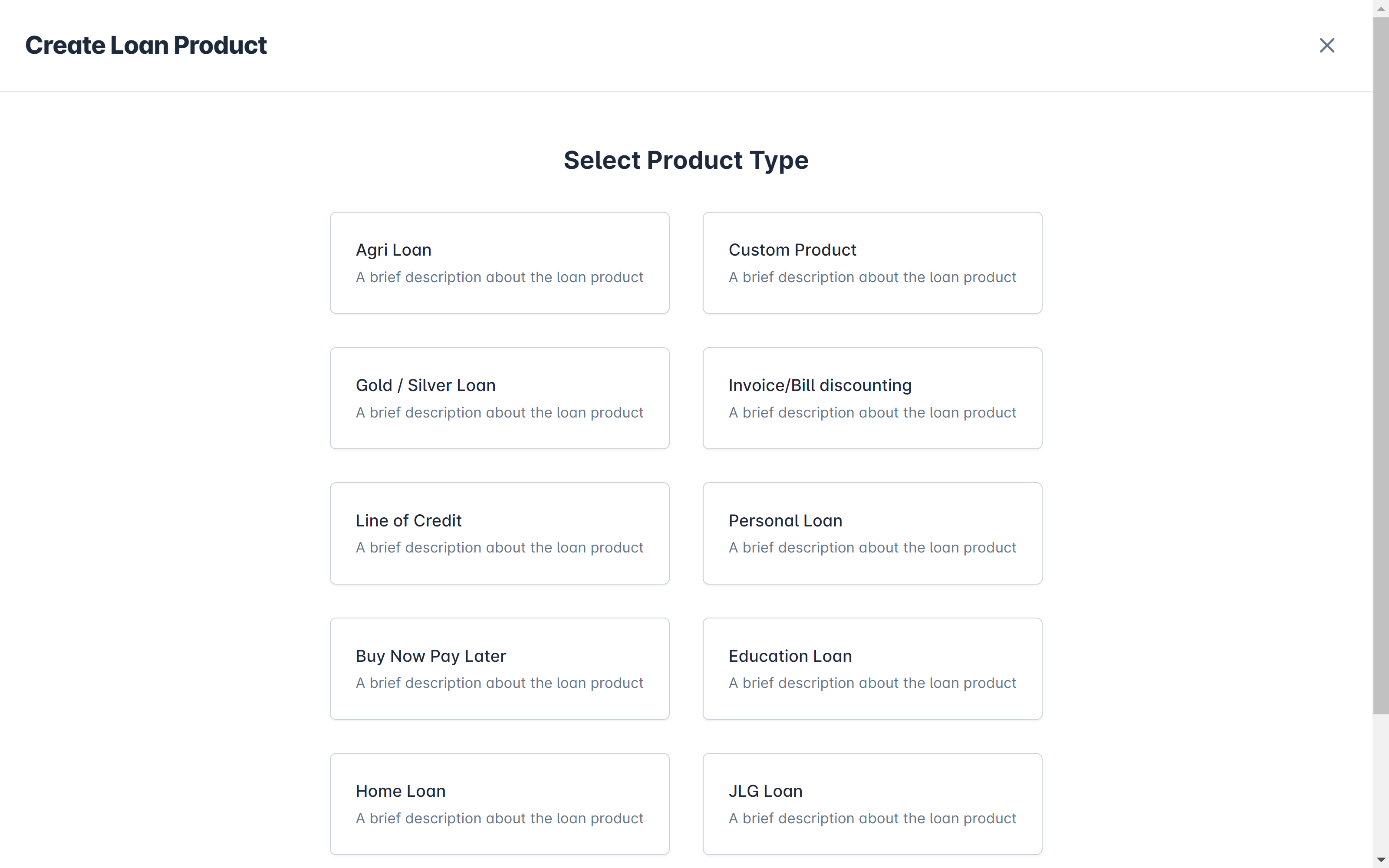

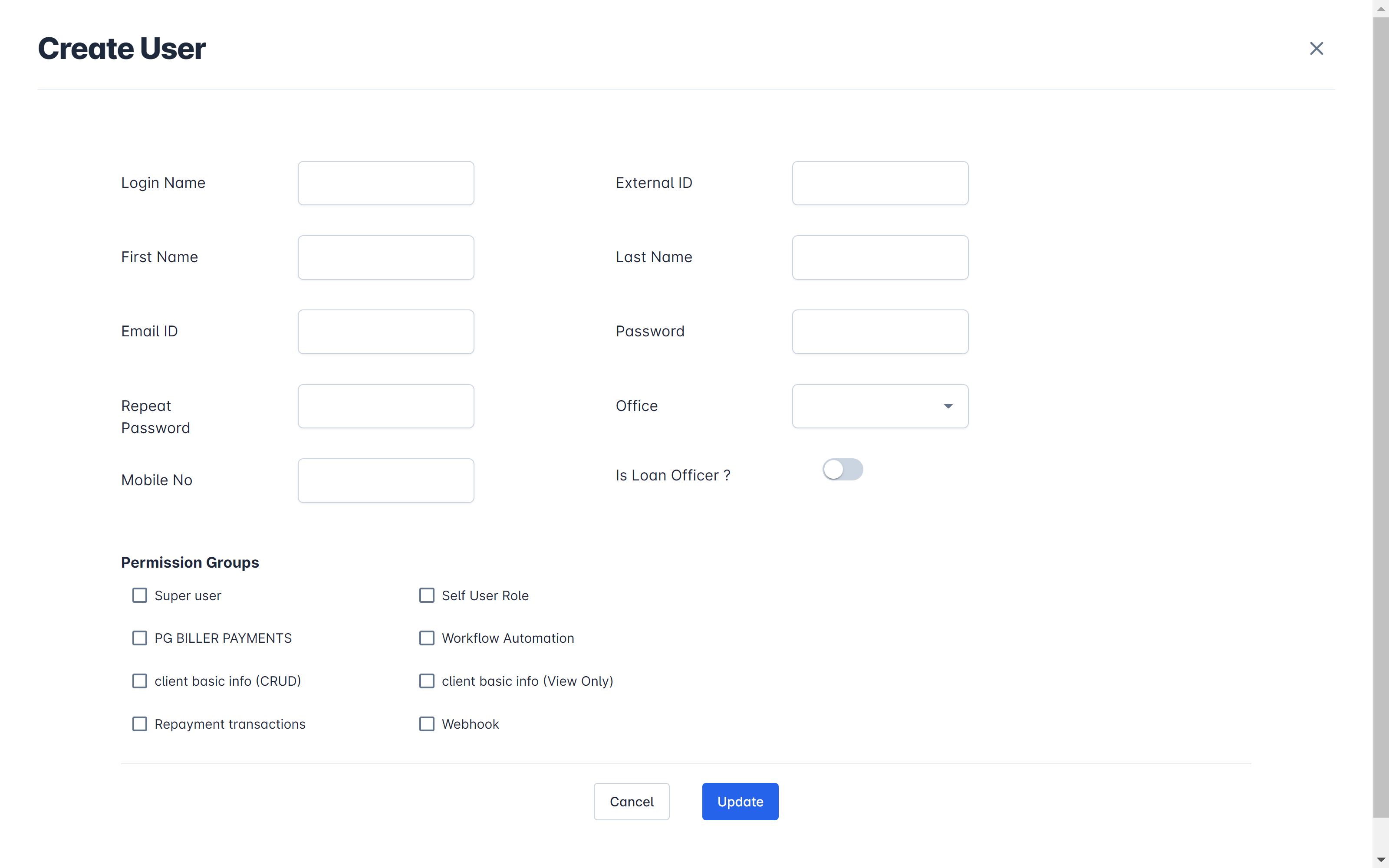

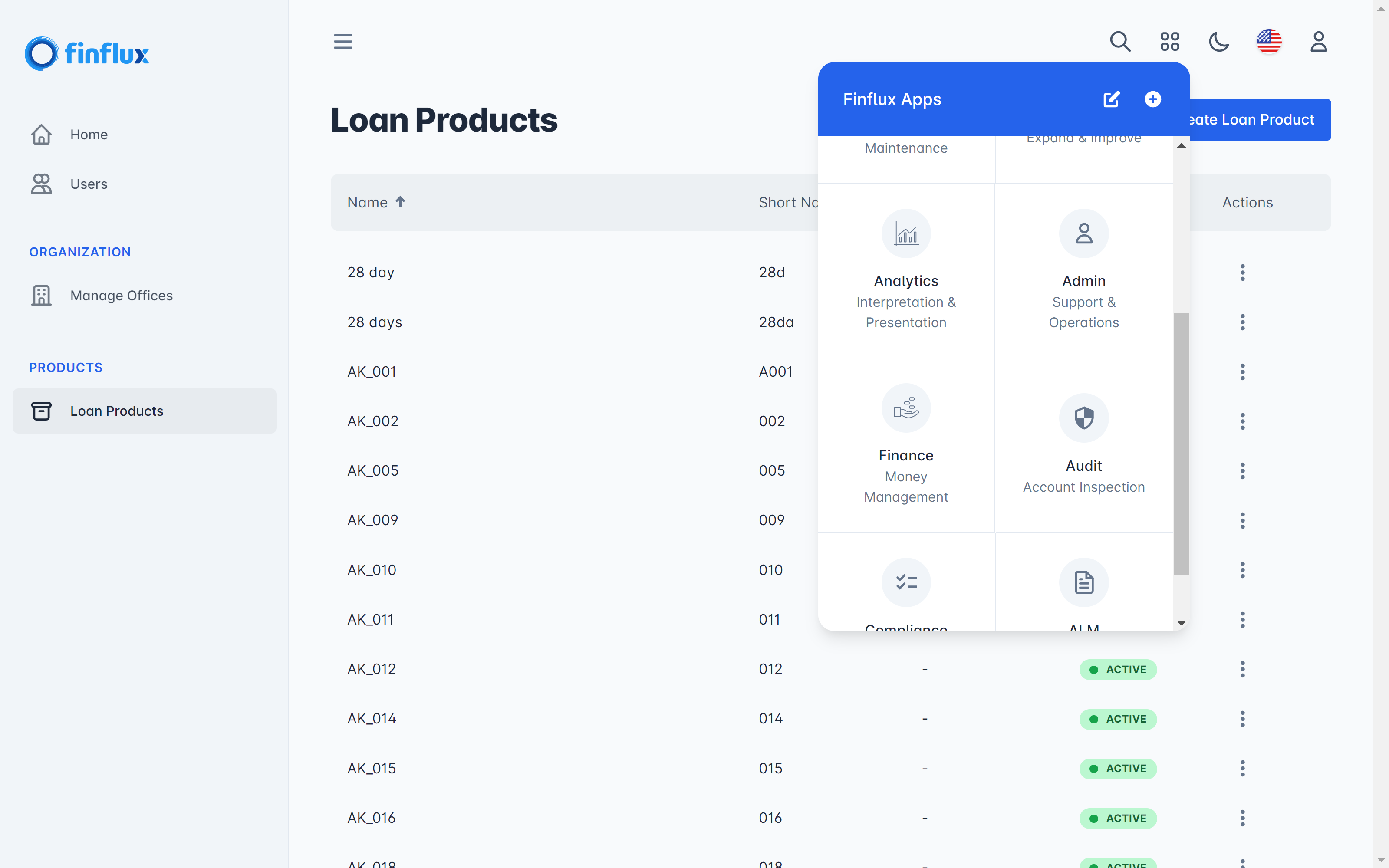

Media

Finflux Plan

Finflux offers a tiered pricing model with basic features starting at $50 per user per month and advanced features at $100 per user per month.

Pay As You Go

Pay As You Go

1 User Per Year

Finflux is committed to ‘no-surprise’ pricing. From software to service – everything needed to make your lending business successful is included in your annual subscription plan.

No upfront fees, pay as you go.

Deployment options - Pricing based on SaaS or On-Premise.

Lowest Total Cost of Ownership (TCO) in the industry.

Full-Stack Solution - End to End Lending applications.

Immediate ROI - We help you lend faster, better and cheaper.