creditonline

4.6

17

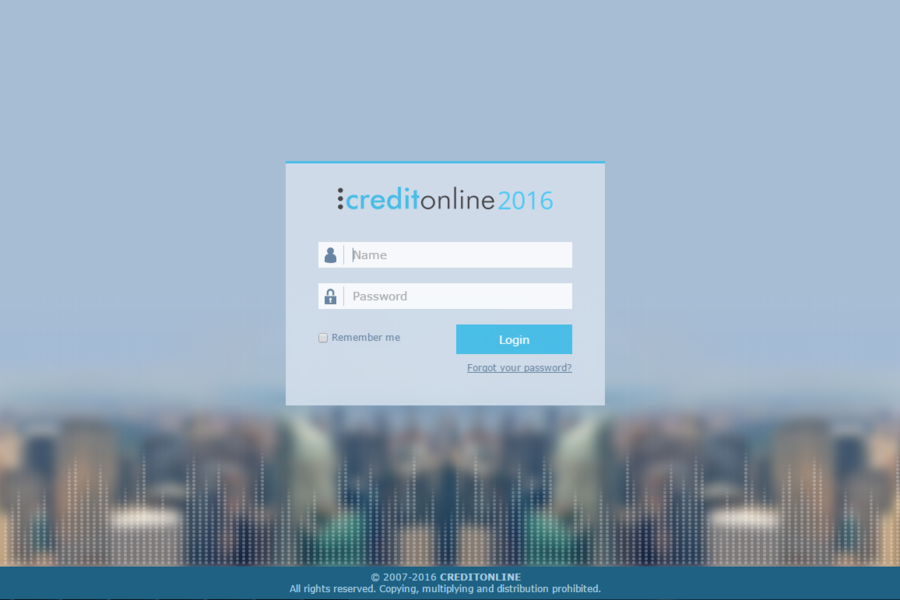

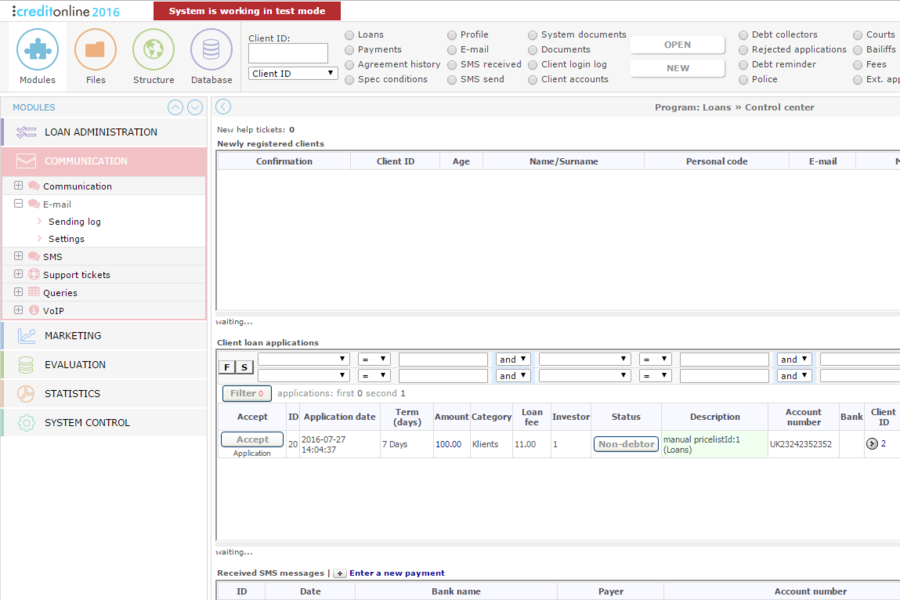

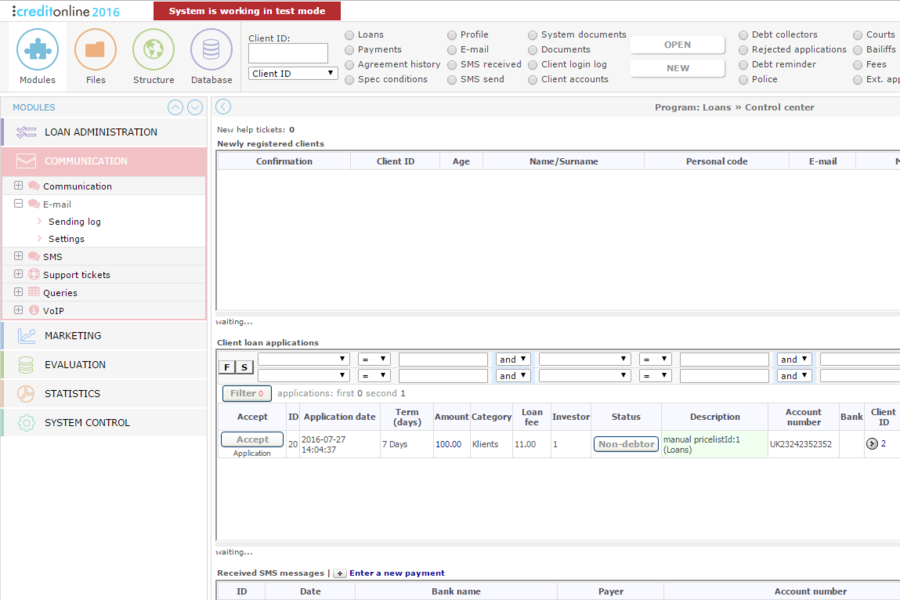

CreditOnline is a loan management system with tools for all aspects of the loan business, 24/7 support, and an end-to-end lending process. They have launched 80 successful projects in 8 countries over the past 6 years and have developed a fully automated loan life cycle process. They have created multiple tools and solutions for various challenges their customers have faced and are actively improving and expanding the system based on client needs and suggestions.

Strengths

-

Automation

Automated loan origination and management processes

-

Customization

Highly customizable to fit specific business needs

-

Scalability

Can handle large volumes of loan applications and data

Weaknesses

-

Integration

May require additional integration with other systems

-

Pricing

Pricing may be high for small businesses

-

Learning Curve

May require some training to fully utilize all features

Opportunities

- Growing demand for online loan origination and management solutions

- Opportunity to expand into new markets

- Opportunity to form partnerships with other financial institutions

Threats

- Competitive market with other established loan origination and management solutions

- Regulatory changes may impact the industry and product

- Data security concerns and potential breaches

Ask anything of creditonline with Workflos AI Assistant

http://www.creditonline.eu

Apolo

Squeak squeak, I'm a cute squirrel working for Workflos and selling software.

I have extensive knowledge of our software products and am committed to

providing excellent customer service.

What are the pros and cons of the current application?

How are users evaluating the current application?

How secure is the current application?

Media

creditonline Plan

Creditonline offers a tiered pricing strategy with three versions, ranging from $49 to $149 per month, based on features and usage.