CreditHQ

4.9

1

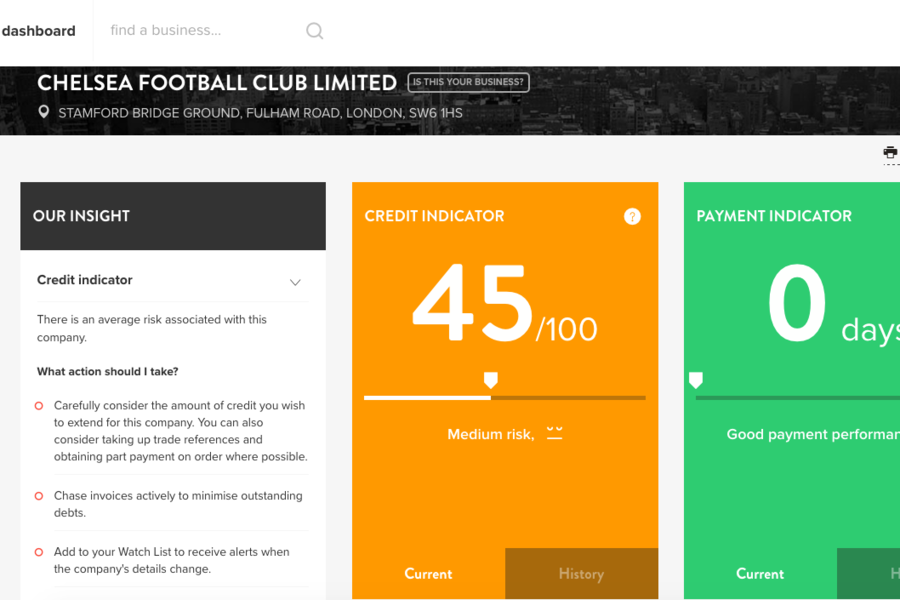

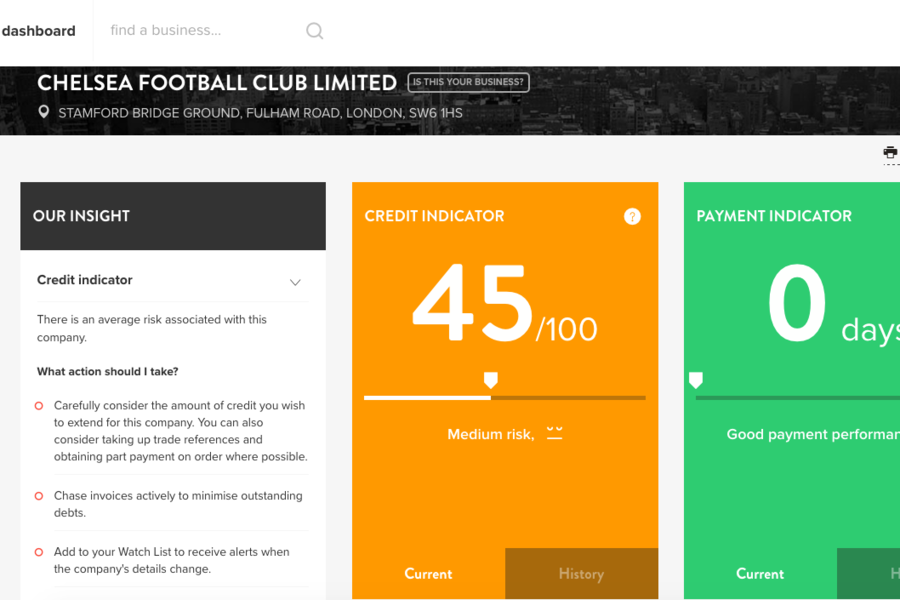

CreditHQ provides financial insights to help businesses trade with the best customers and suppliers, and get paid on time. It helps businesses make informed decisions on offering credit terms, chase outstanding invoices, and improve their own credit score for better cash flow.

Strengths

-

Automated credit checks

Saves time and effort

-

Real-time credit monitoring

Provides up-to-date information

-

Customizable credit limits

Tailored to specific needs

Weaknesses

-

Limited credit bureau coverage

May not have data from all bureaus

-

No integration with accounting software

Requires manual data entry

-

No free trial

May deter potential customers

Opportunities

- Potential for growth

- Improves user experience

- Access to more data

Threats

- May struggle to gain market share

- Could impact data availability

- Could lead to decreased demand

Ask anything of CreditHQ with Workflos AI Assistant

Apolo

Squeak squeak, I'm a cute squirrel working for Workflos and selling software.

I have extensive knowledge of our software products and am committed to

providing excellent customer service.

What are the pros and cons of the current application?

How are users evaluating the current application?

How secure is the current application?

Media

CreditHQ Plan

CreditHQ offers a free version with limited features and a paid version starting at £25/month with additional features and credit reports.