Credit Risk Platform

4.9

3

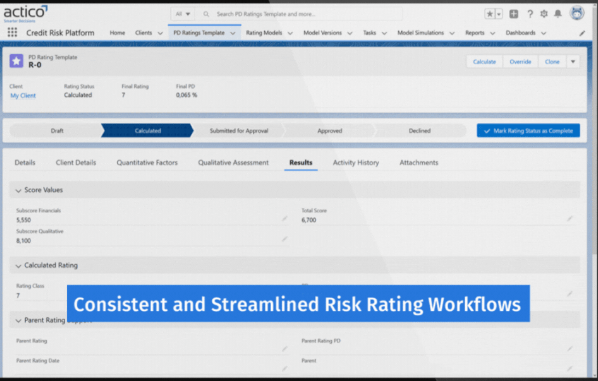

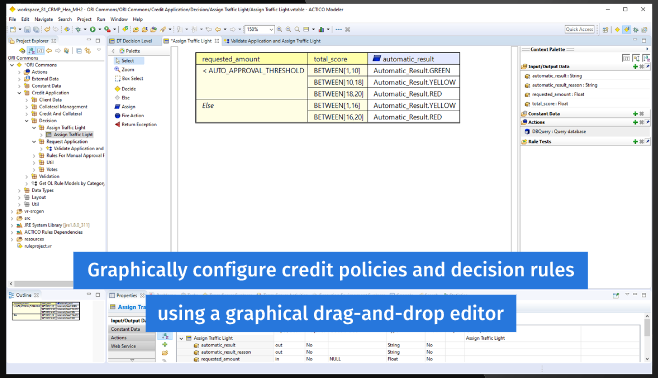

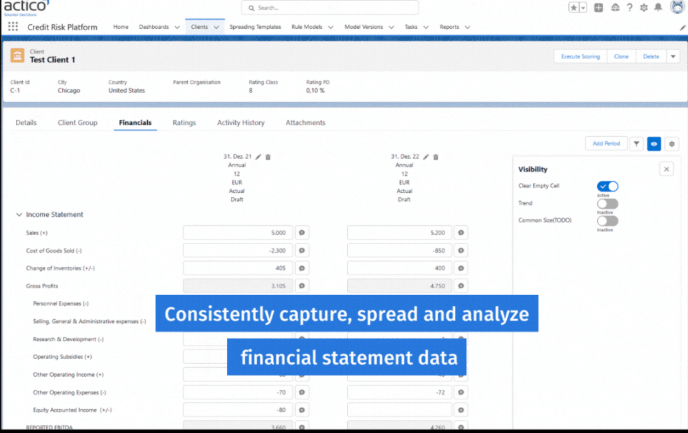

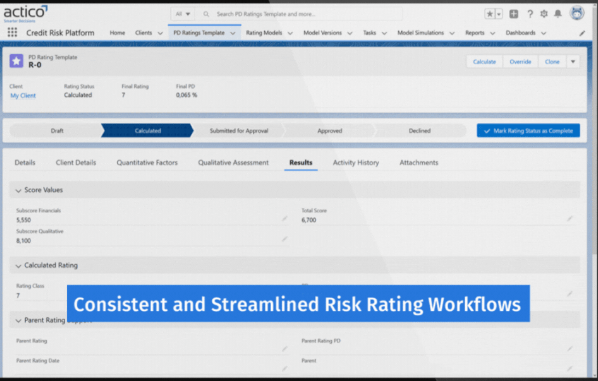

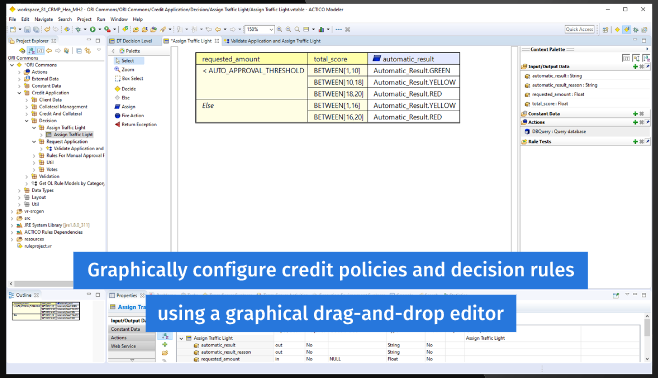

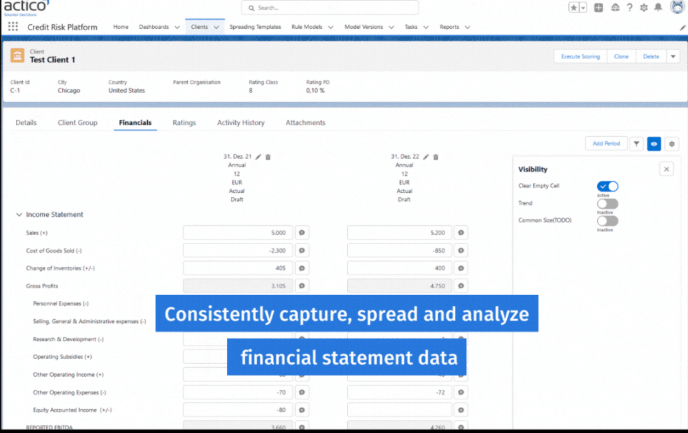

Credit Risk Platform is a SaaS banking software that streamlines financial spreading, credit analysis, and credit approval workflows for faster and informed credit decisions. It allows the implementation of bank-internal rating models and access to external credit scorecards. The solution is built on the Salesforce platform and offers a secure, flexible cloud-based solution for risk assessment processes.

Strengths

-

Accuracy

Provides accurate credit risk assessment

-

Customization

Can be customized to fit specific business needs

-

Automation

Automates credit risk assessment process

Weaknesses

-

Cost

Can be expensive for small businesses

-

Integration

May require integration with existing systems

-

Data Availability

Relies on availability of accurate data

Opportunities

- Growing demand for credit risk assessment solutions

- Opportunity to expand globally

- Opportunity to form partnerships with other businesses

Threats

- Competition from other credit risk assessment platforms

- Changes in regulations may affect the platform's functionality

- Security breaches may affect the platform's reputation

Ask anything of Credit Risk Platform with Workflos AI Assistant

https://www.actico.com/solutions/credit-risk-management/

Apolo

Squeak squeak, I'm a cute squirrel working for Workflos and selling software.

I have extensive knowledge of our software products and am committed to

providing excellent customer service.

What are the pros and cons of the current application?

How are users evaluating the current application?

How secure is the current application?

Media

Credit Risk Platform Plan

Credit Risk Platform offers a tiered pricing model based on the number of users and features, starting at $5,000 per year.