Credit Cloud

4.2

74

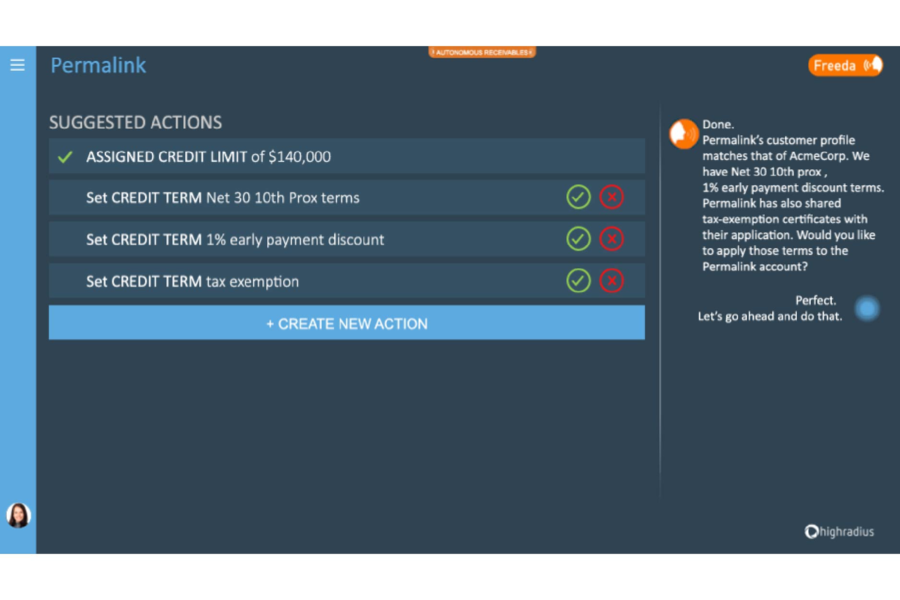

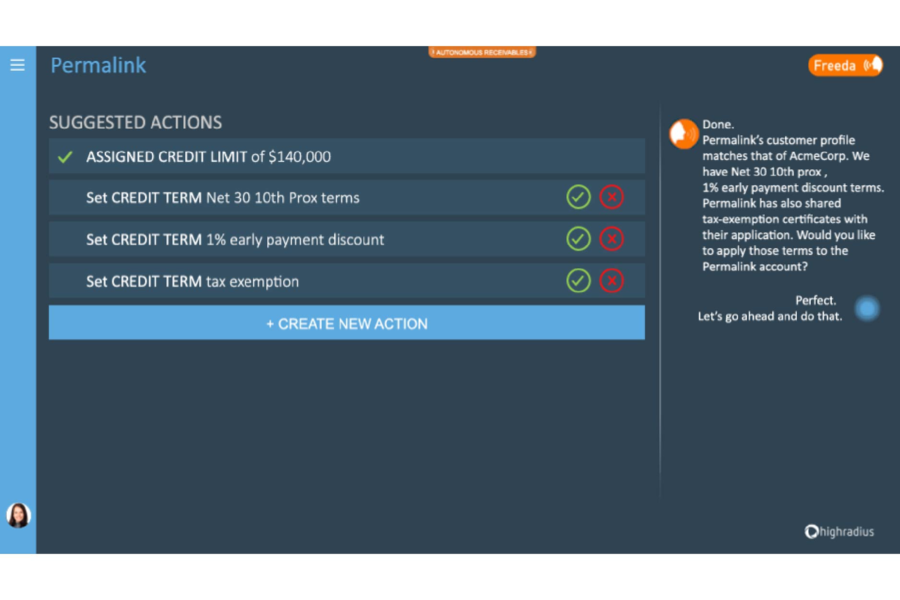

HighRadius Credit Cloud automates credit management process for quicker and more accurate decisions with the 4 Cs.

Strengths

-

Efficient credit management

Automated credit decision-making and monitoring

-

Scalability

Can handle large volumes of credit applications and data

-

Integration

Can integrate with other software and systems

Weaknesses

-

Dependence on data accuracy

Inaccurate data can lead to incorrect credit decisions

-

Limited customization

May not be able to fully customize to specific business needs

-

Cost

May be expensive for small businesses or startups

Opportunities

- As more businesses seek to manage credit risk, there is a growing market for Credit Cloud

- Credit Cloud can expand into new industries or geographic regions

- Can form partnerships with other software providers or financial institutions

Threats

- There are other credit management software providers in the market

- Changes in regulations can impact credit management practices

- Data breaches or cyber attacks can compromise sensitive credit information

Ask anything of Credit Cloud with Workflos AI Assistant

Apolo

Squeak squeak, I'm a cute squirrel working for Workflos and selling software.

I have extensive knowledge of our software products and am committed to

providing excellent customer service.

What are the pros and cons of the current application?

How are users evaluating the current application?

How secure is the current application?

Media

Credit Cloud Plan

Credit Cloud offers a tiered pricing strategy with three versions, starting at $49/month, increasing in features and price up to $199/month.