CheckMark Payroll

4.4

8

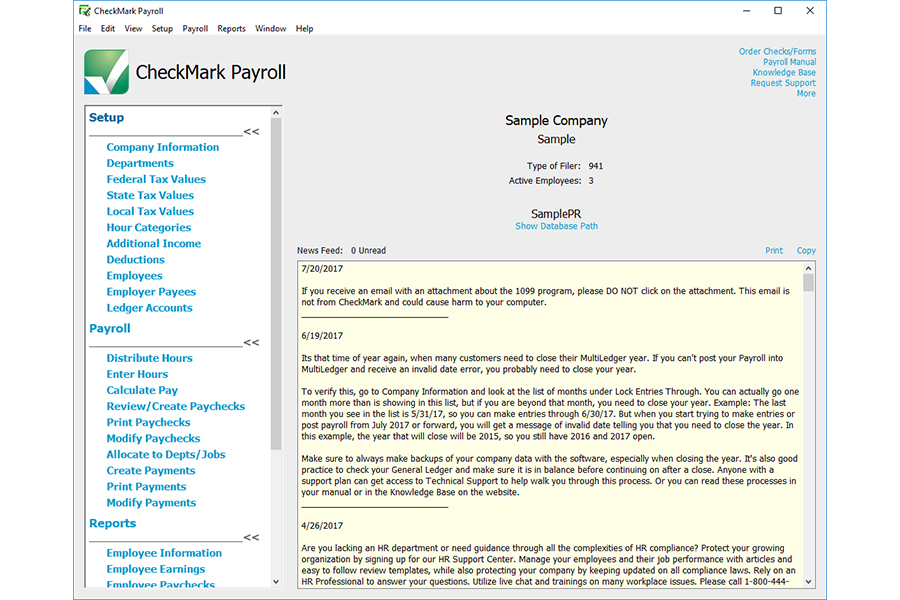

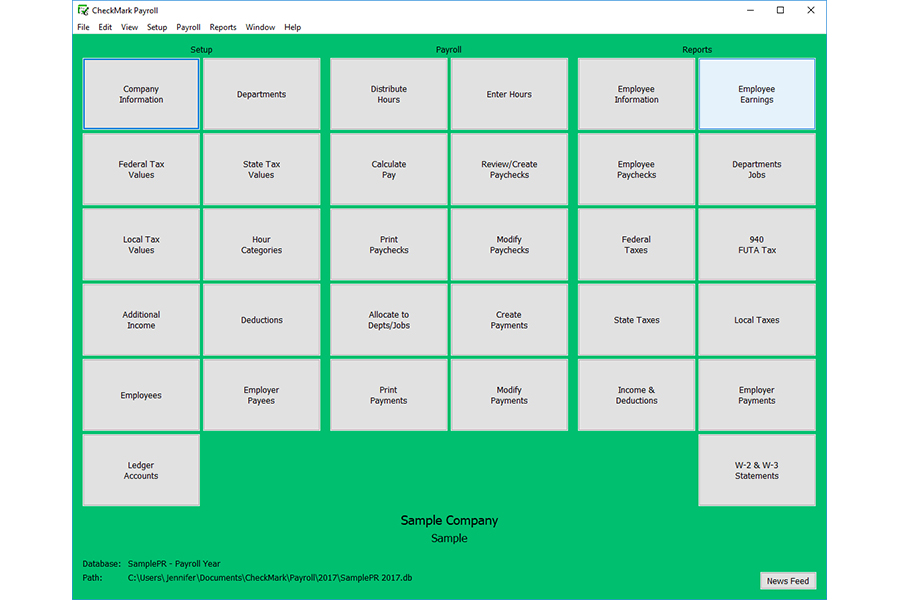

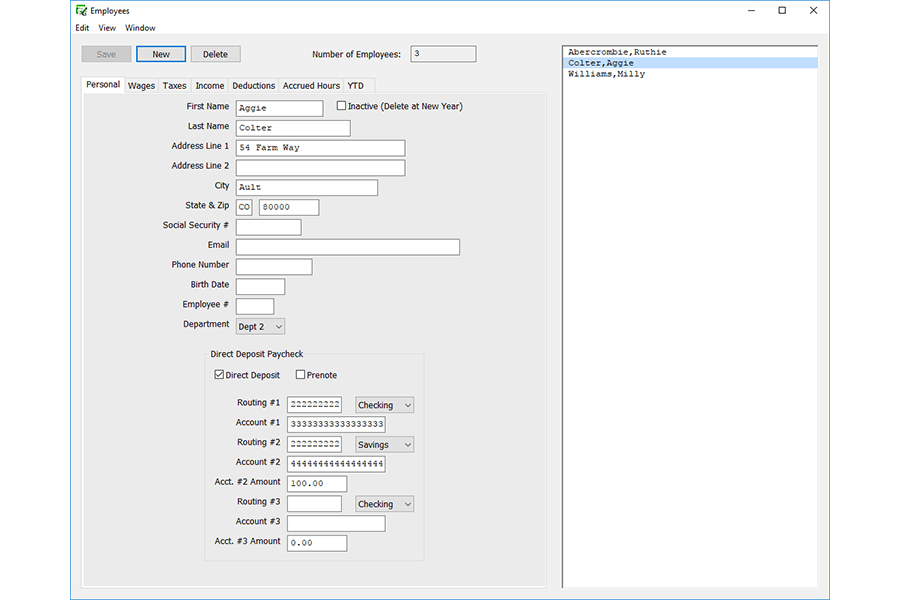

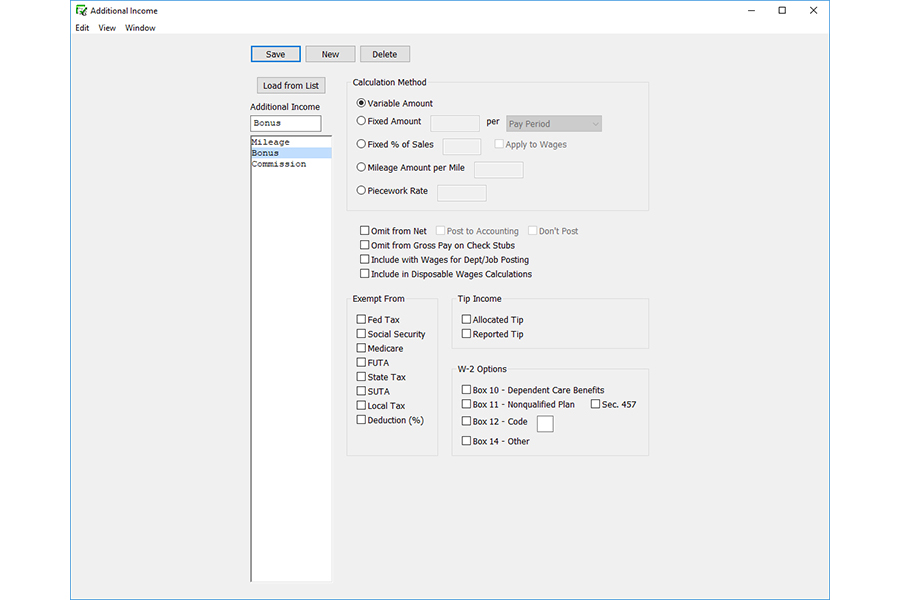

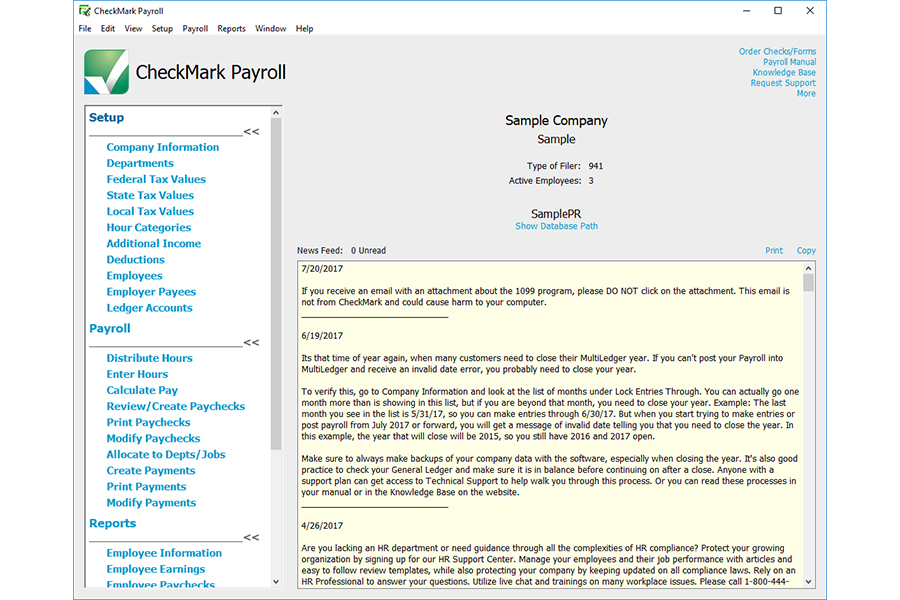

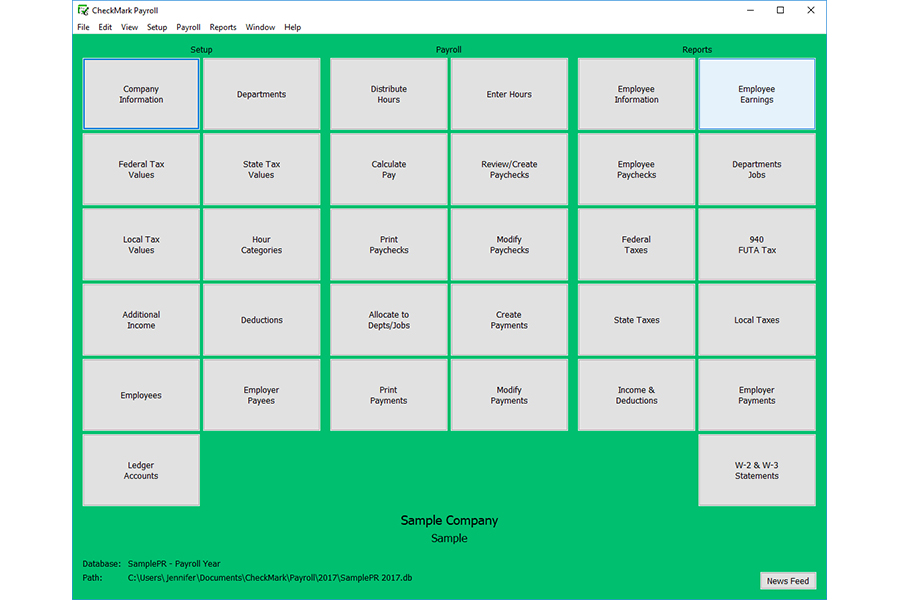

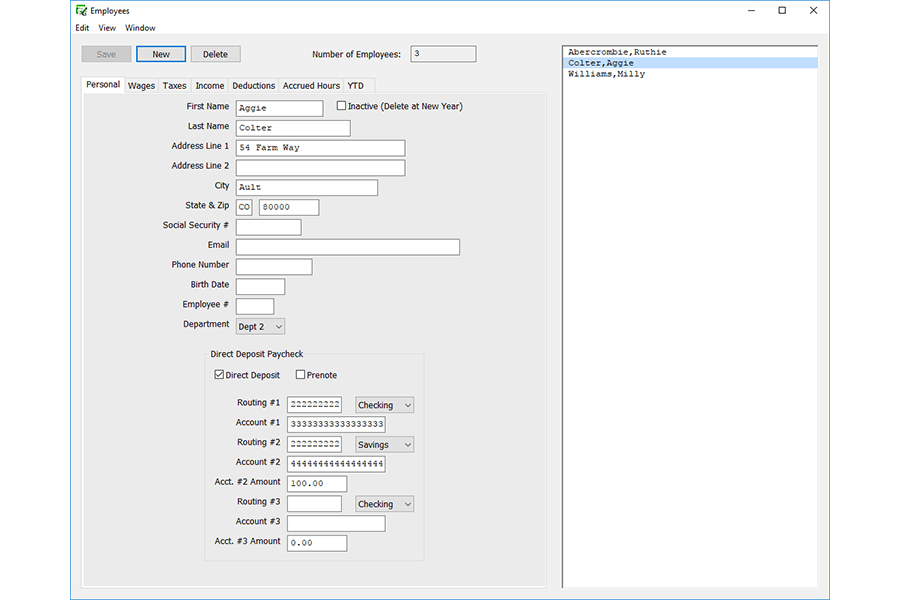

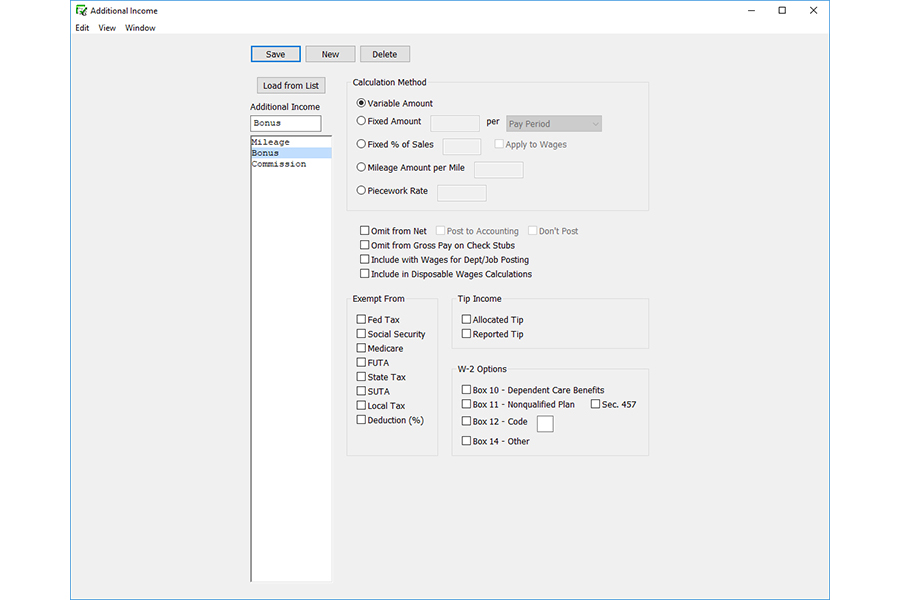

CheckMark Payroll Software is an affordable software solution packed with advanced features and functionalities. It allows users to easily create and manage unlimited databases, companies, and employees, making it a valuable tool for business owners, employers, CPAs, and payroll service providers.

With CheckMark Payroll Software, users can process unlimited payrolls, making it a scalable solution that can grow with your business. Our payroll program integrates seamlessly with many accounting programs, making it easy to use and manage.

One of the standout features of CheckMark Payroll Software is its flexibility when it comes to creating and printing checks. Users can choose to use direct deposit, paper checks, or both in the same check run, and the software even offers the ability to print signatures on checks. Additionally, the software can print MICR encoding on blank check stock or use pre-printed checks. For those receiving the direct deposit, CheckMark Payroll Software also allows users to easily email check stubs.

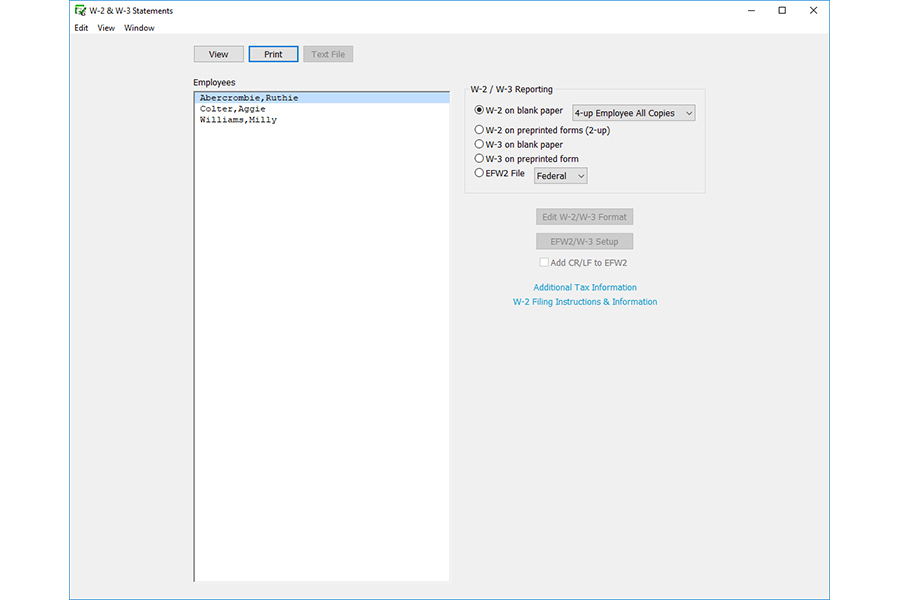

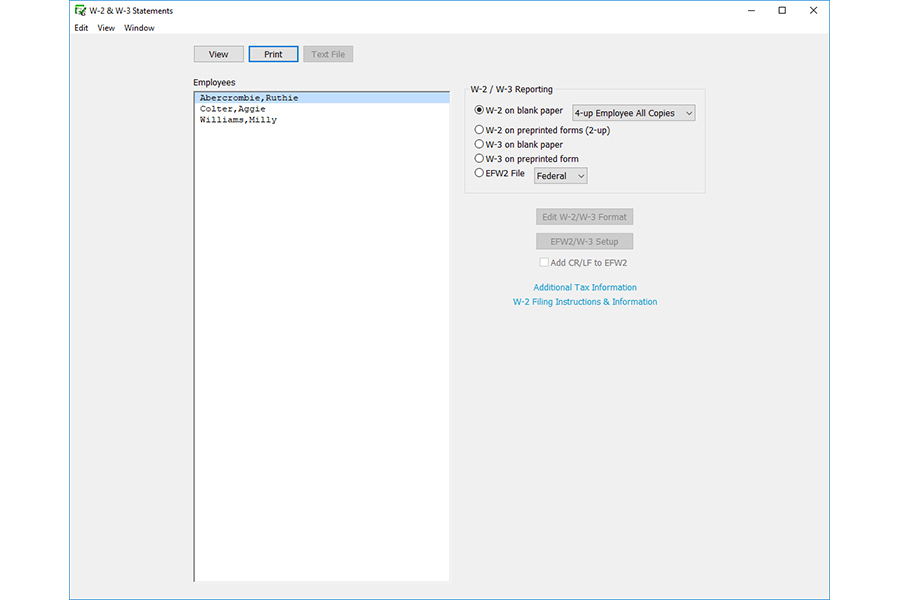

The software also offers a range of features to help users manage their taxes and compliance. It allows users to print 941’s, 940’s, 944’s, and 943’s on blank paper, and it can print W-2 and W-3 forms on blank, pre-printed paper, or e-file them.

Best of all, CheckMark Payroll Software offers a simple and attractive pricing model that is perfect for small and medium-sized businesses. Whether you’re a solo entrepreneur or a growing company, CheckMark Payroll Software has the features and flexibility you need to manage your payroll with ease.

Ask anything of CheckMark Payroll with Workflos AI Assistant

http://www.checkmark.com

Apolo

Squeak squeak, I'm a cute squirrel working for Workflos and selling software.

I have extensive knowledge of our software products and am committed to

providing excellent customer service.

What are the pros and cons of the current application?

How are users evaluating the current application?

How secure is the current application?

Media

CheckMark Payroll Plan

CheckMark Payroll Pro+

579

Per Year

Get support quickly so you can get back to business with Pro+ plan. Best for small businesses and CPAs, who want faster and top-of-the-queue responses to their issues.

Self Service Payroll

Automatic Payroll Calculation

Unlimited Companies

Unlimited Salaried & Hourly Employees

Reduced data recovery rates

Online access to program fixes

Unlimited Payrolls (Regular, Bonus, Off-Cycle, etc.)

All Pay Frequencies

Multiple Pay Rates

MICR Encoded Check Printing

ACH Direct Deposit

Printing & E-Filing of Forms 941, 940, 944, 943, W-2, & W-3

Employer Payroll Tax Filings

Access to 40+ Types of Payroll Reports

Employee Benefits (Health, Retirement, Insurance, etc.)

Customized Vacation and Sick Leave Policies

Customized Deductions and Garnishments

Up to 300 mins of support within 12 months

Exclusive Pro+ toll-free phone number

Top-of-the-queue priority

Reduced data recovery rates

Online access to program fixes

Exclusive Pro+ Support Live Chat

CheckMark Payroll Pro

509

Per Year

Ideal for customers looking for reliable software, excellent service and great value. Best for customers with basic knowledge of tax reporting and filing.

Self Service Payroll

Automatic Payroll Calculation

Unlimited Companies

Unlimited Salaried & Hourly Employees

Unlimited Payrolls (Regular, Bonus, Off-Cycle, etc.)

All Pay Frequencies

Multiple Pay Rates

MICR Encoded Check Printing

ACH Direct Deposit

Printing & E-Filing of Forms 941, 940, 944, 943, W-2, & W-3

Employer Payroll Tax Filings

Access to 40+ Types of Payroll Reports

Employee Benefits (Health, Retirement, Insurance, etc.)

Customized Vacation and Sick Leave Policies

Customized Deductions and Garnishments

Up to 90 mins within 12 months

Online access to program fixes