ABLE Origination

4.9

1

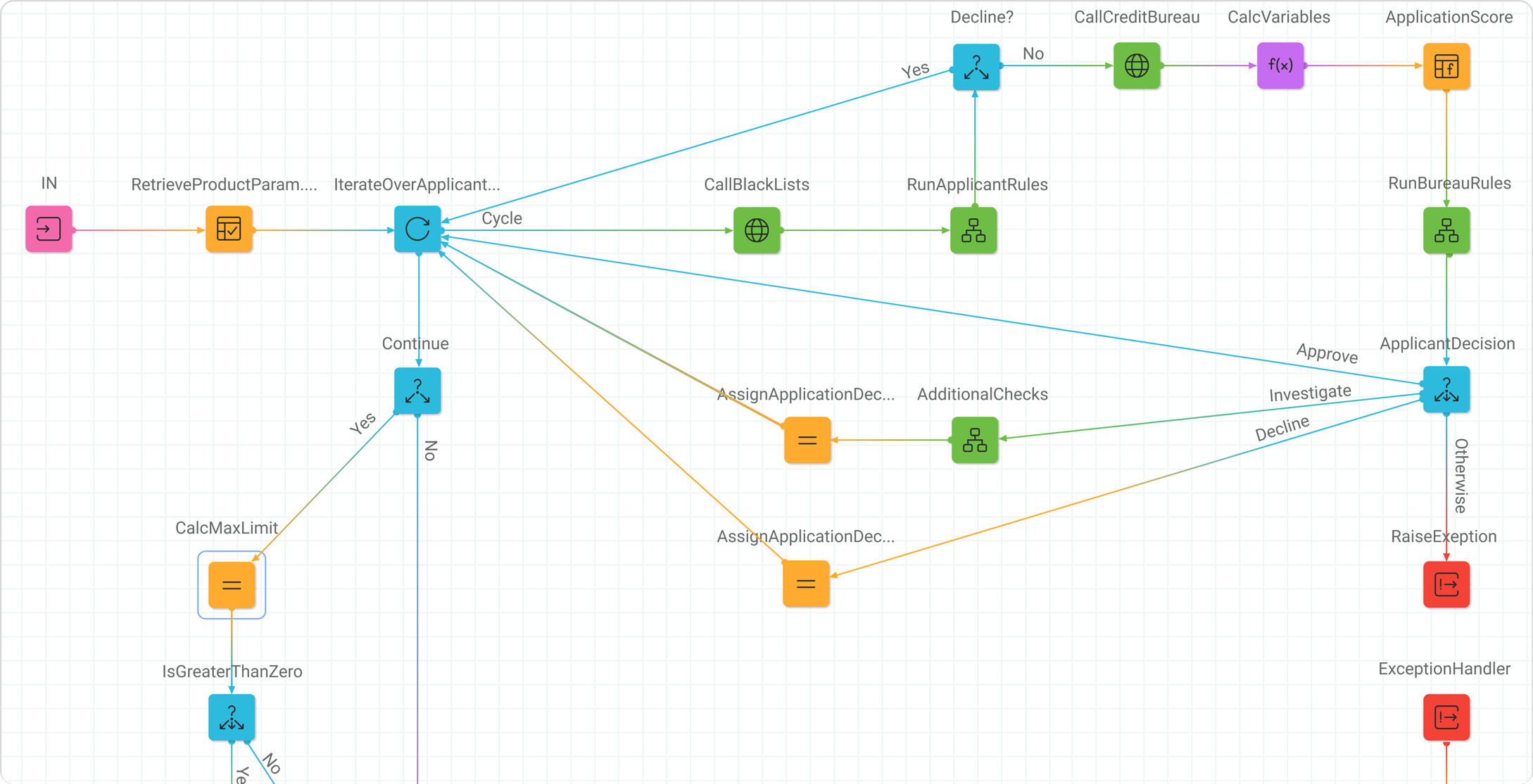

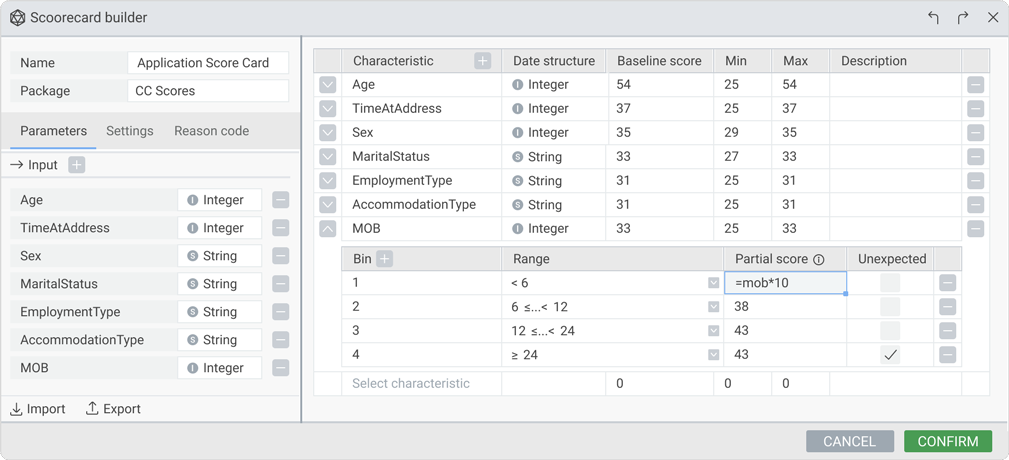

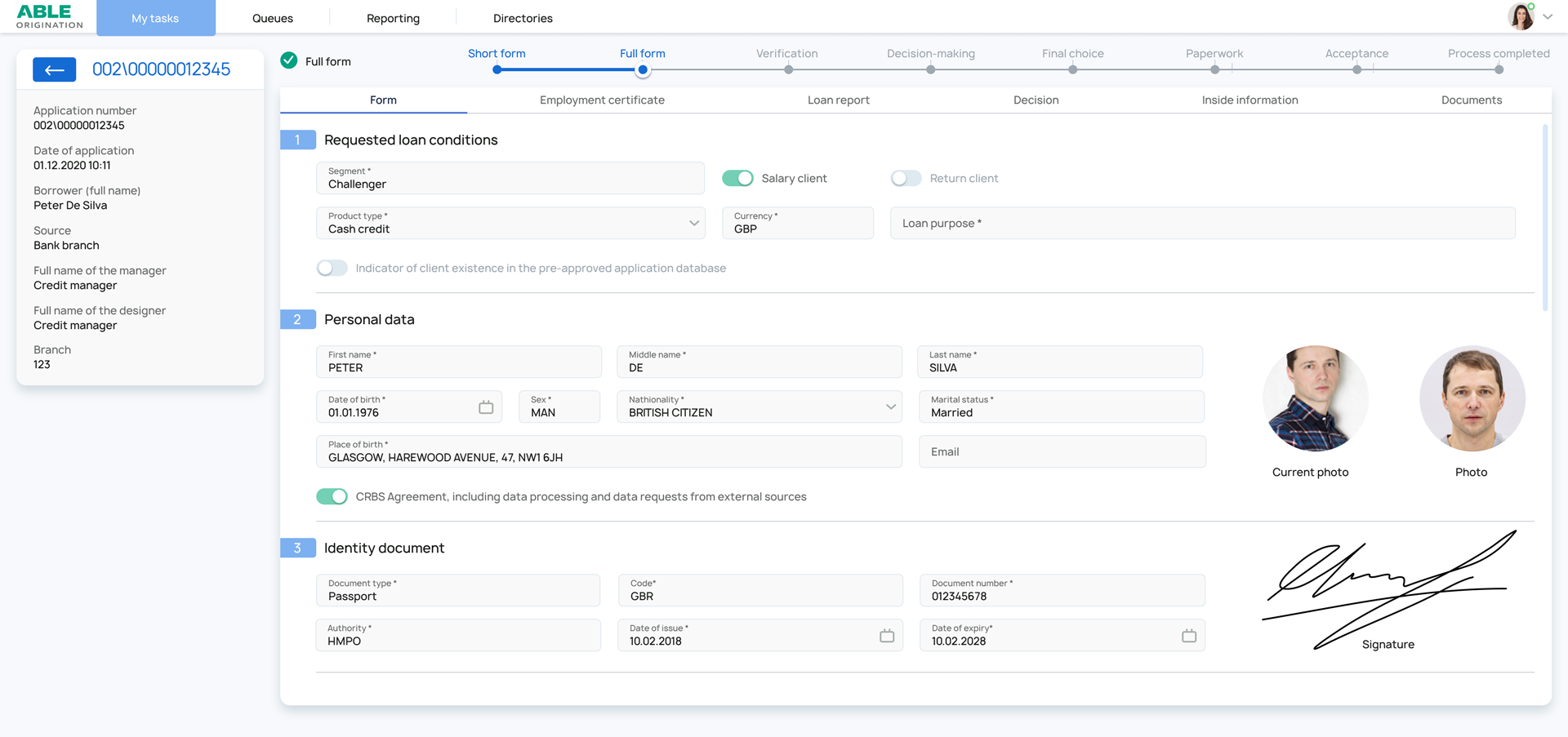

ABLE Origination platform automates the whole loan origination process. The platform operates with little or no human interaction. Due to the 360° customer view, ABLE Origination provides a unique customer experience and maximizes portfolio revenue.

Features:

- Pre-configured functionality

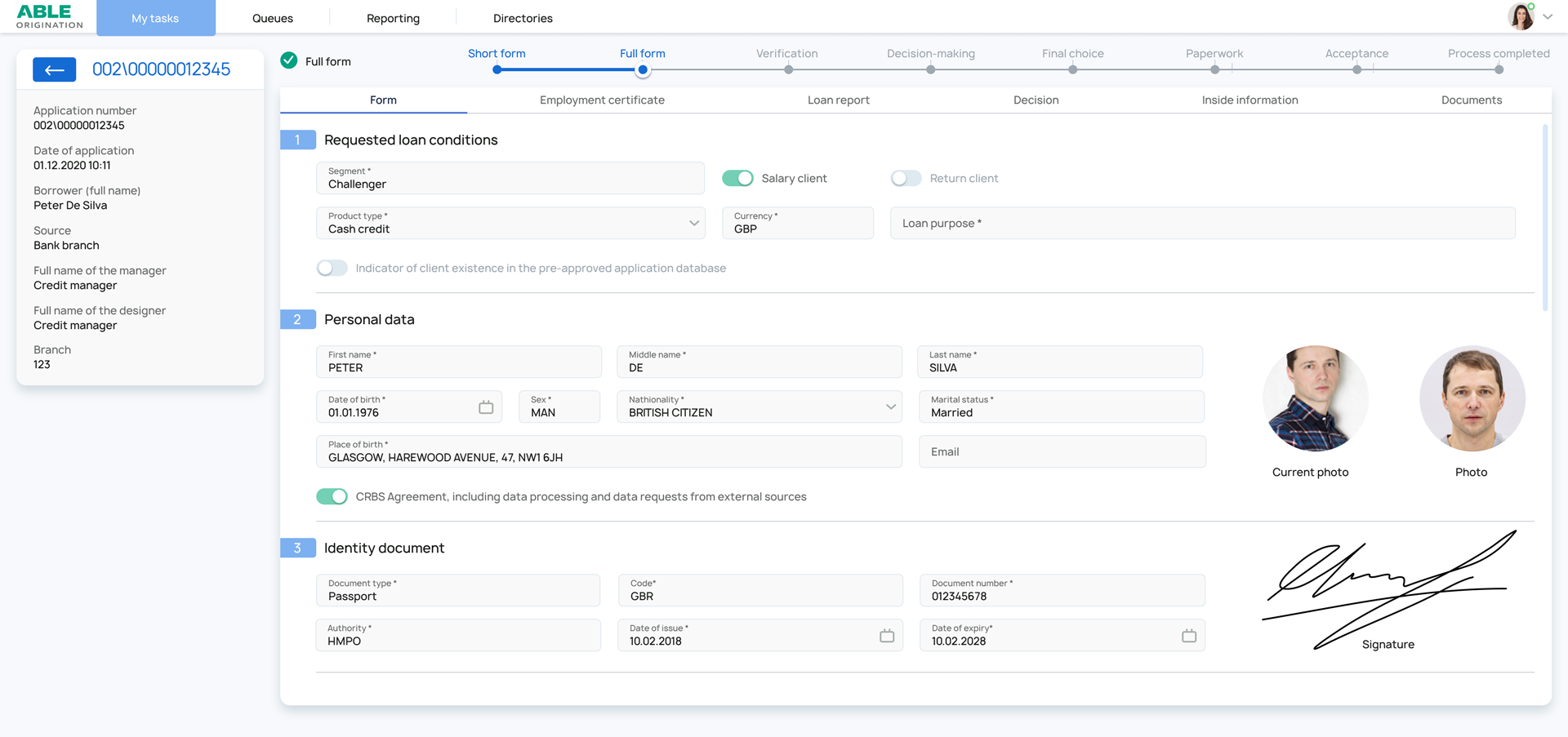

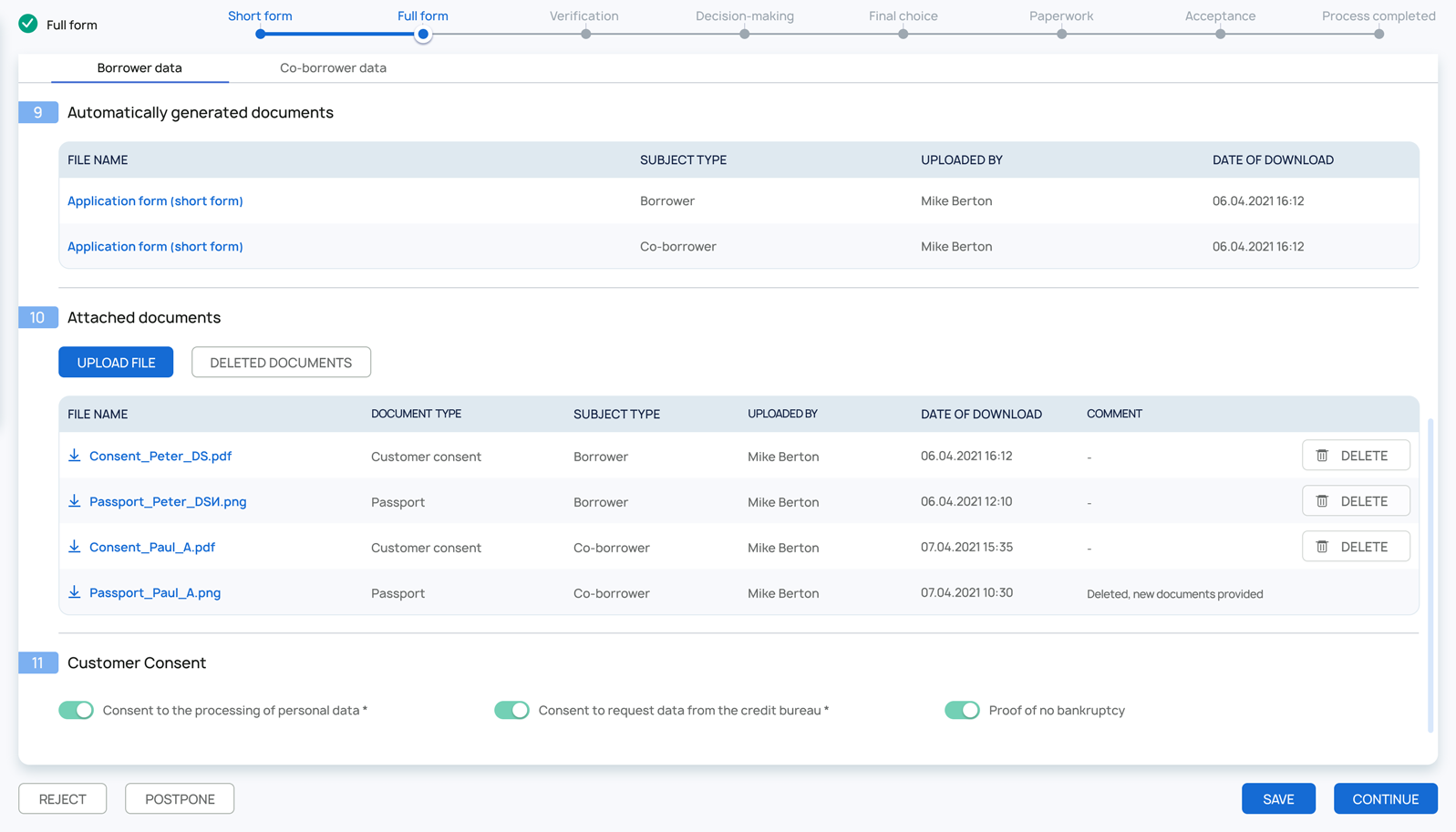

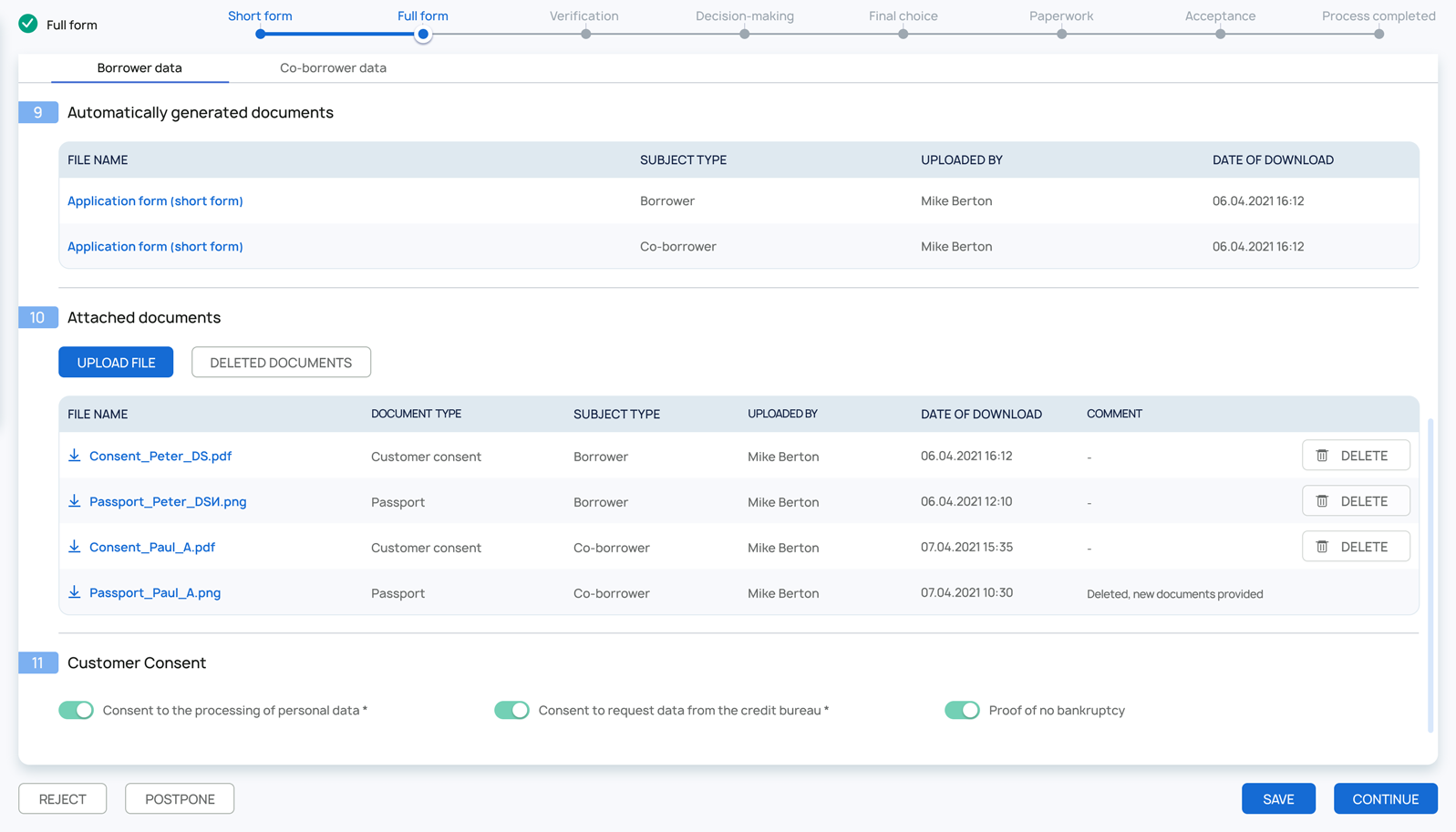

- Data capturing

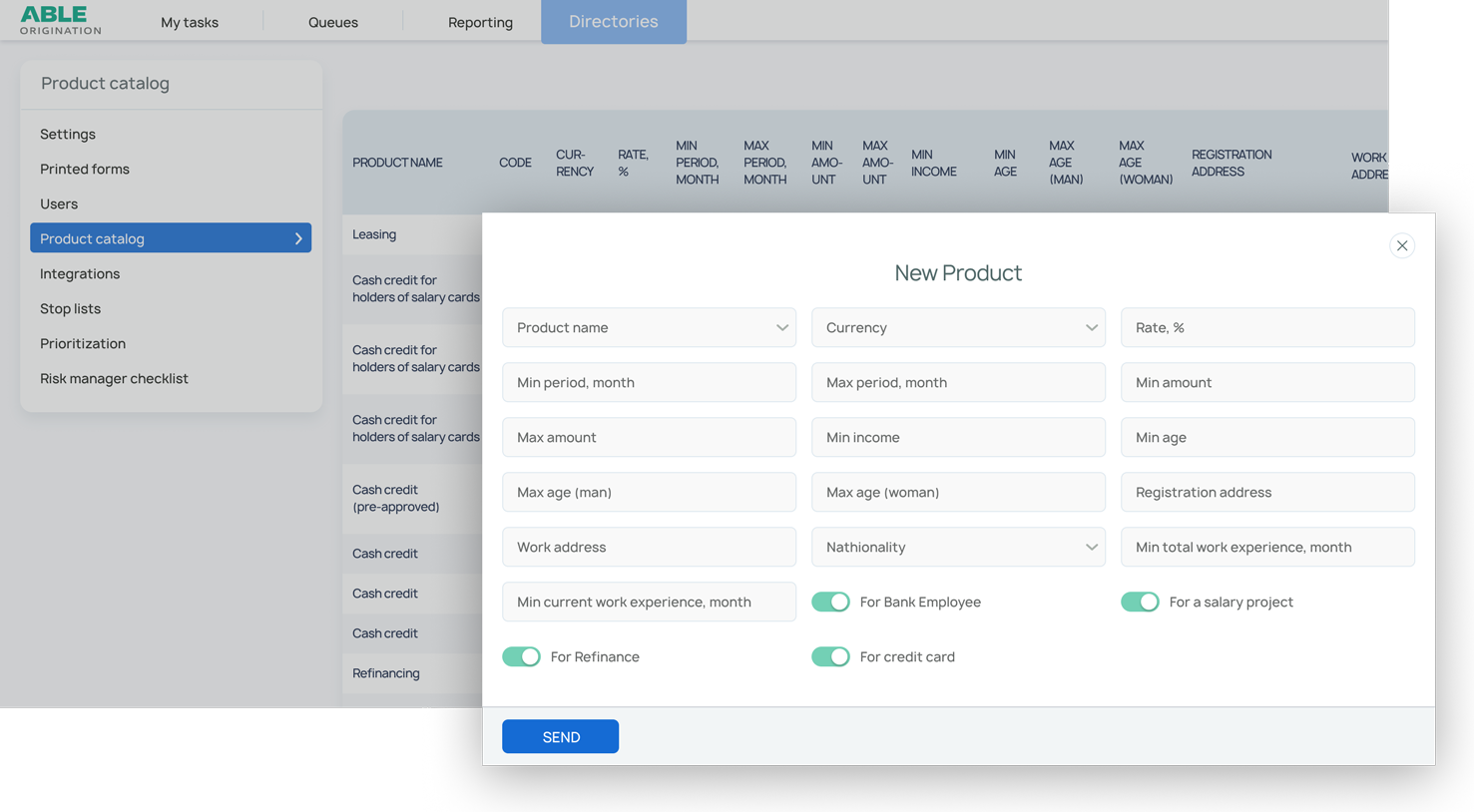

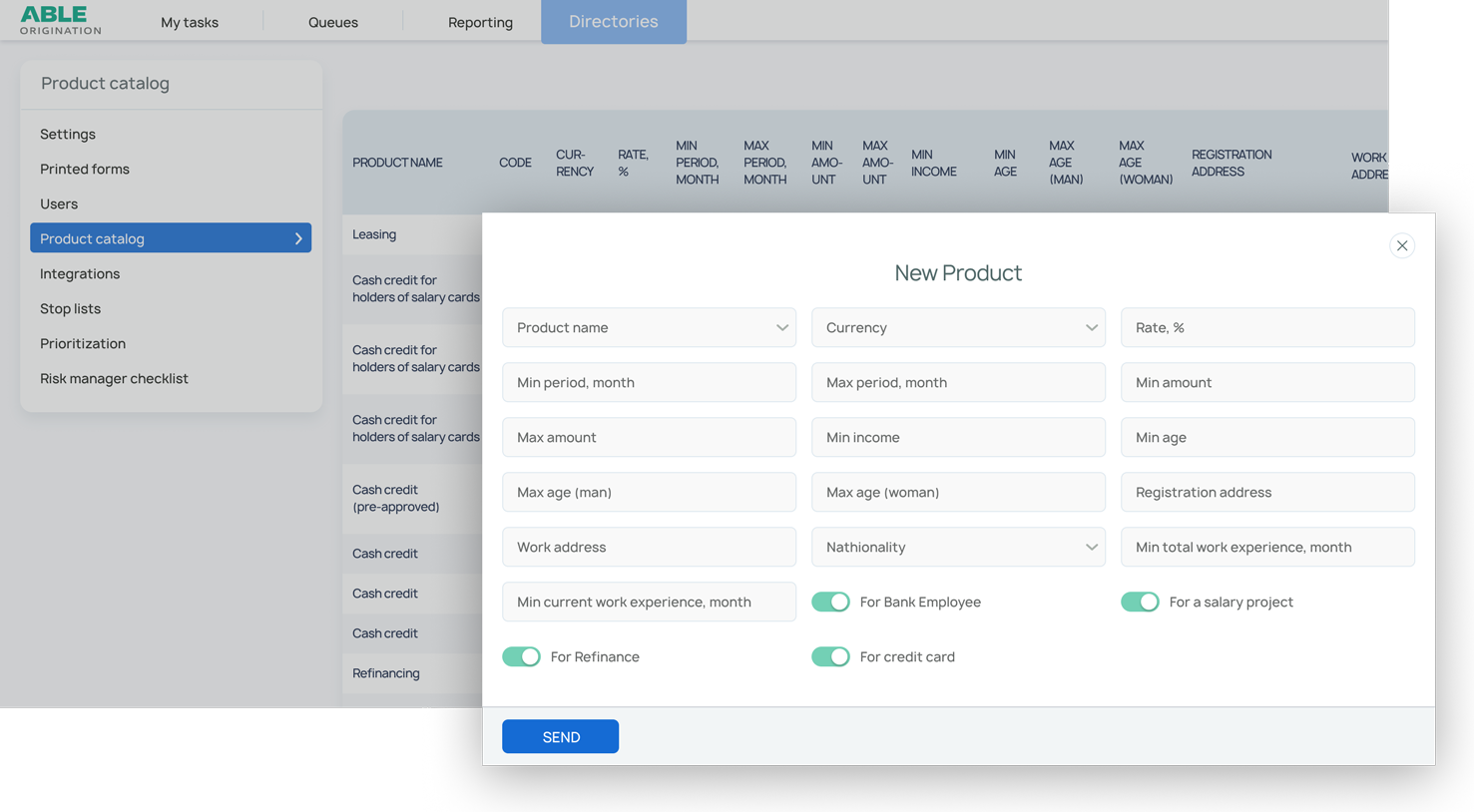

- Product catalog

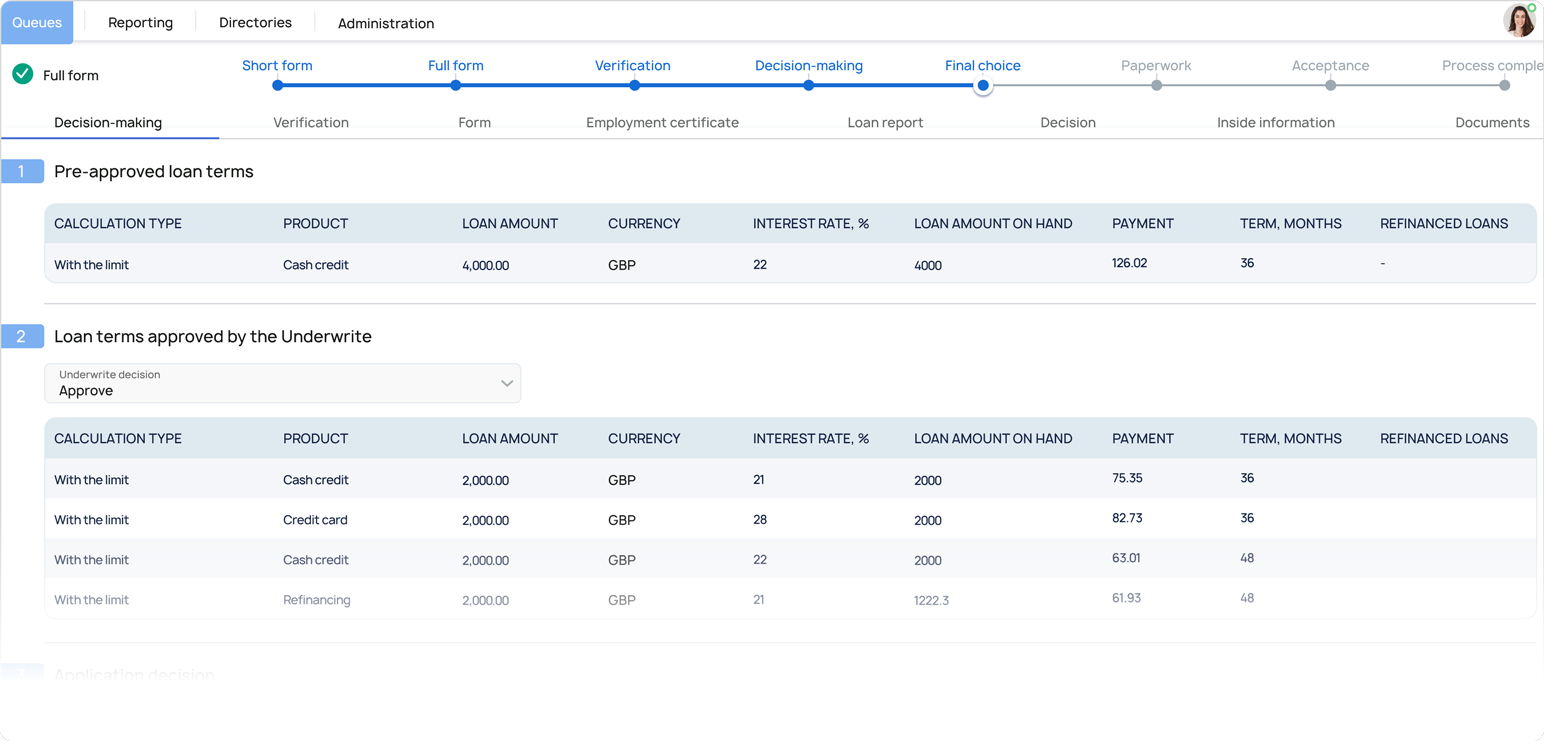

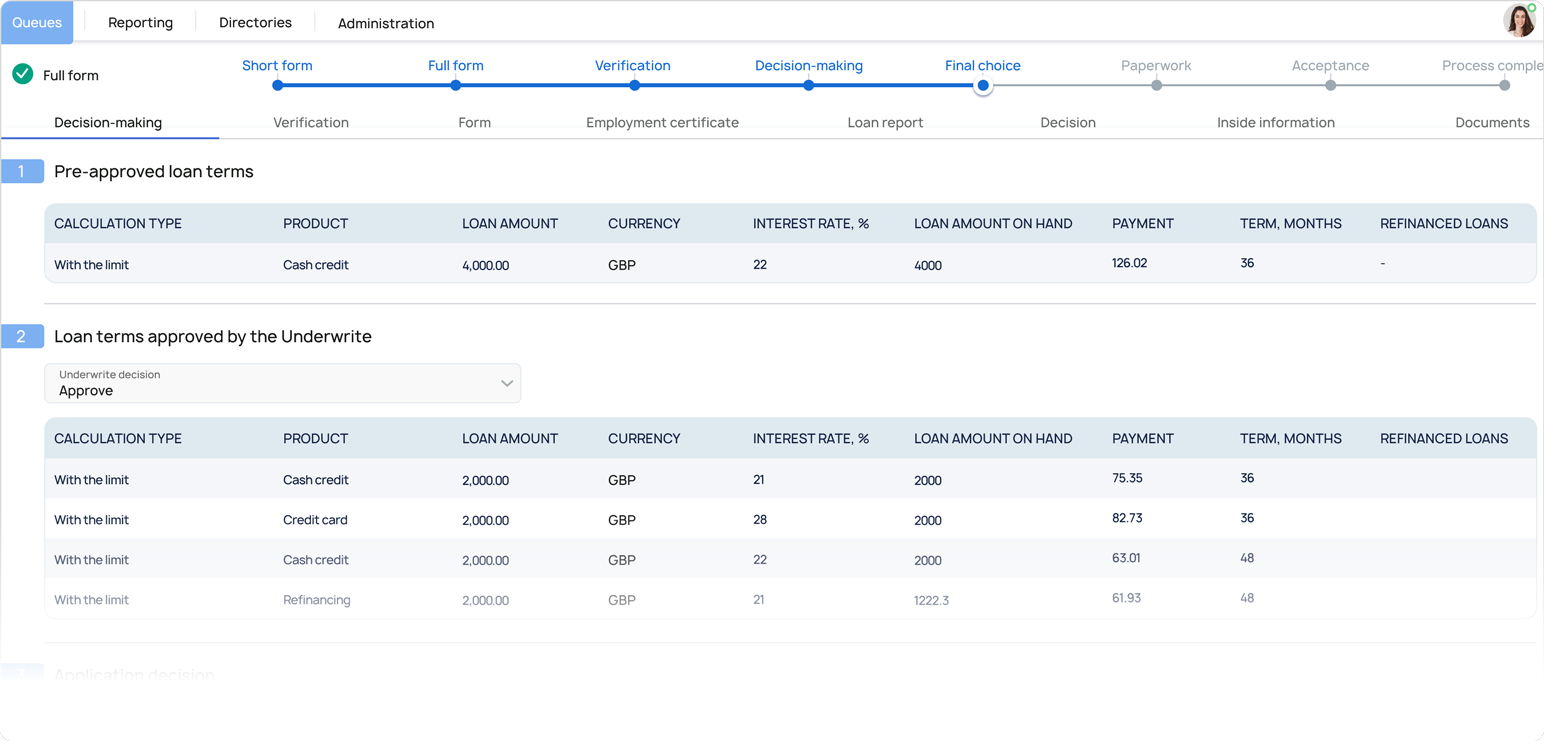

- Offer calculation

- Multichannel customer data exchange

- Application management

- Integration with 3rd party services

- Documents recognition

- Dashboards and reports

ABLE Origination automates:

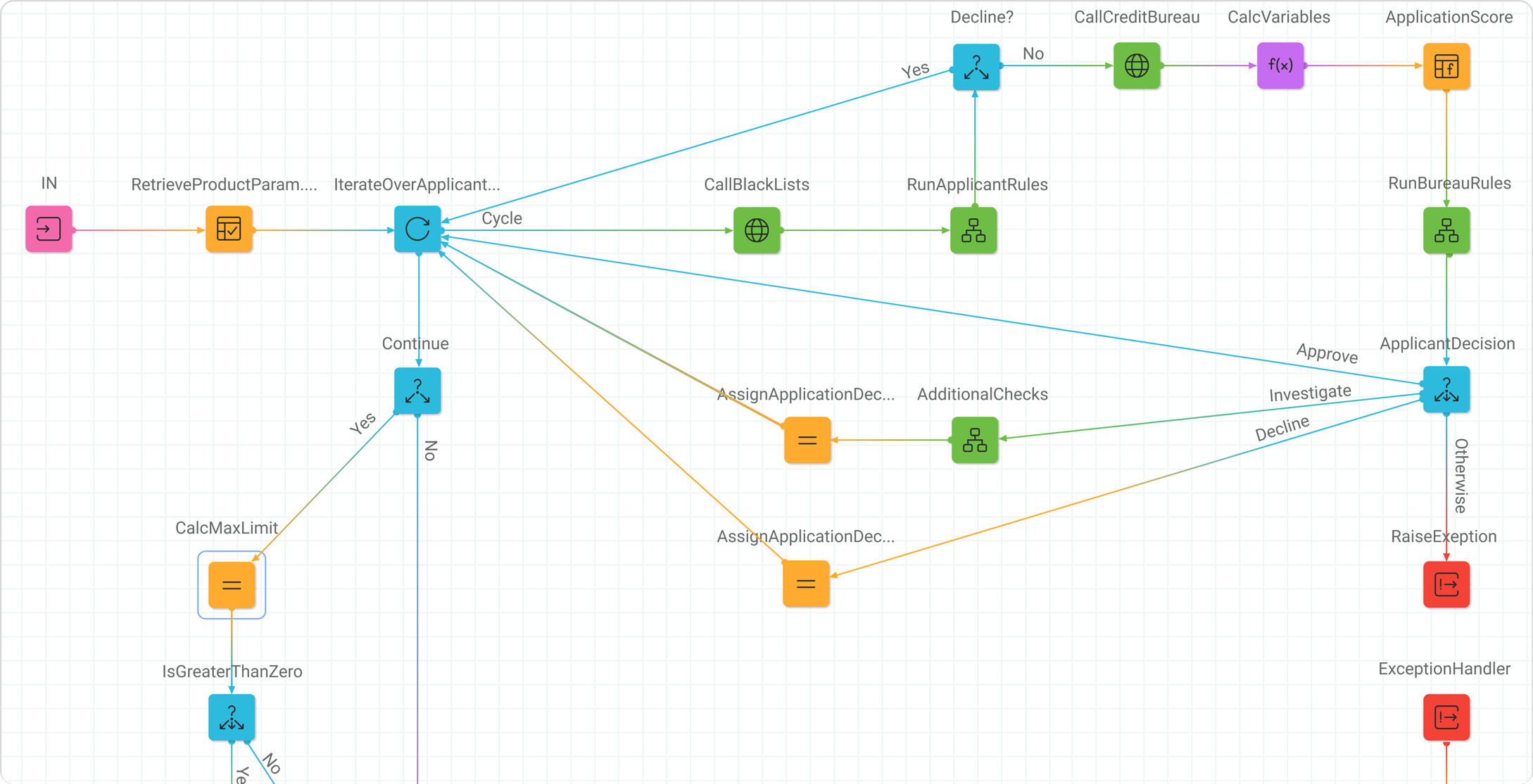

- Data validation through integration with external data systems

- Initiation of omnichannel application

- Debt consolidation and restructuring

- Negotiation with customers

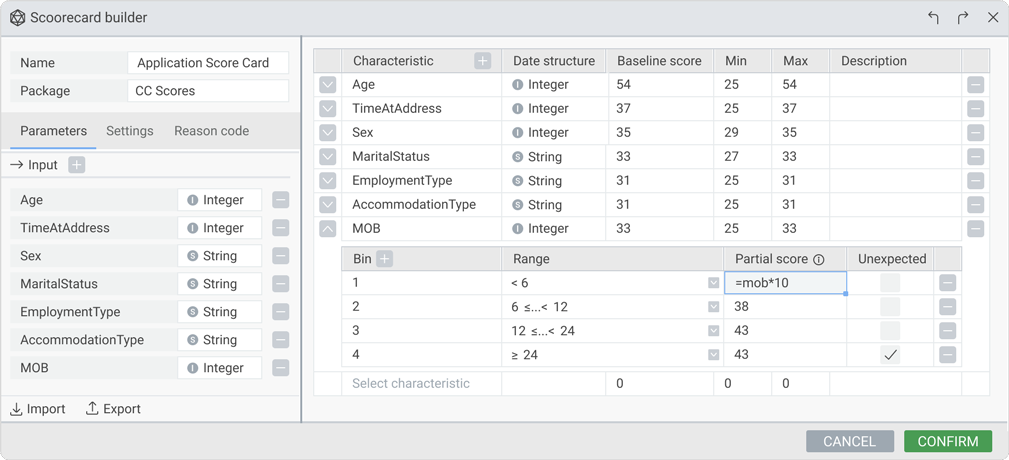

- Decisions on applications

- Personalized offers

- Loan disbursement

Target Market:

Banking groups, payment instructions, lenders, auto-dealers, neobanks, and many more.

Ask anything of ABLE Origination with Workflos AI Assistant

https://rndpoint.com/

Apolo

Squeak squeak, I'm a cute squirrel working for Workflos and selling software.

I have extensive knowledge of our software products and am committed to

providing excellent customer service.

What are the pros and cons of the current application?

How are users evaluating the current application?

How secure is the current application?

Media