-

Automated expense tracking

Hurdlr automatically tracks expenses and categorizes them for easy tax filing.

-

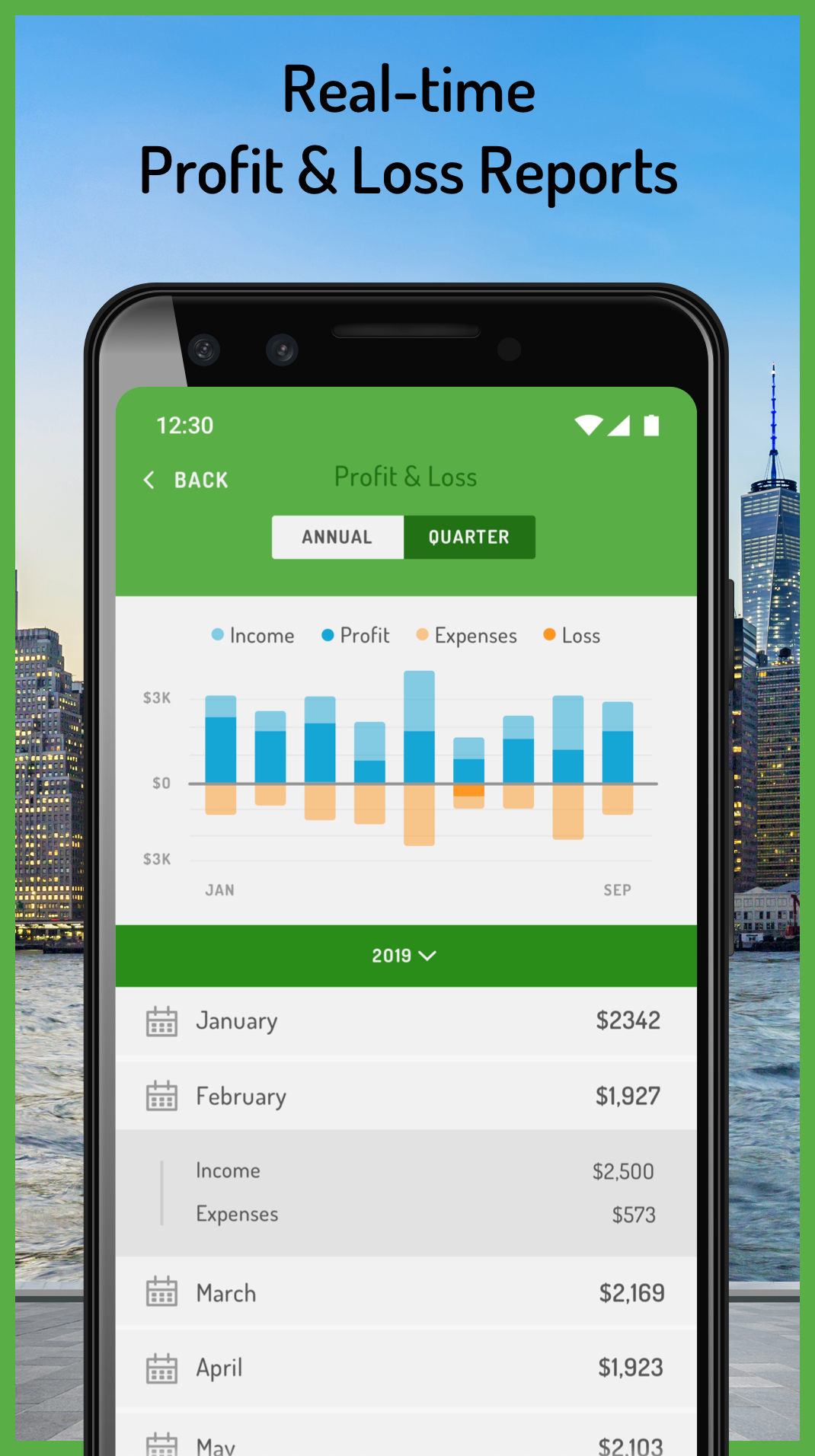

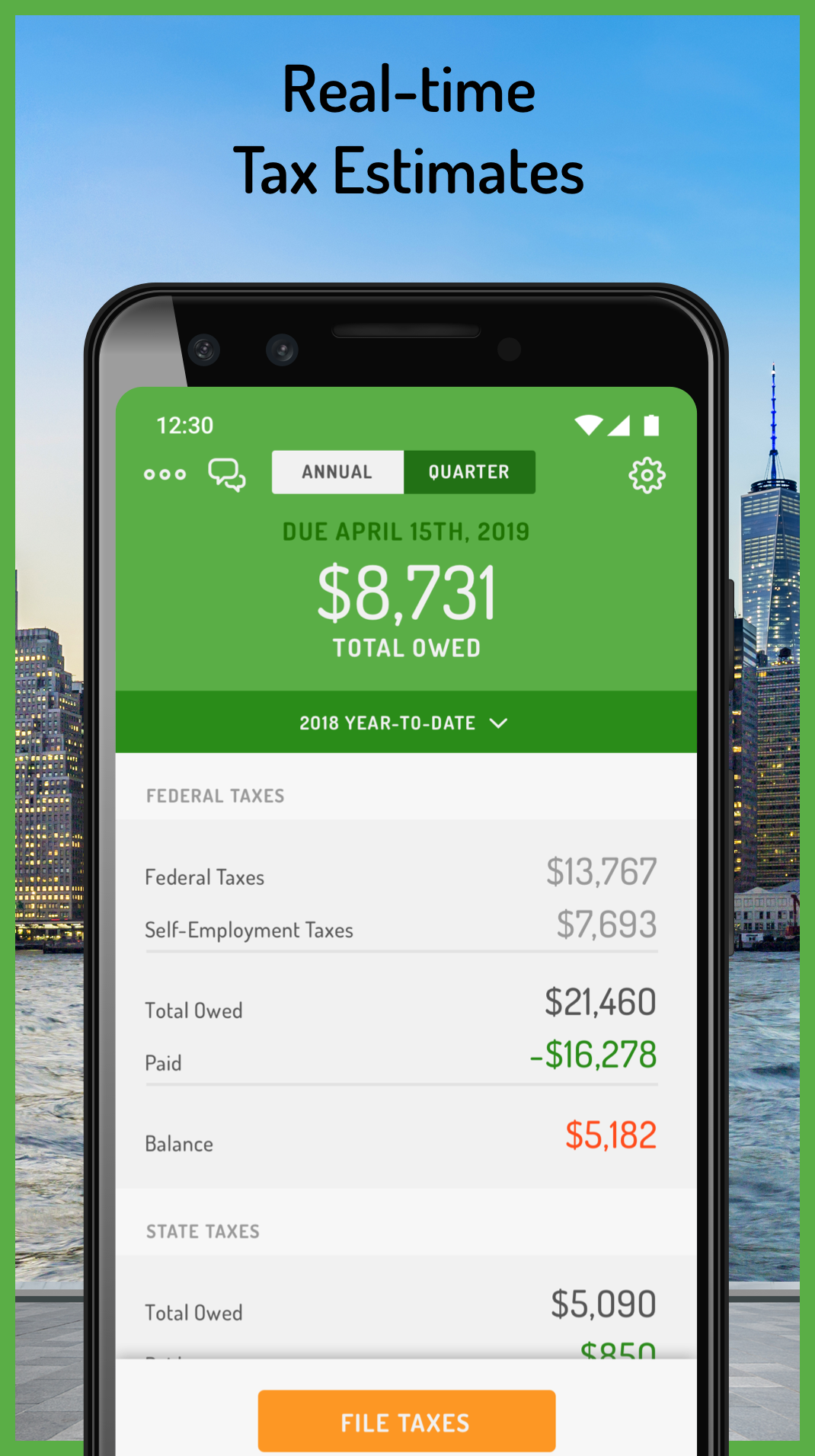

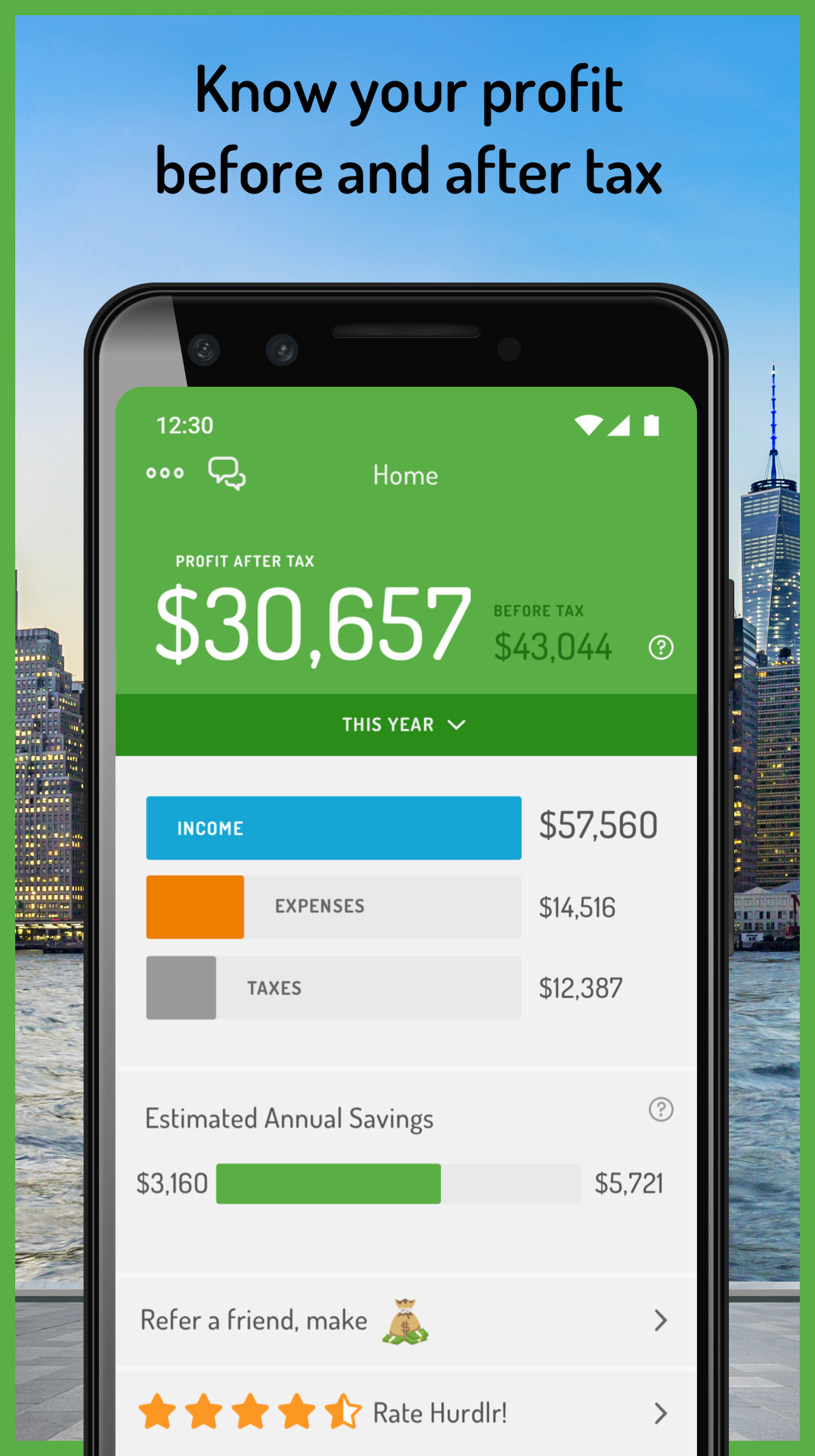

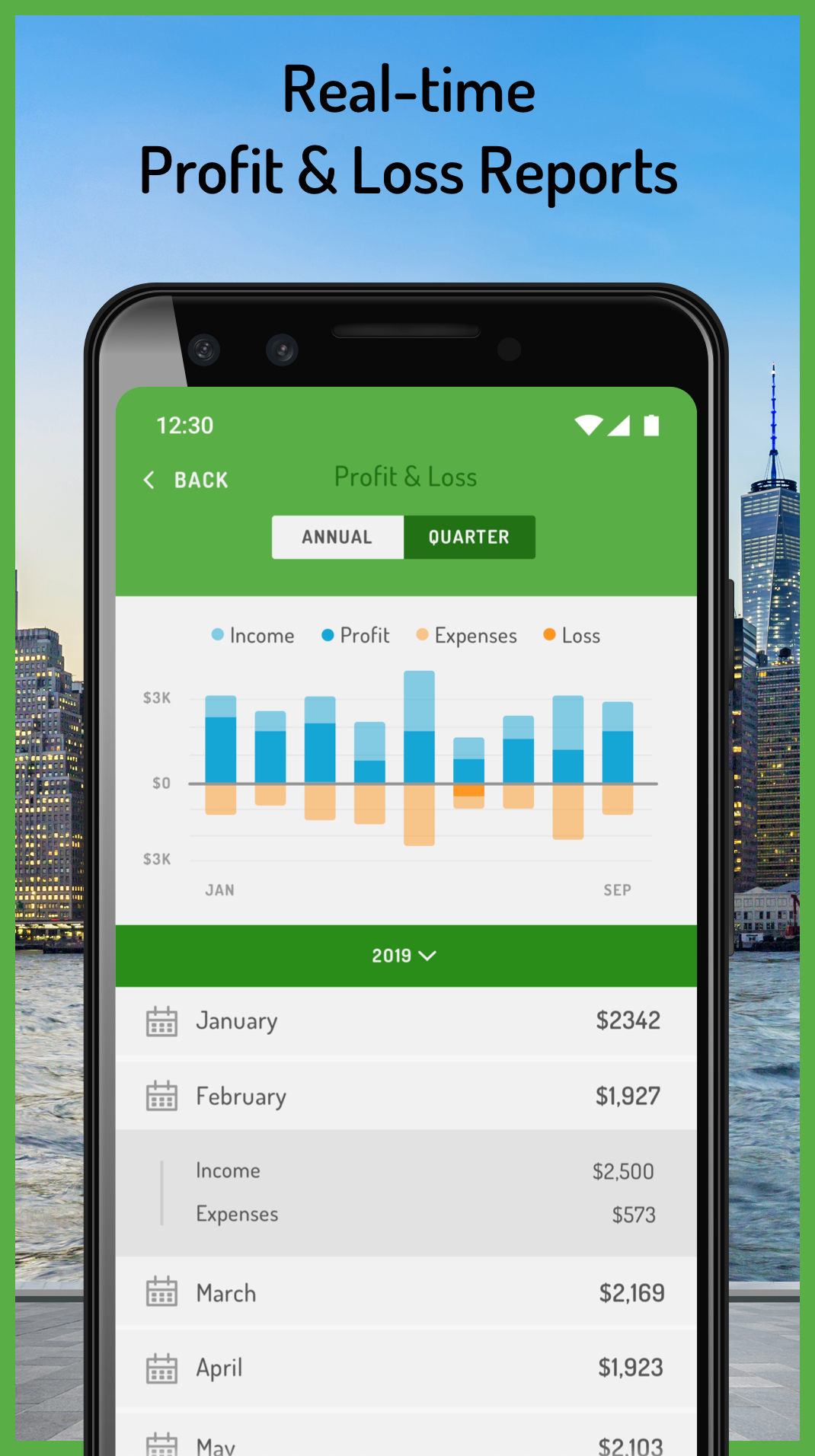

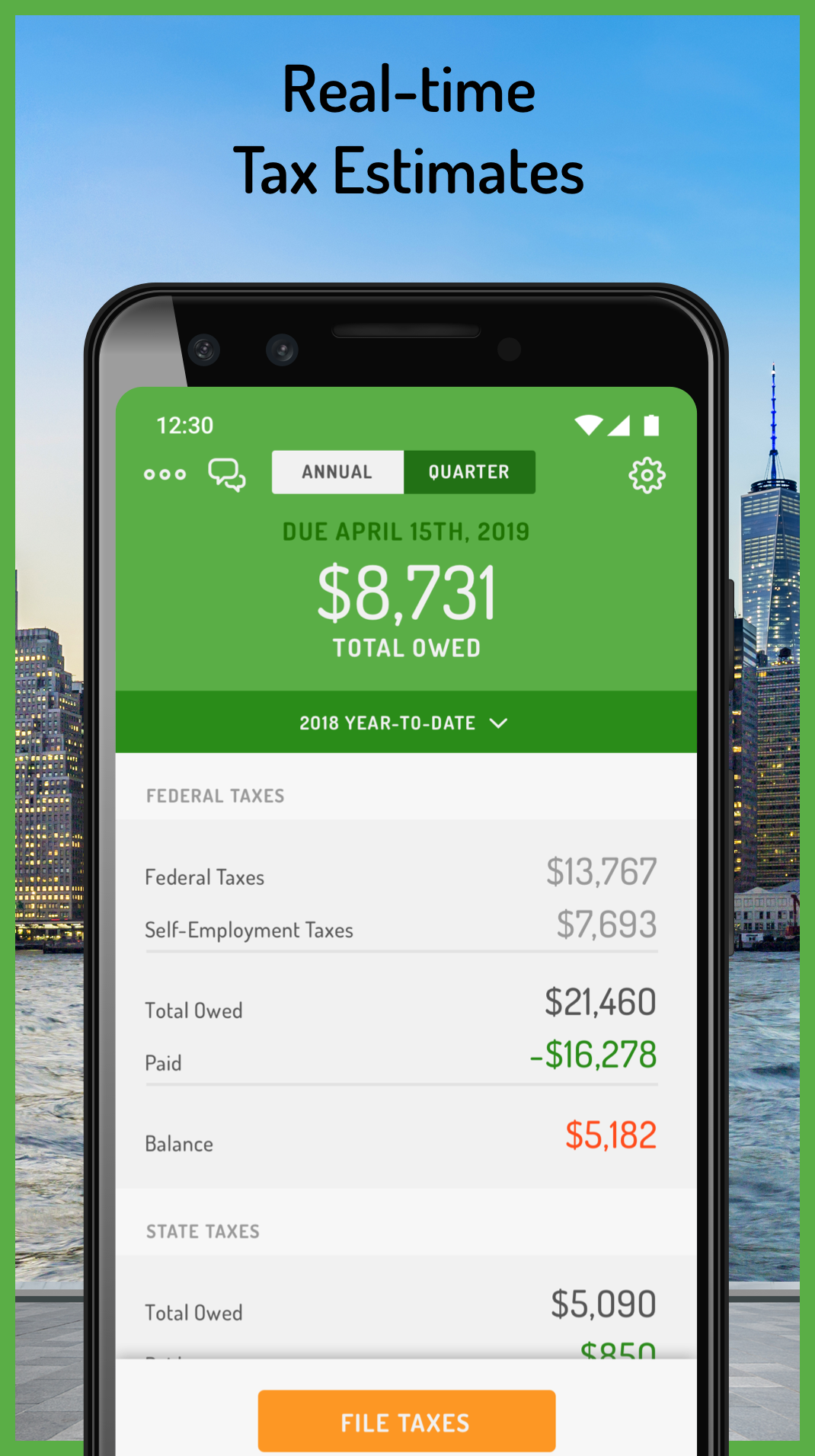

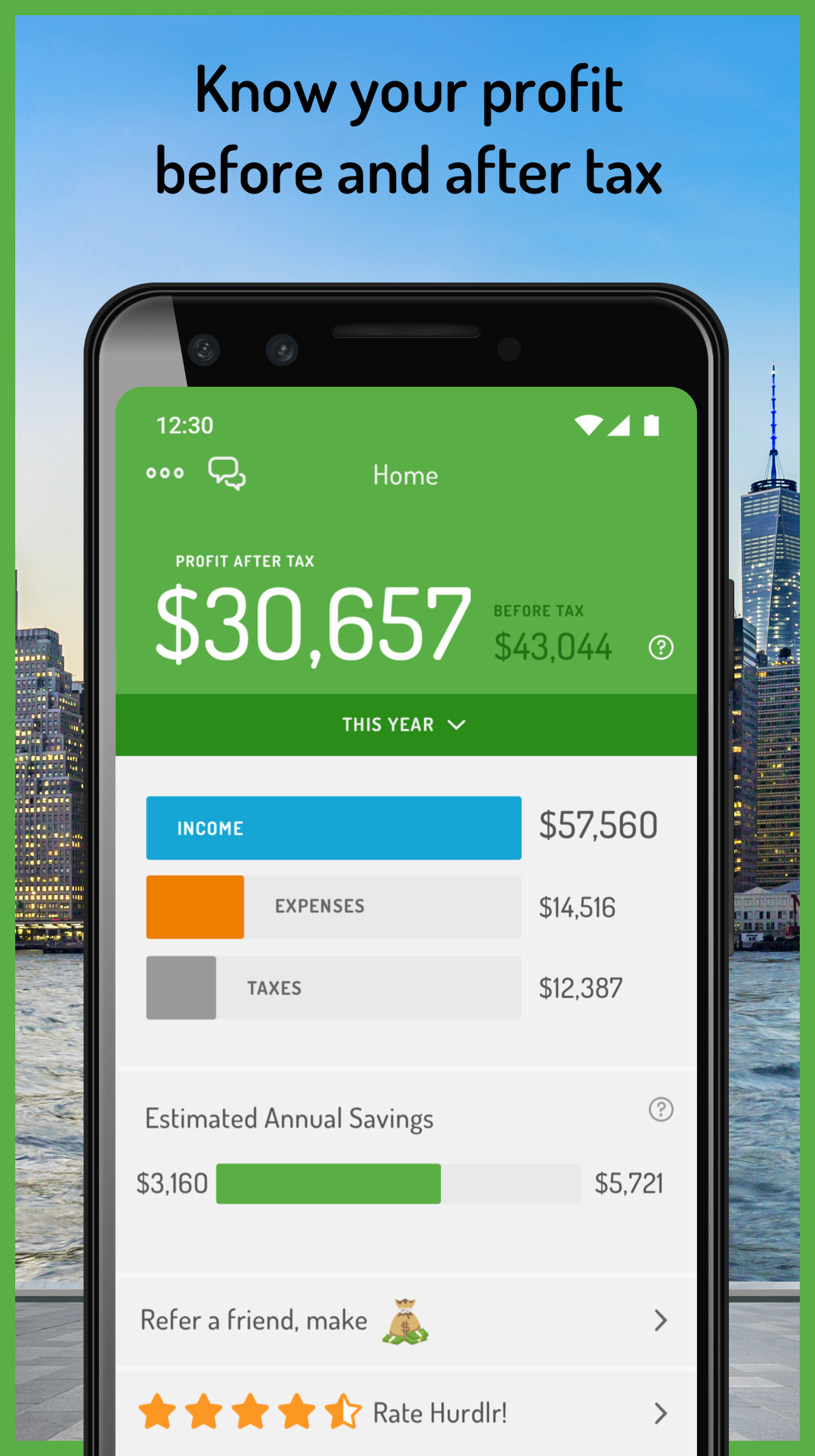

Real-time financial insights

Users can see their income, expenses, and taxes in real-time, allowing for better financial decision-making.

-

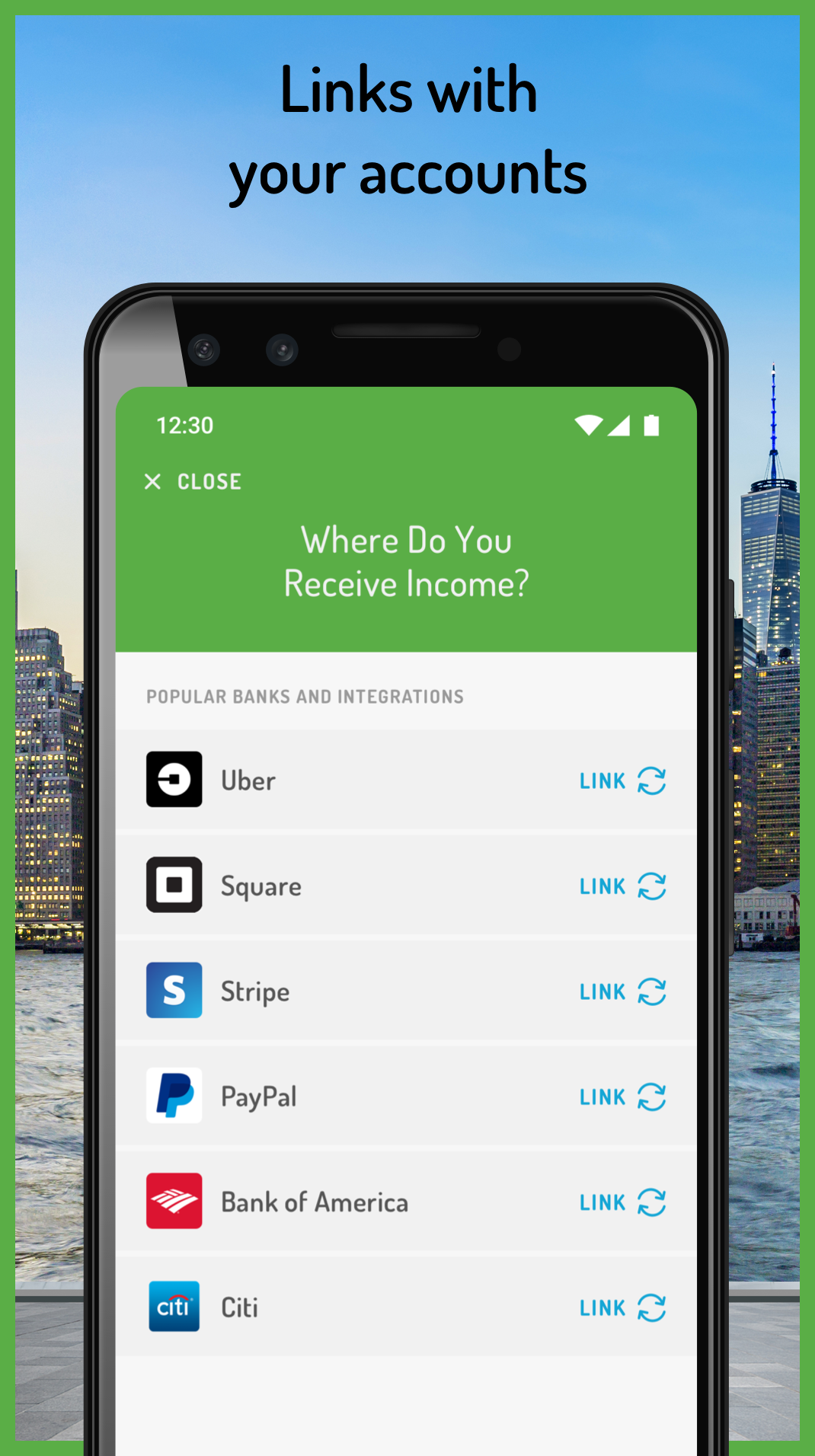

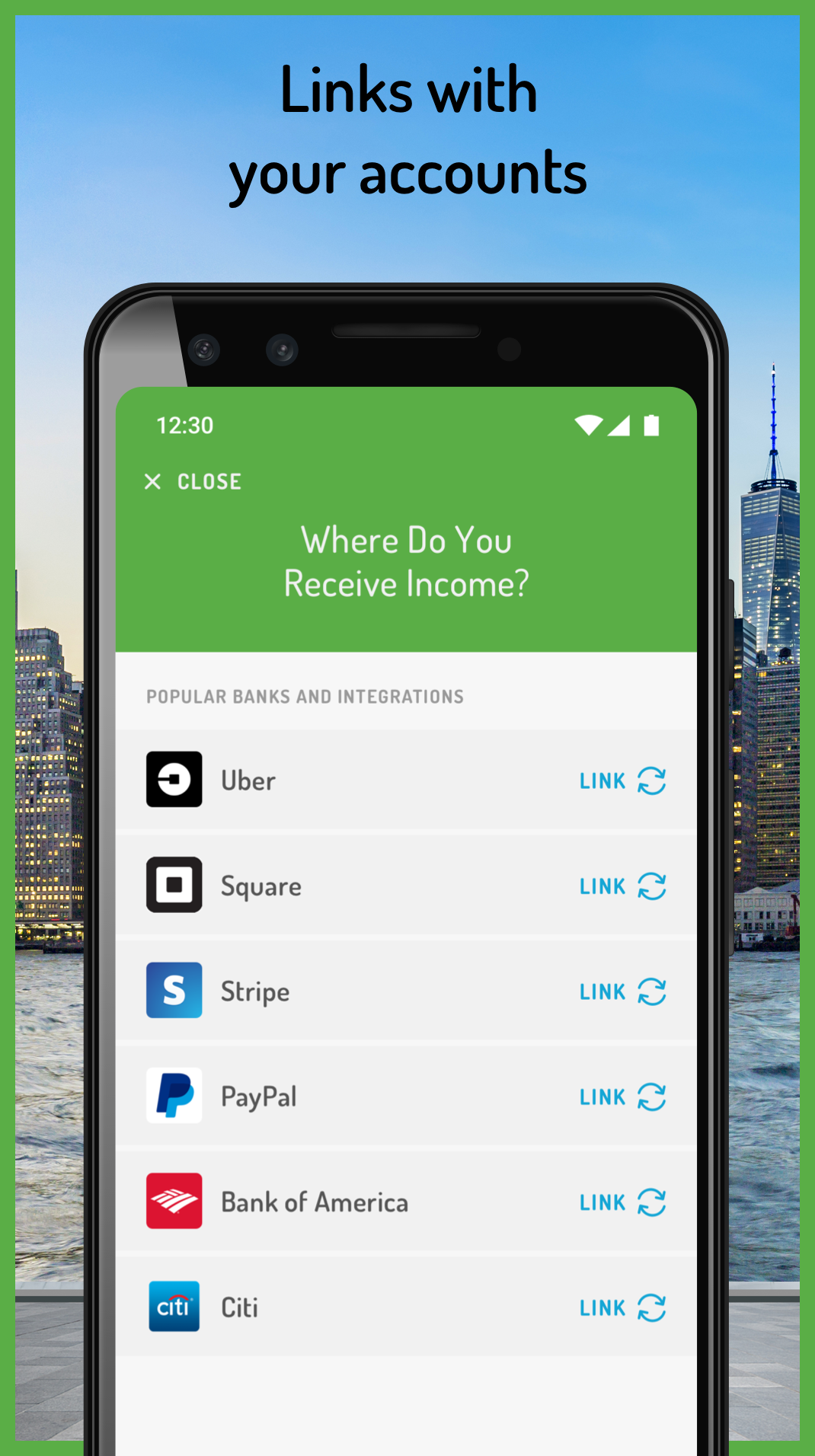

Integrations with popular platforms

Hurdlr integrates with popular platforms like Uber, Etsy, and Airbnb to automatically track income and expenses.

-

Limited features for non-US users

Some features, like tax filing, are only available for US users.

-

Limited customer support

Customer support is only available via email, and some users report slow response times.

-

Limited customization options

Users cannot customize the categories or tags used for expense tracking.

- Hurdlr could expand its features and customer base by offering tax filing and other services in new markets.

- Hurdlr could partner with other platforms to offer integrated expense tracking and financial insights.

- Adding more customization options for expense tracking could attract users who want more control over their financial data.

- Hurdlr faces competition from established players like QuickBooks and FreshBooks.

- Changes in tax laws could require Hurdlr to update its software, which could be costly and time-consuming.

- Data breaches or other security concerns could damage Hurdlr's reputation and lead to loss of customers.

Ask anything of Hurdlr with Workflos AI Assistant

https://www.hurdlr.com/Review Distribution

-

👍

High - rated users

This software AUTOMATICALLY tracks your mileage, making the IRS requirement of maintaining a mileage log simple.More robust reporting features would be useful.

-

👎

Low - rated users

I originally purchased the premium version of this software because it seemed amazingly easy to use and able to integrate with my bank accounts for a reasonable price. Once you link your bank accounts, it automatically pulls all your transactions and suggests rules for you to approve them. Its best feature to me was the ability to ditch spreadsheets and have all transactions categorized and organized with reports available, including quarterly tax calculations. In addition, Hurdlr also tracks your mileage usage automatically. Sounds good, right?! Keep reading...Hurdlr’s “auto-mileage” tracking system was a total disappointment. I have a Samsung cell and despite the instructions on optimizing your phone, the app will not accurately log your trips. Addresses will be different and will always be off by a few miles, requiring a manual fix every single time. So much for "auto-tracking!" It may not seem a big deal, but to me, every mile counts when it comes to deductions, and in spite of Hurdlr's insistence that even a car's odometer falls short of miles, I heartily disagree. I have compared my car's odometer to Google Maps and they ALWAYS match exactly. So, that was a huge let-down as I was looking forward to discontinuing mileage logging on a spreadsheet. Another very disappointing feature is the lack of simple details in its income tracking. If you accept different forms of payments and they don't all come from the same source, you will have to manually fix everything. For example, if you receive payments via Square and they are deposited in your bank account, you’ll have double entries with different amounts since Square reports the amount before its fees and your bank deposit will not include the fees. Hurdlr’s solution is to only link one account. The problem is when you use a practice management software, such as Massagebook, and accept other forms of payments without going through Square, you’ll have to manually fix everything!!!.

Media