Aspire

4.4

121

Aspire is a finance operating system for businesses that offers payment, management, and earning solutions beyond what traditional banks, bookkeepers, or rewards programs can provide. Their goal is to empower entrepreneurs with the financial tools they need to succeed and make a positive impact on their communities.

Strengths

-

Ease of use

Intuitive interface and simple navigation

-

Customization

Flexible and customizable to fit specific business needs

-

Scalability

Can handle large amounts of data and users without performance issues

Weaknesses

-

Limited integrations

May not integrate with all necessary third-party tools

-

Pricing

May be expensive for small businesses or startups

-

Customer support

May have limited or slow customer support options

Opportunities

- Growing demand for SaaS solutions in the target market

- Opportunity to add new features and functionality to stay competitive

- Opportunity to form partnerships with complementary software providers

Threats

- Intense competition from established and emerging SaaS providers

- Increased concern over data security and privacy may impact customer trust

- Changing regulations and compliance requirements may impact product development and sales

Ask anything of Aspire with Workflos AI Assistant

https://aspireapp.com/

Apolo

Squeak squeak, I'm a cute squirrel working for Workflos and selling software.

I have extensive knowledge of our software products and am committed to

providing excellent customer service.

What are the pros and cons of the current application?

How are users evaluating the current application?

How secure is the current application?

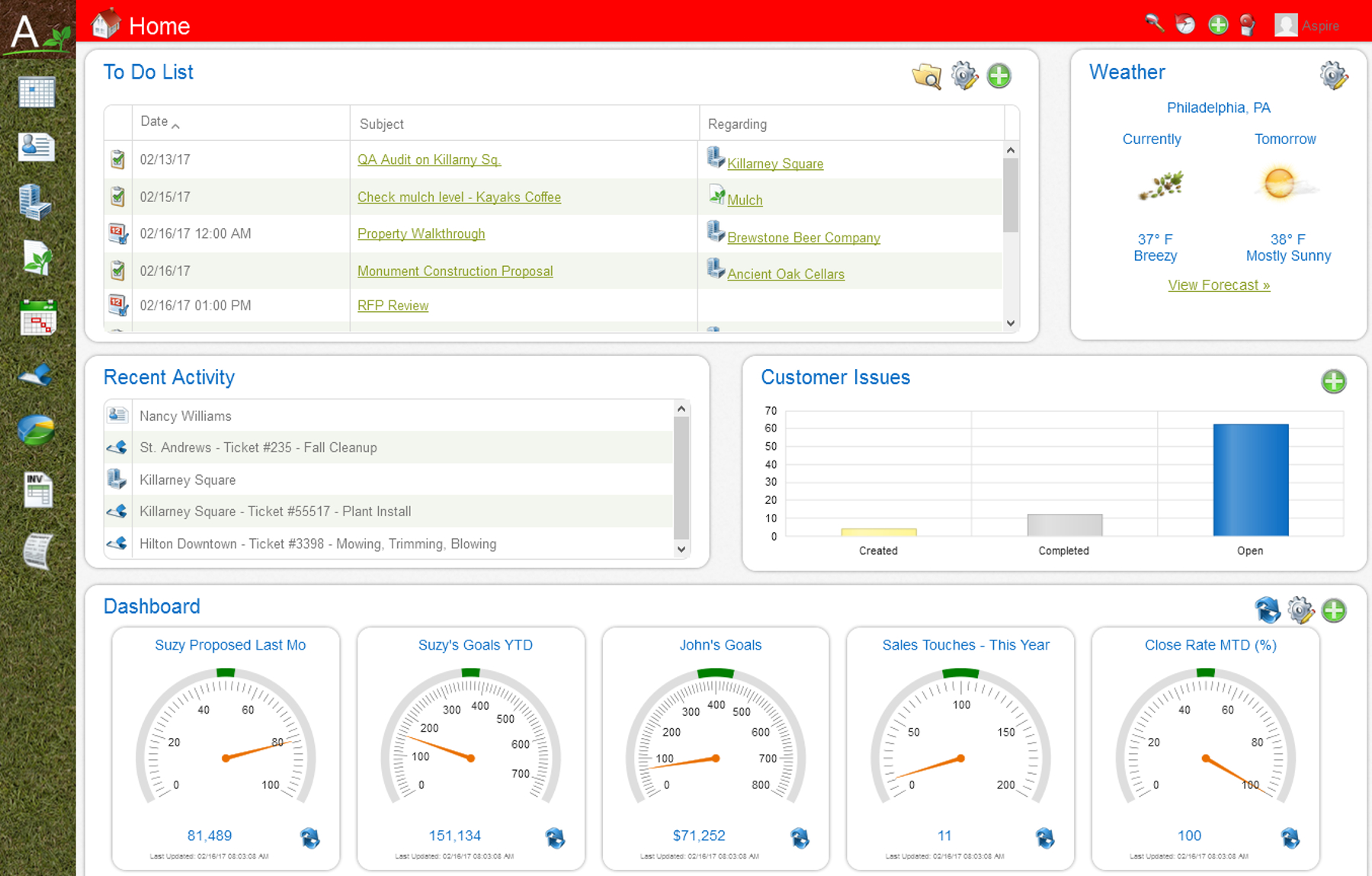

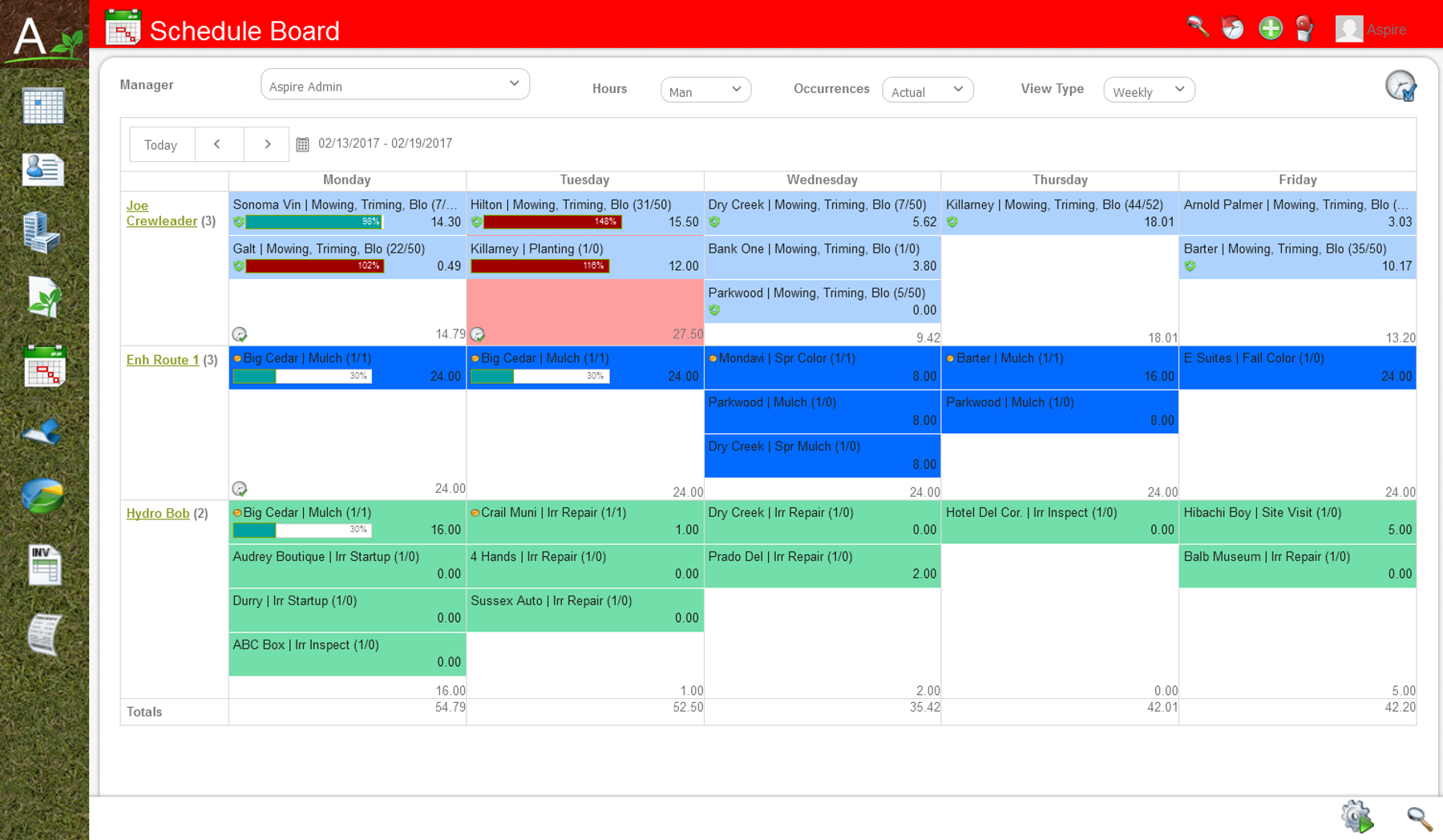

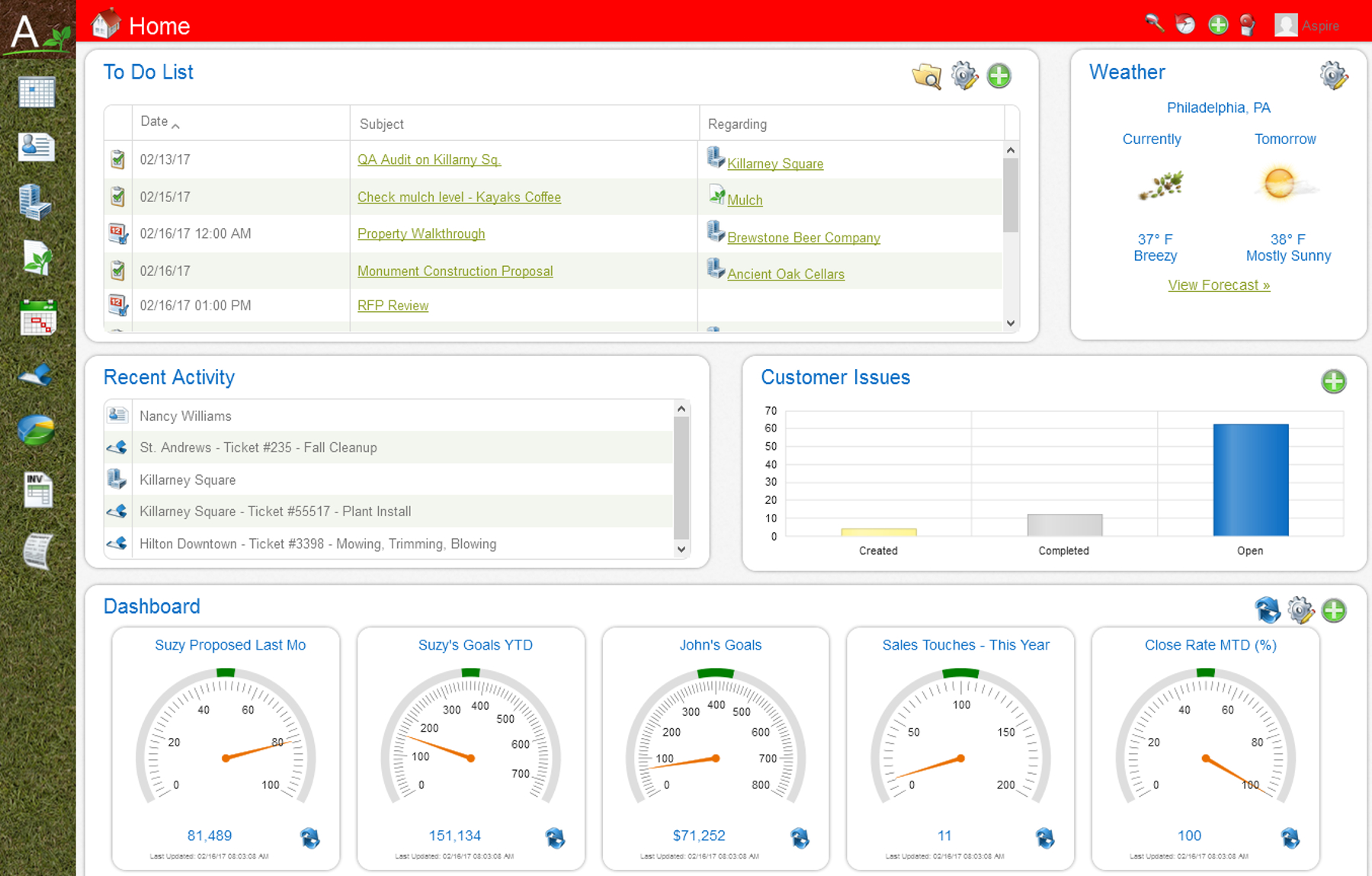

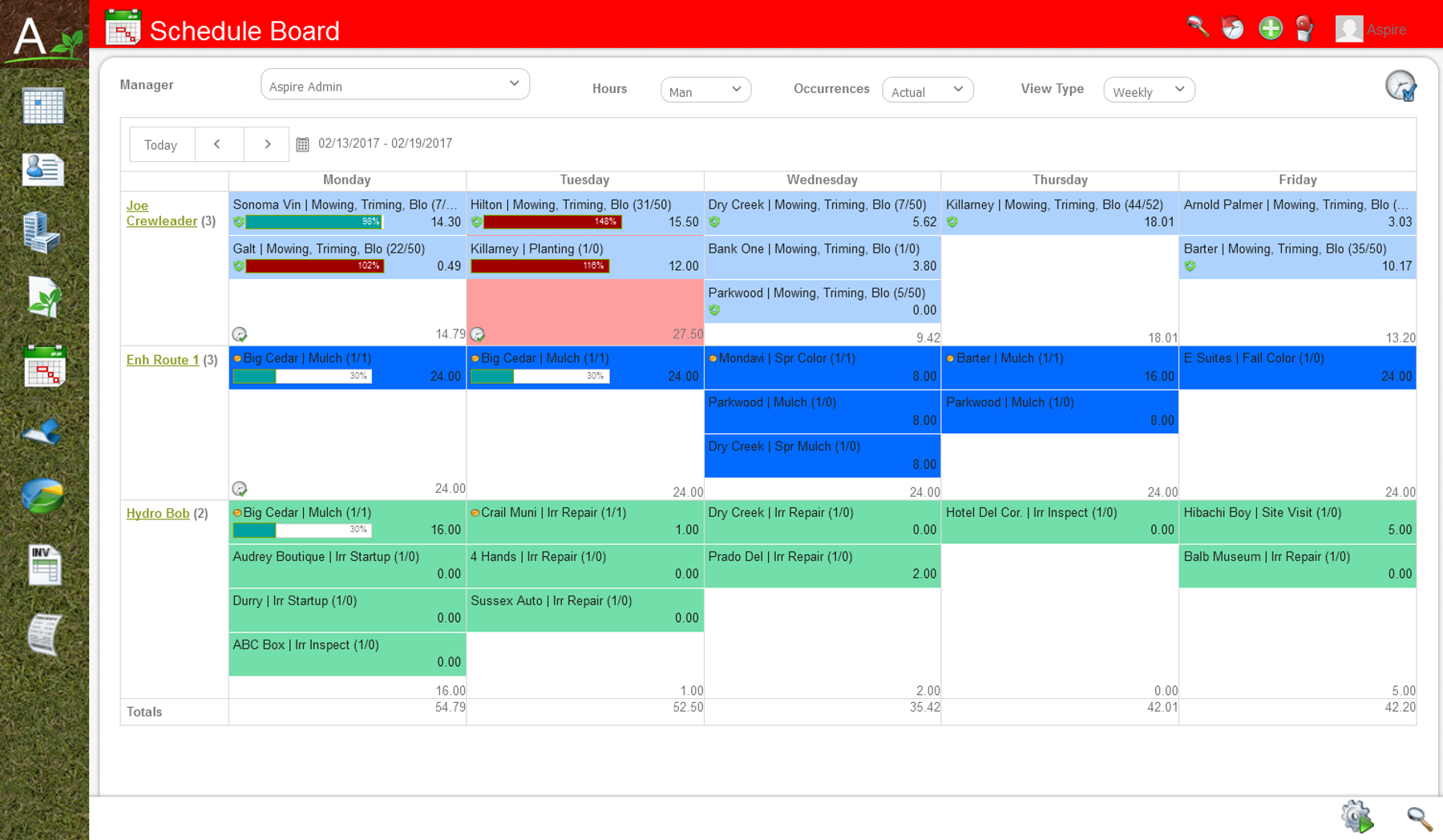

Media

Aspire Plan

Aspire's pricing strategy offers three versions with varying features and prices, catering to different customer needs and budgets.

BUSINESS ACCOUNT

12

3 users Per Month

A powerful financial stack of international payments, cards, receivables, and bookkeeping all in one account | Ideal for companies with 0-20 employees

3 Admin & Finance Users

Multi-Currency Accounts - USD, SGD, IDR, with more coming soon

Free local transfers and best FX rates, up to 3x cheaper than banks

Create & send invoices, with automated payment tracking

Multi-currency corporate cards, physical and virtual

1% Cashback on card spend on digital marketing and subscriptions

Integrated with Xero & Quickbooks

SPEND MANAGEMENT

99

10 Users Per Month

Gain real-time visibility and control with intuitive spend management integrated with global payments | Ideal for companies with 20-200 employees

3 Admin & Finance Users, 7 Employee Users

Deploy budgets across teams or projects, set spend limits and approval flows

Instantly issue corporate cards for employees with multiple currencies, controls, and cashback

Manage claims with spend policies and one-click reimbursements

Automated payables with OCR and integrated bulk & scheduled bill payments

Free local transfers and best FX rates up to 3x cheaper than banks

Integrated with Xero & Quickbooks

SPEND CUSTOM

Contact Us

Per Month

Advanced solutions designed for expanding regional companies with multiple entities | Ideal for companies with more than 200 employees | Everything In Spend Management and

Custom data and accounting fields to map transactions to entity, location, custom fields, and more

Multiple entity management in a single dashboard view

Dedicated account manager & in-person employee training sessions

Native Netsuite integrations